Berger Paints Q2 2023: Net Profit Soars 33% to Rs 292 Crore, Revenue Up by 3.6%

Berger Paints Q2 2023

Berger Paints’ Q2 2023 Performance and CEO’s Insights

Berger Paints, a prominent player in the Indian paint industry, recently unveiled its financial results for the second quarter of the fiscal year 2023.

These results provided valuable insights into the company’s performance during this period. According to Berger Paints’ CEO, Abhijit Roy, several factors contributed to the outcomes, including the timing of the festive season and the impact of unexpected rainfall in September.

In this discussion, we will delve deeper into these factors and analyze the financial results and strategic outlook shared by Abhijit Roy.

Impact of Delayed Festive Season and September Rains

One of the key takeaways from Berger Paints’ Q2 report was the impact of a delayed festive season and unseasonal rainfall in September on the company’s sales of topcoats, particularly exterior coatings.

This is a critical point because the demand for paint products is often closely tied to seasons and weather conditions.

The festive season in India, which includes major holidays like Diwali, is traditionally a peak period for various industries, including paint manufacturers.

However, in 2023, the festivities were delayed, which affected the timing of consumer spending and consequently, the demand for paints.

Furthermore, unanticipated rainfall in September disrupted outdoor construction and painting projects, further influencing Berger Paints’ sales in this segment.

This insight highlights the importance of seasonality and external factors in the paint industry. Companies like Berger Paints need to adapt their strategies to account for such variables and diversify their product offerings to mitigate the impact of weather-related fluctuations.

Financial Performance

Moving on to the financial aspects of Berger Paints’ Q2 report, the company’s consolidated net profit for the second quarter reached an impressive Rs 292.13 crore, marking a substantial 33% increase compared to the same period in the previous year.

This surge in net profit reflects the company’s ability to not only weather external challenges but also capitalize on growth opportunities within the market. The 33% increase is a testament to the effectiveness of the company’s strategies and operations.

The consolidated revenue also showed positive growth, with a 3.6% increase, reaching Rs 2767.3 crore in Q2FY24.

This indicates that Berger Paints not only managed to protect its existing market share but also expanded it. This growth is crucial in a competitive industry like paints, where numerous players are vying for market dominance.

A 3.6% increase in revenue is a substantial achievement and showcases Berger Paints’ resilience and market strength.

In addition to net profit and revenue growth, the company’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for the second quarter was Rs 473.65 crore.

This figure represents a significant 30.4% year-on-year increase. EBITDA is a key financial metric that provides insights into a company’s operational efficiency and profitability.

The notable increase in EBITDA is indicative of Berger Paints’ ability to generate substantial profits from its core operations.

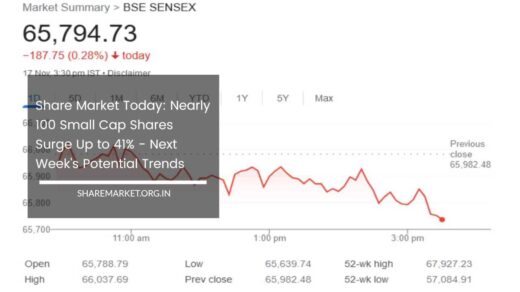

Despite these positive financial indicators, it’s worth noting that at 2:04 PM, the company’s stock was trading at Rs 546.9 on the National Stock Exchange, showing a slight decrease of 0.56% from its previous close.

This minor dip in the stock price is a common occurrence in the stock market and should be viewed in the context of broader market dynamics. Investors often react to a variety of factors, and short-term fluctuations are part of the stock market’s natural ebb and flow.

CEO’s Insights and Strategy

Abhijit Roy, the Managing Director and Chief Executive Officer of Berger Paints, shared his insights on the company’s performance in Q2 2023.

He noted that the decorative segment had witnessed double-digit volume growth. This is a positive sign, indicating that consumers continued to invest in beautifying their living spaces.

However, the value growth in this segment was relatively lower, suggesting that the increased volume sales might have been driven by lower-priced products. This insight underscores the importance of product mix and pricing strategies for a company like Berger Paints.

Abhijit Roy also mentioned that during the quarter, sales of lower-end and commodity items were higher. This information provides a nuanced view of the market dynamics.

Companies often produce a range of products, from premium to budget-friendly, to cater to diverse consumer preferences.

Understanding which product categories are performing well is vital for future product development and marketing strategies.

The CEO’s comments about the impact of the delayed festive season and September rains shed light on the company’s ability to adapt to unforeseen challenges. In business, adaptability is a crucial trait.

Companies that can quickly adjust their strategies in response to changing circumstances are better positioned to thrive, even in adverse conditions.

However, not all segments were negatively affected by external factors. Abhijit Roy highlighted strong value growth in the general industrial and powder coatings verticals.

This is a promising development, as it indicates that certain areas of Berger Paints’ business were less vulnerable to external influences and experienced growth.

Understanding which segments are resilient can help the company focus its resources and efforts on areas with higher growth potential.

Moreover, the CEO emphasized the company’s commitment to expanding its network and implementing digital initiatives. In today’s business landscape, digital transformation is a critical factor for sustained success.

Implementing digital technologies can enhance operational efficiency, provide better customer experiences, and drive growth.

Abhijit Roy’s mention of digital initiatives signals the company’s forward-looking approach to embracing technology.

Company Overview

Berger Paints, with its headquarters in Kolkata, is a well-established player in the Indian paint industry. The company boasts 16 manufacturing units not only in India but also in international locations, including Nepal and Poland.

This widespread manufacturing presence allows Berger Paints to serve a diverse and global customer base, which is advantageous for its growth and sustainability.

In conclusion, the Q2 2023 financial report and insights from CEO Abhijit Roy shed light on Berger Paints’ performance during a challenging period marked by a delayed festive season and unseasonal rainfall.

Despite these challenges, the company demonstrated remarkable financial growth in terms of net profit, revenue, and EBITDA. Abhijit Roy’s strategic vision, emphasizing adaptability, product diversification, and digital transformation, bodes well for the company’s future.

Berger Paints’ ability to weather external disruptions and achieve growth in various product segments showcases its strength and resilience in the competitive paint industry.