Market Closed With Slight Gains; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Indian Stock Market Trends on January 11 and Market Prediction for January 12

In the realm of the stock market, January 11 unfolded as a day marked by the continuation of a consolidation phase, resulting in subdued and nearly flat trading.

Ajit Mishra, a market expert from Religare Broking, noted the lackluster trading activity during this period.

However, despite the overall muted atmosphere, Indian benchmark indices managed to secure slight gains.

This report delves into the key highlights of the trading session, analyzes the performance of various indices and stocks, and provides insights from market experts regarding the potential trajectory on January 12.

Key Highlights of January 11:

The BSE Midcap and Smallcap indices emerged as the stars of the day, recording a rise of 0.7 percent, outperforming the benchmark. Small and medium-sized stocks exhibited resilience, contributing to the positive momentum in the market.

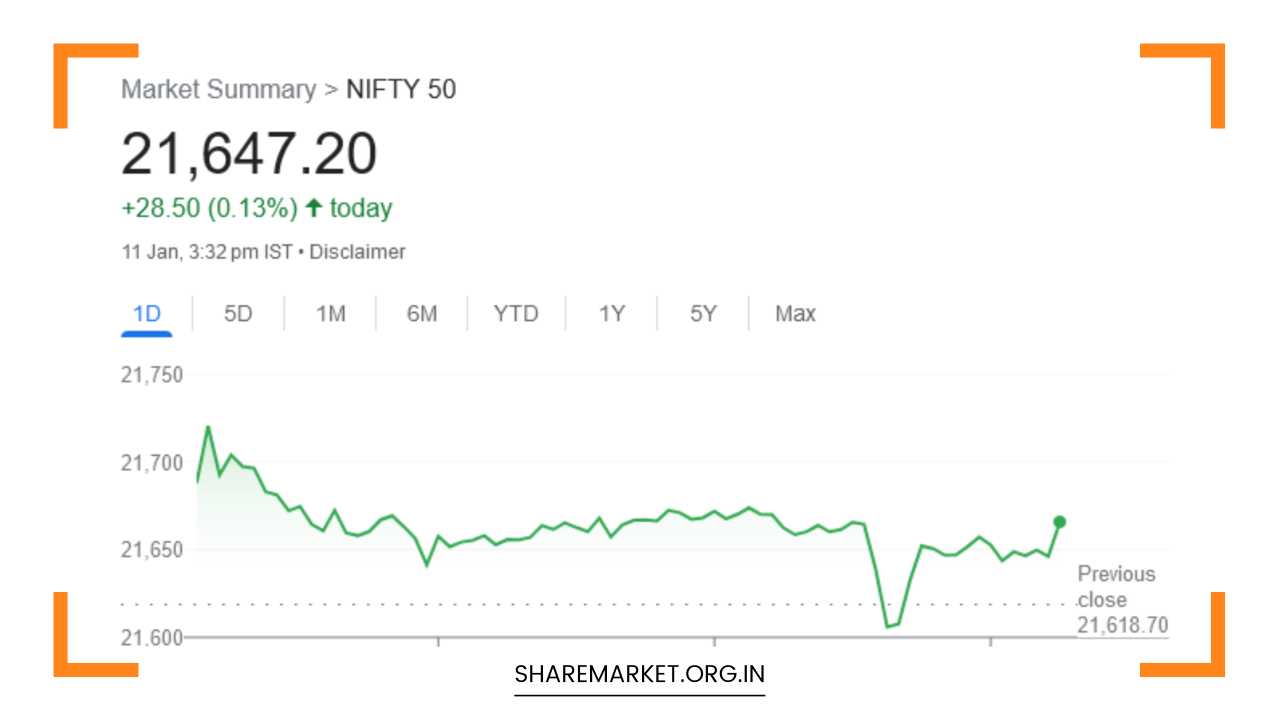

The Sensex closed at 71,721.18, registering a modest increase of 63.47 points or 0.09 percent. Similarly, the Nifty closed at 21,647.20, posting a gain of 28.50 points or 0.13 percent. Amidst the 2022 shares that witnessed an increase, 1251 shares experienced a decline, while 63 shares remained unchanged.

