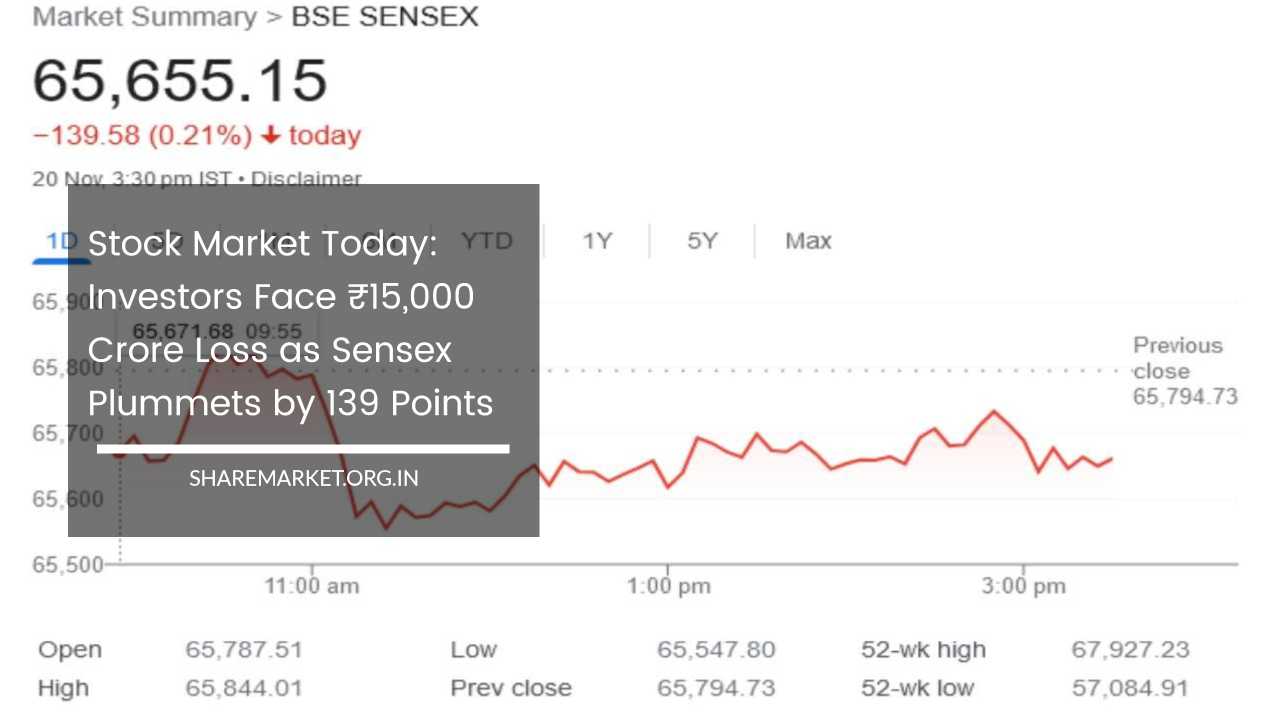

Stock Market Today: Investors Face ₹15,000 Crore Loss as Sensex Plummets by 139 Points

Stock Market Today

On Monday, November 20, the Indian stock markets experienced a tumultuous trading session, leaving investors grappling with a noticeable downturn that reverberated across various sectors.

In this detailed overview, we will not only delve into the specific numerical metrics characterizing the market on that day but also unravel the underlying dynamics that shaped the trading session, offering a comprehensive understanding of the challenges and opportunities that unfolded.

Sectoral Impact and Collective Losses:

The key indices, Sensex and Nifty, recorded declines, marking a challenging day for investors. The downturn was particularly pronounced in auto, FMCG, metal, and realty stocks, contributing to a collective loss of approximately Rs 15,000 crore for market participants.

This decline sent shockwaves through the investment community, highlighting the inherent volatility and uncertainty that can define the stock market.

However, amidst the prevailing gloom, there was a silver lining in the form of robust buying activity witnessed in small-cap stocks.

The BSE Smallcap index managed to close with a gain of about 0.39%, offering a glimmer of hope amid the broader market decline. This resilience in small-cap stocks hinted at the dynamic nature of market movements, where opportunities for growth can still be found even in challenging times.

Market Indices and Individual Stock Movements:

As the closing bell rang, the BSE Sensex registered a decline of 139.58 points or 0.21%, settling at 65,655.15. Similarly, the NSE Nifty saw a dip of 37.80 points or 0.19%, concluding the day at 19,694.00.

These figures painted a vivid picture of the challenges faced by the Indian stock market on that particular Monday.

The performance of individual stocks within the Sensex revealed a nuanced narrative of winners and losers. Out of the 30 Sensex stocks, 10 managed to close with gains. Bharti Airtel emerged as the frontrunner, boasting the highest rise at 1.48%.

