AVP Infracon IPO Listing: Stock list at 5% premium over IPO price

AVP Infracon IPO Listing

AVP Infracon IPO: A Comprehensive Analysis

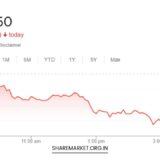

AVP Infracon’s foray into the public market on March 20, 2024, on the NSE SME platform resembled a baptism by fire. The initial euphoria of a strong investor response and a listing premium was quickly doused by a dramatic drop in the stock price, leaving many IPO investors in a near flat position.

This in-depth analysis delves into the intricacies of AVP Infracon’s IPO, dissecting the investor enthusiasm, the volatile listing day performance, and the company’s future prospects within the dynamic Indian infrastructure sector.

A Deluge of Subscriptions: Decoding the Investor Appeal

The ₹52.34 crore AVP Infracon IPO witnessed a remarkable oversubscription of 21.45 times, exceeding market expectations. This robust response can be attributed to several key factors:

- Riding the Infrastructure Wave: The Indian government’s focus on infrastructure development presents a promising growth avenue for construction companies. AVP Infracon’s core business in road projects aligns well with this national priority, potentially attracting investors seeking exposure to this growth narrative.

- Diversified Project Portfolio: Beyond roads, AVP Infracon boasts a diversified portfolio encompassing bridges, irrigation projects, and flyovers. This diversification mitigates risk by offering exposure to various segments within the infrastructure sector. Additionally, ventures into hospital, hotel, and commercial/residential projects hint at the company’s potential for expansion beyond core offerings, further enticing some investors.

- Financial Performance and Growth Potential: AVP Infracon’s financial performance appears healthy with a reported net profit of Rs 12.05 crore and revenue of Rs 115.50 crore in FY 2023. The first half of the current financial year also indicates continued growth. These metrics suggest a company with a solid foundation for future expansion.

A Fumbled Start: The Short-Lived Listing Day Euphoria

Despite the positive pre-IPO sentiment, the listing day unfolded dramatically. The initial 5.3% premium quickly vanished as the stock price plummeted to the lower circuit, closing at Rs 75.05, effectively wiping out the listing gain.

This unexpected volatility highlights the inherent risks associated with IPOs, particularly for smaller companies listed on the SME platform. Several factors might have contributed to this sudden drop:

- Profit Booking by Short-Term Investors: Some investors might have subscribed to the IPO with the sole intention of reaping quick profits on the listing day. Their selling pressure could have triggered the downward spiral.

- Lack of Broader Market Support: The overall market sentiment on the listing day might not have been conducive to sustained gains for AVP Infracon’s stock. Broader market fluctuations can significantly impact the performance of newly listed companies.

- Lower Valuation Expectations: Analyst expectations regarding AVP Infracon’s post-listing valuation might not have materialized, leading to some investor disappointment and selling activity.

Beyond the Numbers: A Deeper Look at AVP Infracon’s Prospects

While the initial investor response and financial metrics suggest promise, AVP Infracon’s long-term success hinges on navigating several critical challenges:

- The Cutthroat Competition: The Indian construction sector is fiercely competitive. AVP Infracon will need to develop a robust strategy to secure new projects and maintain profitability amidst established players. This might involve competitive bidding strategies, forging strategic partnerships, and focusing on niche segments within the infrastructure space.

- Project Execution Efficiency: Successful project execution is paramount. Delays or cost overruns in projects can significantly impact AVP Infracon’s financial performance and erode investor confidence. Implementing robust project management practices, effective cost control measures, and building strong relationships with suppliers and contractors will be crucial for mitigating these risks.

- Market Vulnerabilities: The construction sector is susceptible to external factors like fluctuations in interest rates, commodity prices, and government policies. Rising interest rates can increase project costs and dampen investor sentiment. Similarly, fluctuations in commodity prices can impact project budgets and profitability. Additionally, changes in government regulations or infrastructure spending priorities could directly affect AVP Infracon’s business prospects. Close monitoring of these external factors and adapting business strategies accordingly will be essential for navigating market vulnerabilities.

Investing in AVP Infracon: A Cautious Approach is Key

Given the volatile debut and inherent risks associated with IPOs, especially those of smaller companies listed on the SME platform, a cautious approach is recommended for potential investors. Several steps can be taken to mitigate investment risk:

- Thorough Due Diligence: Conducting in-depth due diligence is crucial. This involves a meticulous analysis of AVP Infracon’s financial statements, project pipeline, competitive landscape, management team capabilities, and risk mitigation strategies. Consulting financial advisors with expertise in IPOs can further enhance investment decision-making.

-

Risk Tolerance and Investment Horizon: Investors should critically evaluate their risk tolerance and investment horizon. AVP Infracon might be suitable for investors with a long-term perspective who are comfortable with the inherent volatility of small-cap stocks and the construction sector. However, those seeking short-term gains or with a low-risk appetite might be better served by looking elsewhere.

-

Monitoring Future Performance: Closely monitoring AVP Infracon’s future performance is essential. Tracking project execution timelines, financial results, news announcements, and industry trends will provide valuable insights into the company’s progress and potential.

Final Thoughts: A Bumpy Road Ahead with Potential Rewards

AVP Infracon’s IPO journey has been a rollercoaster ride so far. The initial investor enthusiasm suggests optimism about the company’s growth potential within the Indian infrastructure sector.

However, the volatile listing day performance serves as a stark reminder of the inherent risks associated with IPO investments, particularly for smaller companies.

While AVP Infracon’s financial performance and diversified project portfolio provide a foundation for future success, navigating a competitive landscape, ensuring efficient project execution, and adapting to market fluctuations will be critical for long-term viability.

Potential investors should carefully consider the risks and rewards before making an informed decision about investing in AVP Infracon.

By adopting a cautious approach, conducting thorough due diligence, and closely monitoring the company’s future performance, investors can potentially benefit from AVP Infracon’s long-term growth trajectory while mitigating some of the associated risks.

The Indian infrastructure sector is poised for significant growth in the coming years, and AVP Infracon, if it can successfully navigate the challenges, has the potential to be a part of this exciting story.