Top gainers on the Nifty included Hero MotoCorp, Bajaj Auto, Reliance Industries, Axis Bank, and BPCL. On the flip side, Infosys, Dr Reddy’s Laboratories, SBI Life Insurance, HUL, and Wipro were among the top losers on Nifty.

The sectoral indices displayed a mixed bag of trends. The BSE Capital Goods index dropped by 1 percent, and the BSE IT index fell by 0.5 percent. However, the BSE Auto and Oil & Gas indices recorded a rise of 1 percent each.

Insights from Market Experts:

As market participants look ahead to January 12, insights from experts shed light on the potential market movements.

Kunal Shah of LKP Securities highlighted that Nifty faced selling pressure within the range of 21700-21750. Despite this, it remained resilient and managed to stay above its 10-day moving average.

The immediate support for Nifty has now shifted to 21600, with technical resistance at 21730. Additionally, a significant positional support is identified at 21500.

Bank Nifty witnessed a tug of war between bullish and bearish sentiments, leading to heightened volatility during the trading session.

Shah pointed out a major hurdle for Bank Nifty at 48000, accompanied by substantial call writing at this level. A breakthrough beyond this obstacle could trigger a sharp short-covering rally.

On the downside, the support for Bank Nifty remains at 46900. A breach of this level during any correction might escalate selling pressure in the market.

Aditya Gaggar, Director of Progressive Shares, drew attention to the dynamic performance of small and medium stocks, suggesting that mid and smallcaps outperformed the frontline index.

Gaggar hinted at a potential bullish flag pattern forming in Nifty, hinting at the possibility of a significant upward movement post-pattern breakout.

Ajit Mishra of Religare Broking echoed the sentiment of continued consolidation, characterizing the market as exhibiting dull trading and concluding almost flat.

Nifty, according to Mishra, has been navigating within a range for nearly two weeks, and the market’s direction remains elusive due to mixed trends in important indices.

Consequently, Mishra advised market participants to prioritize hedged positions, especially with the onset of the results season, and exercise patience until a clearer market direction emerges.

Looking Ahead to January 12:

As market participants brace themselves for January 12, several factors come into play. The insights from experts paint a nuanced picture of the potential market movements:

- Nifty’s Resilience and Support Levels: Kunal Shah’s observation regarding Nifty’s resilience within the 21700-21750 range and its ability to stay above the 10-day moving average suggests a certain degree of strength. The immediate support for Nifty has shifted to 21600, providing a crucial level for traders to monitor. Technical resistance at 21730 and a significant positional support at 21500 add further layers to the analysis.

- Bank Nifty’s Volatility and Potential Rally: The dynamic movement in Bank Nifty, as pointed out by Shah, signifies a struggle between bullish and bearish forces. The 48000 level presents a substantial hurdle, with call writing indicating significant resistance. A breakthrough past this level could potentially trigger a substantial short-covering rally, offering traders an opportunity to capitalize on the upward momentum. On the downside, the support at 46900 acts as a critical level to watch, as a breach might intensify selling pressure.

- Small and Medium Stocks’ Outperformance: Aditya Gaggar’s emphasis on the outperformance of small and medium stocks suggests a shift in investor sentiment towards these segments. The speculation of Nifty forming a bullish flag pattern further adds intrigue, hinting at a potential breakout and a subsequent sharp bounce. This underlines the importance of monitoring not only the benchmark indices but also the broader market dynamics.

- Consolidation and Mixed Trends: Ajit Mishra’s cautionary note on the continued phase of consolidation and the unclear market direction due to mixed trends in crucial indices serves as a reminder for market participants to exercise prudence. With the results season unfolding, Mishra’s advice to prioritize hedged positions aligns with the cautious tone, urging traders to navigate the market with vigilance until a clearer trend emerges.

Final Remarks:

In conclusion, the Indian stock market on January 11 exhibited a blend of consolidation, resilience, and sector-specific movements. While the benchmark indices closed with slight gains, the underlying dynamics suggest a nuanced landscape.

As market participants gear up for January 12, the observations and insights from experts provide valuable guidance.

The resilience of Nifty, the volatility in Bank Nifty, the outperformance of small and medium stocks, and the overarching theme of consolidation collectively shape the narrative of the market.

Traders and investors are advised to closely monitor key support and resistance levels, stay attuned to sectoral trends, and exercise caution amidst the ongoing uncertainties in the market.