Market Closed in Red Mark: Nifty Prediction for Jan 23

Nifty Prediction

Market Overview and Analysis

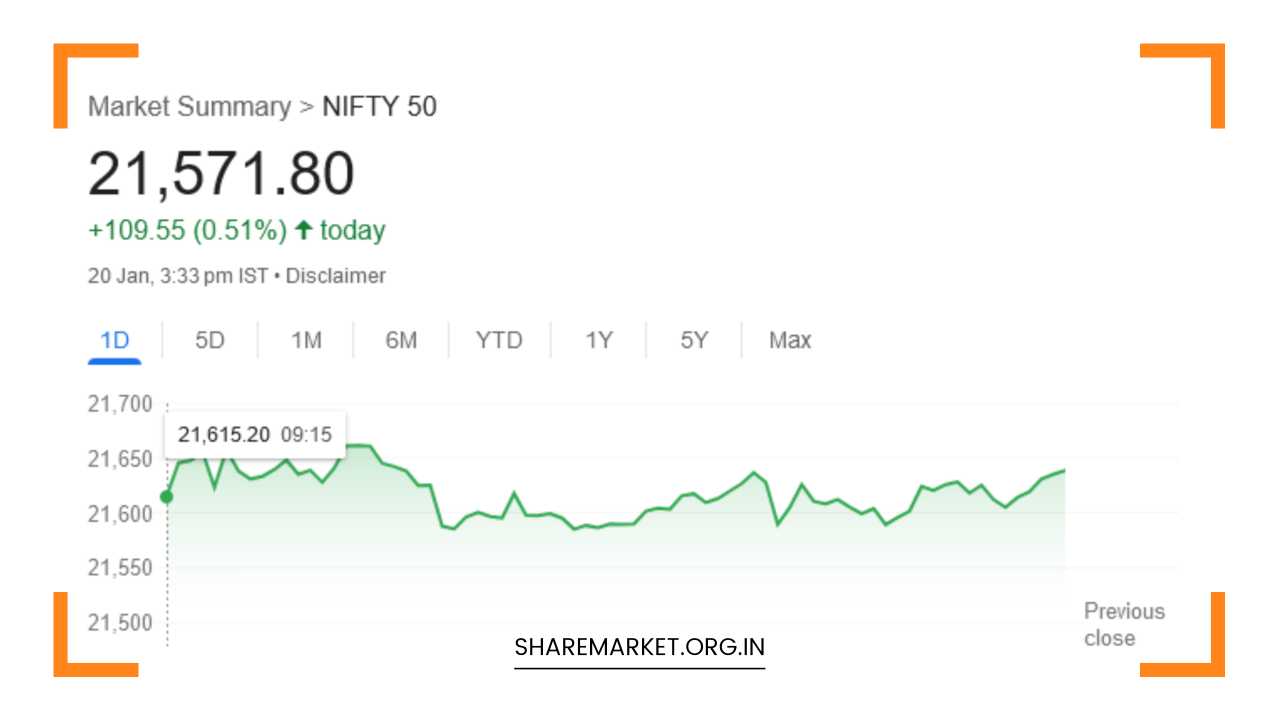

The Nifty index started the trading day on a positive note, opening with gains, but soon witnessed considerable volatility, setting the tone for a dynamic session.

Analysts foresee a continued consolidation in the market, projecting that this phase may persist until the Nifty remains within the range of 21,500-21,700.

As the trading day concluded, the stock market exhibited a bearish trend. The Nifty closed at approximately 21,600, signaling a decline.

The Sensex, the benchmark index for the Bombay Stock Exchange, also faced a setback, falling by 259.58 points or 0.36% to reach 71,423.65.

The Nifty experienced a relatively milder decline of 36.70 points or 0.17%, closing at 21,585.70.

In terms of individual stock movements, around 1,971 shares saw an increase, while 1,706 registered a decline, with 87 remaining unchanged. Notably, both the BSE Midcap and Smallcap indices managed to secure gains of 0.4%.

Analyzing the day’s top performers and underperformers, prominent names such as HUL, M&M, TCS, IndusInd Bank, and HCL Technologies found themselves among the top losers on the Nifty.