The remaining gainers included HCL Tech, Wipro, Tech Mahindra, and Tata Consultancy Services (TCS), all recording positive movements ranging from 0.48% to 1.18%.

This subset of stocks stood as a testament to the resilience demonstrated by certain sectors amid the broader market turmoil.

Conversely, 20 Sensex stocks closed in the red, with Bajaj Finance leading the pack with a substantial loss of 2.11%. Other notable decliners encompassed Mahindra & Mahindra (M&M), UltraTech Cement, Bajaj Finserv, and Tata Motors, all witnessing declines ranging from 1.02% to 1.96%.

These contrasting movements underscored the heterogeneity of the market on that particular trading day, with winners and losers distributed across diverse industry segments.

Market Capitalization and Economic Impact:

Zooming out to a broader market perspective, the Bombay Stock Exchange (BSE) portrayed a mixed picture. Out of the 3,980 shares traded on the exchange that day, 1,878 closed with gains, while 1,936 experienced a decline.

Additionally, 166 shares maintained a flat trajectory without any fluctuations. This distribution of outcomes among traded stocks provided a comprehensive view of the market sentiment prevailing on November 20.

During the trading session, 413 shares reached their new 52-week high, underscoring the resilience of certain stocks amid the market turbulence.

Conversely, 32 shares touched their new 52-week low, signifying the challenges faced by some companies during this period.

The total market capitalization of companies listed on the BSE reflected the economic impact of the day’s events. On November 20, this metric came down to Rs 327.36 lakh crore, as opposed to Rs 327.51 lakh crore on the previous trading day (Friday, November 17).

The decrease in market capitalization amounted to an approximate Rs 15,000 crore loss, signifying a tangible erosion in the wealth of investors.

This decline serves as a tangible indicator of the economic impact of the day’s events. The approximate Rs 15,000 crore loss not only represents a substantial monetary setback but also underscores the inherent risks and uncertainties associated with stock market investments.

Investors, both institutional and retail, found themselves navigating a complex landscape where market forces and sector-specific trends converged to create a challenging environment.

Resilience of Small Cap Stocks and Divergence in Outcomes:

The performance of small-cap stocks, characterized by positive momentum in the BSE Smallcap index, introduces an interesting dimension to the narrative.

While large-cap stocks faced declines, the resilience displayed by small caps hints at the dynamic nature of market movements. Investors, ever watchful for opportunities, may find solace in the fact that certain segments of the market managed to weather the storm.

The contrasting fortunes of individual stocks within the Sensex highlight the importance of diversification in investment strategies. While some stocks weathered the storm with gains, others faced significant declines.

This diversity in outcomes emphasizes the need for investors to carefully assess their portfolios, taking into account the varied performance of different sectors.

Bajaj Finance’s leading position among the decliners underscores the vulnerability of financial stocks during market downturns.

As a major player in the financial sector, its decline of 2.11% serves as a barometer for the challenges faced by financial institutions amid broader market uncertainties.

Conversely, the positive movements in technology and communication stocks, as exemplified by Bharti Airtel and IT companies like HCL Tech and TCS, suggest a level of resilience in these sectors.

Broader Market Trends and Polarization:

The broader market trends, as reflected in the BSE’s overall performance, underscore the complexity of market dynamics. With nearly half of the traded shares closing with gains and the other half facing declines, the market on November 20 exhibited a degree of polarization.

This divergence in outcomes may have been influenced by a myriad of factors, including global economic conditions, geopolitical events, and sector-specific news.

The number of shares reaching their new 52-week high and low during the trading session provides additional insights. The 413 shares reaching their new 52-week high highlight pockets of strength and positive momentum in the market.

Investors keen on identifying potential opportunities may scrutinize these stocks for sustained growth potential. On the flip side, the 32 shares touching their new 52-week low signal challenges faced by certain companies, warranting a closer examination of their financial health and market positioning.

Key Takeaways and Future Considerations:

In conclusion, the events of November 20 in the Indian stock markets serve as a microcosm of the broader challenges and opportunities inherent in equity investments.

The day’s declines, particularly in sectors such as auto, FMCG, metal, and realty, underscore the volatility and uncertainty that investors must navigate.

The contrasting performances of individual stocks within the Sensex, coupled with the divergent outcomes in small-cap and midcap indices, highlight the need for a nuanced and diversified approach to investing.

As market participants reflect on the events of November 20, they may glean valuable insights to inform future investment decisions.

Whether adjusting portfolio allocations, reassessing risk tolerance, or staying abreast of sector-specific trends, investors can use this episode as a guide for navigating the ever-changing landscape of the stock market.

Ultimately, the comprehensive overview provided here aims to equip stakeholders with a deeper understanding of the complexities that unfolded on that particular trading day, fostering informed decision-making in the realm of financial markets.