Chavda Infra IPO Listing: Entry at 40% Premium Leads to Profit Booking, Lower Circuit Imposed on Day One

Chavda Infra IPO Listing

Chavda Infra IPO Listing: Strong Debut Amidst High Investor Enthusiasm

Chavda Infra, a company specializing in contract construction services, created waves in the financial market as its shares made an impressive entry onto the NSE SME platform.

The Chavda Infra Initial Public Offering (IPO) not only received an overwhelming response from investors but also showcased remarkable subscription rates, underlining the growing appetite for IPOs in India’s ever-evolving financial landscape.

This comprehensive article delves into the details of Chavda Infra’s IPO listing, its market performance, investor response, the company’s background, and its financial health.

The Chavda Infra IPO Unveiled

Chavda Infra’s IPO garnered significant attention right from the announcement stage. The company, specializing in contract construction services, embarked on a journey to raise funds through the capital market.

The IPO offered investors an opportunity to become part of Chavda Infra’s growth story by subscribing to its shares.

The IPO’s timing was strategically chosen, and it coincided with a period of heightened interest in the infrastructure and construction sector, aligning with the Indian government’s initiatives in the same domain.

Overwhelming Investor Response

One of the most remarkable aspects of Chavda Infra’s IPO was the unprecedented level of investor enthusiasm it generated.

The IPO was oversubscribed by a staggering 180.06 times, making it one of the most sought-after IPOs in recent memory.

This remarkable response reflected not only investor confidence in Chavda Infra’s prospects but also the broader optimism in the Indian economy.

To break down the subscription numbers further:

- Qualified Institutional Buyers (QIB) showed substantial interest, with a subscription rate of 95.10 times.

- Non-Institutional Investors (NII) exhibited remarkable enthusiasm, oversubscribing their portion by a whopping 241.96 times.

- Retail investors were particularly keen, subscribing at a rate exceeding 2022 times their allocated portion.

These subscription rates clearly underscored the faith investors had in Chavda Infra’s growth potential and the promising outlook for the construction and infrastructure sector.

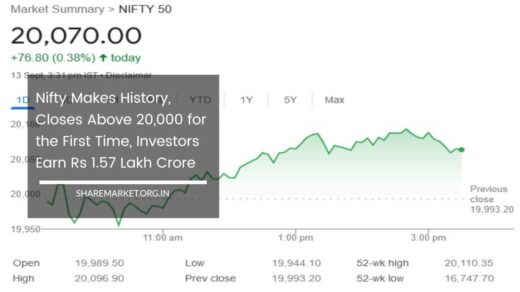

IPO Price and Listing Gain

The IPO was initially offered to investors at a price of Rs 65 per share, signaling the company’s valuation at the time of the offering.

However, when the shares made their market debut, they surged to Rs 91, marking an impressive 40% premium for IPO investors. This remarkable listing gain demonstrated the immediate market demand for Chavda Infra’s shares.

The listing day was indeed momentous for Chavda Infra and its IPO investors. The surge in share price on the first day not only rewarded early investors but also garnered significant attention in the financial news, drawing further interest from potential investors and market analysts.

Post-Listing Performance and Profit Booking

While the listing day started on a high note with the impressive premium, it was not without its challenges. Post-listing, Chavda Infra’s share prices experienced a downward trajectory due to profit booking.

Investors who had enjoyed substantial gains on the listing day opted to sell their holdings to lock in profits. As a result, the share prices witnessed a decline and closed at the lower circuit of Rs 86.45 by the end of the day.

Nevertheless, even with the profit booking, IPO investors were still able to secure a commendable 33% profit on their investments, a notable achievement in the IPO market.

Chavda Infra: The Company Behind the IPO

Chavda Infra is a part of the Chavda Group, a conglomerate with diverse interests and a prominent presence in Gujarat’s infrastructure and construction sector. The Chavda Group encompasses three distinct businesses:

- Chavda Infra: The flagship company specializing in contract construction services.

- Chavda RMC: Engaged in ready-mix concrete production, serving the construction industry.

- Chavda Developers: Focused on real estate development and construction projects.

Chavda Infra’s geographical footprint extends across key cities in Gujarat, including Ahmedabad, Gandhinagar, and Rajkot.

The company has an impressive track record, having successfully completed over 100 projects valued at approximately Rs 670.99 crore.

As of May 2023, Chavda Infra is actively engaged in 26 ongoing projects with a cumulative value of around Rs 601.39 crore.

These projects encompass a diverse range of segments, including commercial, institutional, and residential ventures.

This robust project portfolio underscores Chavda Infra’s commitment to growth and its role as a key player in shaping Gujarat’s infrastructure landscape.

Financial Health and Growth Trajectory

One of the crucial aspects that investors evaluate when considering an IPO is the financial health of the company. In the case of Chavda Infra, its financial performance has been on an upward trajectory, reflecting its robust financial health and growth potential.

- In the financial year 2021, Chavda Infra reported a net profit of Rs 4.44 crore, showcasing a promising start to its growth story.

- Building on this success, the company’s net profit increased to Rs 5.21 crore in the subsequent financial year, 2022, demonstrating steady growth.

- In the most recent financial year, 2023, Chavda Infra’s net profit saw a substantial surge, reaching an impressive Rs 12.05 crore. This remarkable growth in profitability underscored the company’s capacity to deliver strong financial results.

The consistent improvement in Chavda Infra’s financial performance indicated effective management, efficient execution of projects, and the ability to capitalize on opportunities in the construction and infrastructure sector.

Final Thoughts

Chavda Infra’s IPO listing was marked by a strong debut, showcasing the company’s potential in the construction and infrastructure sector.

The overwhelming investor response, with a subscription rate of 180.06 times, and the substantial listing gain of 40% highlighted the confidence investors had in the company’s prospects.

As part of the Chavda Group, Chavda Infra has carved a niche for itself in Gujarat’s infrastructure landscape, with a diverse portfolio of projects and a commitment to quality and innovation.

Its robust financial performance in recent years further cements its position as a promising player in the construction industry.

The success of Chavda Infra’s IPO not only reflects the company’s potential for growth but also underscores the optimism and dynamism of India’s capital markets.

It serves as a testament to the growing interest of investors in promising companies that contribute to the nation’s infrastructure development.

Overall, Chavda Infra’s IPO listing is a testament to the potential and promise of India’s construction and infrastructure sector, and it will undoubtedly be closely watched by investors and industry stakeholders as the company embarks on its journey of growth and expansion.