Conversely, Coal India, Adani Ports, Adani Enterprises, Kotak Mahindra Bank, and ICICI Bank emerged as the leading gainers.

Examining the sectoral performance, indices related to banking, metal, and power closed with gains ranging from 0.5-1%. On the flip side, sectors such as FMCG, IT, Pharma, and Realty experienced declines in the range of 0.4-1%.

Expert Analysis and Market Commentary

Aditya Gaggar, Director of Progressive Shares, provided insights into the day’s market dynamics. According to Gaggar, the market initiated the session on a robust note, with bullish momentum.

However, as the session unfolded, the bulls seemed to lose their grip, leading to Nifty slipping into the red. The day concluded with Nifty at 21,571.80, marking a decline of 50.60 points.

Gaggar noted that the fall in select major stocks exerted pressure on the Nifty, influencing the overall negative sentiment in the trading session.

A notable observation was the strength exhibited by banking indices, particularly PSU banks, contrasting with losses in FMCG and tech stocks.

The tire sector saw a significant uptick in stock prices, and there was a noticeable acceleration in trading activity at railway counters.

While the broader markets experienced sluggishness, mid and small-cap segments managed to outperform the benchmark indices.

On the technical front, the daily chart for Nifty 50 formed a bearish candlestick pattern, indicating a potential continuation of the ongoing consolidation within the range of 21,500-21,700. This pattern suggested that the market might maintain its current trajectory in the near term.

Sectoral Performance and Stock Movements

Taking a closer look at the top gainers and losers among individual stocks, HUL, M&M, TCS, IndusInd Bank, and HCL Technologies faced headwinds during the trading session.

On the other hand, Coal India, Adani Ports, Adani Enterprises, Kotak Mahindra Bank, and ICICI Bank witnessed positive momentum, emerging as the top performers.

Examining the sectoral indices, banking, metal, and power indices stood out with gains ranging from 0.5-1%. This showcased the resilience and strength in these sectors amid the overall market turbulence.

However, sectors such as FMCG, IT, Pharma, and Realty faced downward pressure, with declines ranging from 0.4-1%.

This divergence in sectoral performance highlighted the varied dynamics within the market, influenced by both domestic and global factors.

Technical Analysis and Market Projections

Kunal Shah, a representative from LKP Securities, delved into the technical aspects of the market, specifically focusing on the Bank Nifty index.

Shah emphasized the index’s strength, pointing out the formation of higher lows on the daily chart.

Maintaining immediate support at 45,700-45,600, Shah suggested that the index needed to surpass the immediate resistance at 46,300 for new bullishness to emerge.

In the event of a successful breach, short-covering might be triggered, propelling Bank Nifty towards 46,500/46,800 levels.

Conversely, a close below the crucial support of 45,600 could extend the downside, potentially pushing the index towards 44,000.

Rupak Dey, also from LKP Securities, echoed the sentiment of a positive opening for Nifty followed by sustained volatility. Dey highlighted the likelihood of continued consolidation within the 21,500-21,700 range.

According to Dey, a decisive breakout on either side of this range is essential to provide clarity on the market’s future direction.

In case Nifty breaches below 21,500, the potential downside could lead to levels of 21,300 and below. On the contrary, a strong breakout above 21,700 is crucial to signal a resumption of the uptrend.

Conclusion and Recommendations

As the market approaches January 23, traders and investors are advised to closely monitor key levels, particularly the range of 21,500-21,700 on the Nifty.

The ongoing consolidation suggests a cautious approach, with a need for confirmation through a decisive breakout.

The dynamics of individual sectors, especially the contrasting performance of banking, metal, and power sectors against FMCG, IT, Pharma, and Realty, should be considered in crafting investment strategies.

It’s essential for market participants to remain vigilant to potential triggers that could influence market sentiment.

Factors such as global economic indicators, geopolitical events, and domestic economic policies can contribute to market movements.

As experts highlight the importance of technical levels and patterns, a well-informed and strategic approach will be crucial for navigating the market landscape in the days ahead.