Sensex Down, Yet These Shares Generate ₹43,000 Crore Profits for Investors

Sensex Down

Market Overview: Navigating Challenges for Profits

Sensex and Nifty Decline Amidst Sectoral Challenges

On Friday, November 17, the Indian stock market faced a downturn as both the Sensex and Nifty registered declines.

The primary drivers behind this setback were the significant sell-off in banking and financial shares and the prevailing weakness in Asian markets, which collectively cast a shadow over market sentiment.

However, amidst this overall decline, a contrasting narrative unfolded in the midcap and smallcap segments, where a bullish trend prevailed, leading to substantial profits for investors.

By the end of the trading session, the BSE Midcap and Smallcap indices closed with gains of 0.27% and 0.36%, respectively.

Sectorial Dynamics: Winners and Losers

Positive Sectorial Performance Amidst Overall Decline

Despite the overarching market decline, certain sectorial indices managed to defy the trend, closing with gains.

Notable among these were the Pharma, Capital Goods, and Realty indices, which showcased resilience in the face of broader market challenges.

Conversely, the energy and oil and gas sectors experienced a decline, contributing to the overall negative sentiment.

Index Performance: Sensex and Nifty Numbers

BSE Sensex and NSE Nifty Facing Headwinds

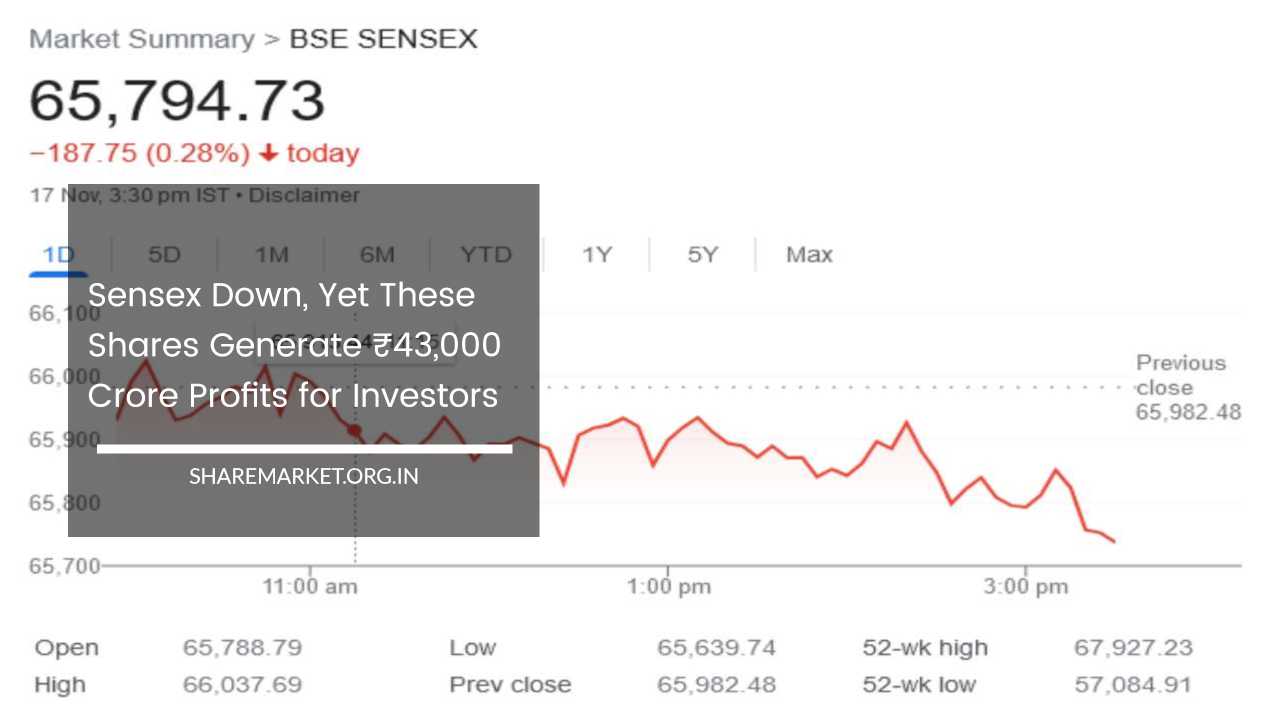

At the close of trading on November 17, the BSE Sensex recorded a fall of 187.75 points or 0.28%, settling at 65,794.73. Simultaneously, NSE’s 50-share index Nifty slipped by 33.40 points or 0.17%, concluding at 19,731.80.

These figures reflected the challenges faced by the broader market, highlighting the impact of both domestic and international factors on India’s key indices.

Investor Gains: Wealth Creation Amidst Turmoil

Total Market Capitalization Rise and Investor Wealth

In the face of the market downturn, investors found a silver lining in the form of wealth creation. The total market capitalization of companies listed on the BSE increased to Rs 327.48 lakh crore on November 17, compared to Rs 327.05 lakh crore on the previous trading day (November 16).

This uptick in market cap translated to a substantial increase of approximately Rs 43,000 crore, reflecting a positive turn of events for investors.

Top Performing Stocks: Winners and Losers

L&T Leads Gainers, SBI Faces Maximum Loss

Among the 30 Sensex stocks, 14 closed with gains on November 17. Larsen & Toubro (L&T) emerged as the top performer, experiencing the highest rise of 2.93%.

Other notable gainers included Hindustan Unilever (HUL), Power Grid, Asian Paints, and Nestle India, with gains ranging from 1.88% to 2.82%.

On the flip side, 16 Sensex shares closed in the red, with State Bank of India (SBI) facing the maximum loss of 1.43%. Axis Bank, Bajaj Finance, ICICI Bank, and Bajaj Finserv also witnessed declines ranging from 0.46% to 1.28%.

Market Dynamics: A Detailed Analysis

Sensex and Nifty: A Closer Look

The BSE Sensex’s decline of 187.75 points showcased the vulnerability of the Indian stock market, highlighting the impact of both domestic and international factors on key indices.

Similarly, NSE’s Nifty slipping by 33.40 points reflected the challenges faced by major players in the market.

This decline may be attributed to the selling pressure in banking and financial shares, signaling potential concerns about the stability of these sectors.

Market Capitalization Surge: A Positive Turn

Investor Wealth and Market Cap Dynamics

One of the most noteworthy aspects of the trading session was the surge in the total market capitalization of companies listed on the BSE.

The increase from Rs 327.05 lakh crore to Rs 327.48 lakh crore represented not just a numerical uptick but also a positive shift in investor sentiment.

This surge of approximately Rs 43,000 crore in market cap directly translated into an increase in the wealth of investors, offering a ray of hope amidst the broader market challenges.

Sectorial Winners and Losers: Unveiling Market Trends

Pharma, Capital Goods, and Realty Resilience

While several sectors faced challenges, the Pharma, Capital Goods, and Realty sectors emerged as beacons of resilience.

These sectors not only weathered the storm of a declining market but also managed to close with gains, underscoring their strength in the current economic landscape. On the contrary, the energy and oil and gas stocks faced headwinds, contributing to the overall decline in market sentiment.

Midcap and Smallcap Resilience: A Bullish Trend

Contrasting Trends in Midcap and Smallcap Segments

Despite the prevailing challenges, the midcap and smallcap segments exhibited a bullish trend, providing a counter-narrative to the overall market decline.

This resilience contributed significantly to the profits made by investors, emphasizing the importance of diversification and strategic investment decisions in navigating volatile market conditions.

Individual Stock Performance: Winners and Losers

L&T’s Remarkable Rise and SBI’s Setback

The standout performer among Sensex stocks was Larsen & Toubro (L&T), which experienced a remarkable rise of 2.93%. This gain not only showcased the strength of the company but also its ability to outperform in challenging market conditions.

On the flip side, State Bank of India (SBI) faced the maximum loss of 1.43%, reflecting the challenges faced by the banking sector.

Axis Bank, Bajaj Finance, ICICI Bank, and Bajaj Finserv also witnessed declines, adding to the complexities of the market landscape.

Market Breadth and Fluctuations: A Comprehensive Picture

Analysis of BSE Trading Session

The Bombay Stock Exchange (BSE) witnessed a total of 3,864 shares being traded on November 17. Within this spectrum, 2,004 shares closed with gains, showcasing a positive market breadth.

However, a decline was observed in 1,720 shares, underlining the challenges faced by a significant portion of the market. Additionally, 134 shares closed flat without any fluctuations, indicating a level of stability amidst the market dynamics.

Notably, 360 shares reached their new 52-week high during the trading session, emphasizing the presence of pockets of strength in the market. On the other hand, 25 stocks touched their new 52-week low, signaling potential areas of caution for investors.

Final Thoughts: Navigating Volatility with Strategic Insights

Key Takeaways and Moving Forward

In conclusion, the trading session on November 17 presented a complex picture of the Indian stock market, marked by both challenges and opportunities.

While the overall decline in Sensex and Nifty reflected the prevailing uncertainties, the resilience of certain sectors, the noteworthy increase in market capitalization, and the profits made by investors underscored the multifaceted nature of market dynamics.

The contrasting performance of individual stocks and the bullish trend in midcap and smallcap segments highlight the importance of a nuanced and strategic approach to investing in navigating the volatility of today’s markets.

As investors continue to assess and adapt to the evolving economic landscape, informed decision-making and a diversified portfolio remain crucial for long-term success in the dynamic world of stock trading.