Market Outlook: Nifty Closes Above 19,400 – Predicting Market Trends for September 4th

Market Outlook

The Indian stock market kicked off the September series with a resounding boom on September 1st, 2023. The Nifty index, in particular, displayed remarkable strength by surging above the 21-day Exponential Moving Average (EMA) for the first time in quite a while.

This development is seen as a bullish sign, indicating the potential for further growth and positive sentiment in the market.

September 1st: Market Highlights

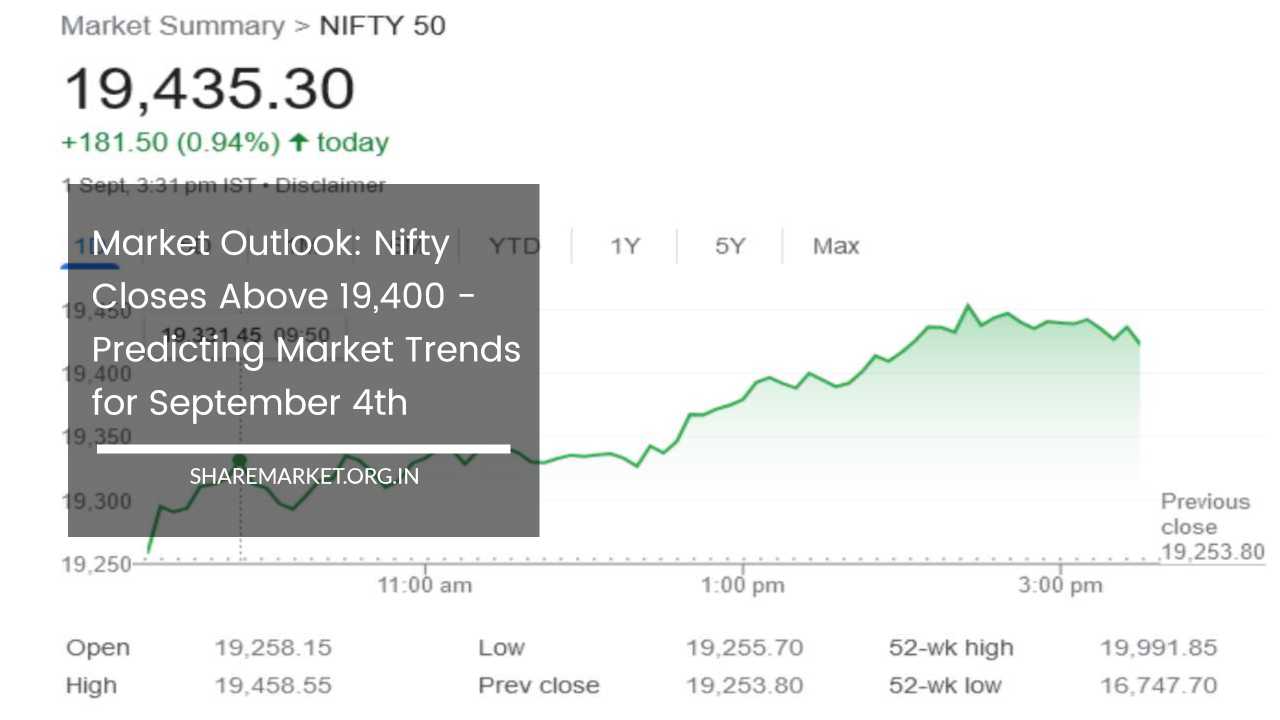

On September 1st, market participants witnessed a bullish trend, culminating in the Nifty index closing above the significant milestone of 19,400 points.

The optimism was driven by widespread buying across various sectors, with the notable exception being the Pharma sector.

As the trading day came to a close, the Sensex, the benchmark index of the Bombay Stock Exchange (BSE), settled at 65,387.16, marking an impressive gain of 555.75 points or 0.86 percent.

The Nifty, representing the National Stock Exchange (NSE), climbed by 181.50 points or 0.94 percent, closing at 19,435.30.

This bullish momentum was reflected in the market breadth, with approximately 2,103 shares registering gains, while 1,456 shares experienced declines.

Notably, there was no change in the stock prices of 108 companies, emphasizing the dynamic nature of the market.

Some of the top gainers in the Nifty included NTPC, ONGC, JSW Steel, Tata Steel, and Maruti Suzuki. Conversely, Cipla, HDFC Life, Dr. Reddy’s Laboratories, UltraTech Cement, and Nestle India were among the top losers.

Sectoral Performance and Positive Data

With the exception of the Pharma sector, all other sectoral indices closed in the green on September 1st. Key sectors like Power, Metal, Auto, Oil and Gas, and Banking witnessed gains ranging from 1 to 2.7 percent.

This broad-based rally signaled investor confidence across a range of industries.

Moreover, both BSE’s Midcap and Smallcap indices posted gains of 0.7 percent each, reinforcing the positive sentiment in the mid and small-cap segments of the market.

The catalyst for this upbeat mood was strong Gross Domestic Product (GDP) and Manufacturing Purchasing Managers’ Index (PMI) data, which energized market participants.

Market Outlook for September 4th

Looking ahead to September 4th, analysts offer insights into the potential market trajectory:

Jatin Gedia of Sharekhan noted that Nifty opened the previous day with a flat trend but witnessed sustained buying throughout the day, resulting in a gain of approximately 180 points. Nifty demonstrated a sharp recovery from the 19,250 zone on the daily chart.

The daily and hourly momentum indicators showed a positive crossover with divergence, hinting at further upside potential in the short term.

On the weekly chart, Nifty managed to close in the green after enduring five consecutive weeks of decline, suggesting the possibility of renewed buying interest.

This indicates that the index has reached a level where buying activity may resume. Consequently, there’s potential for Nifty to ascend towards the 19,650 mark, with support levels around 19,330-19,300 and resistance at 19,520-19,550.

Rupak Dey, Senior Technical Analyst at LKP Securities, observed that Nifty commenced the September series with strong bullish momentum.

Notably, the index surged above the 21-day Exponential Moving Average (EMA) for the first time in several days, signaling a positive outlook.

Additionally, Nifty broke out of a falling channel, further enhancing the bullish sentiment. In the near term, resistance is anticipated around the 19,530 level for Nifty.

A successful breach of this resistance level could potentially drive further upward movement. Conversely, strong support is evident around the 19,340 level.

Bank Nifty’s Rebound

Bank Nifty, which often mirrors Nifty’s performance, also staged a remarkable comeback on September 1st. The index managed to hold the support of its 20-week moving average at 44,144 points and concluded the trading session in positive territory.

Notably, both daily and hourly momentum indicators exhibited a positive crossover, serving as a buy signal. The short-term outlook for Bank Nifty suggests potential movement towards the 45,000 level.

Conclusion: Positive Sentiment and Bullish Momentum

As September unfolds, the Indian stock market is displaying a positive sentiment and bullish momentum. The Nifty’s decisive move above the 21-day EMA and its exit from a falling channel are indicative of market strength.

Analysts suggest that the index has the potential to continue its upward trajectory, with resistance around 19,530 points. Meanwhile, robust support is expected at 19,340 points.

Additionally, Bank Nifty’s rebound and positive momentum further contribute to the overall positive outlook for the market. Strong economic data, including GDP and Manufacturing PMI figures, have bolstered investor confidence.

While market conditions can change rapidly, the current indications point toward a favorable environment for investors and traders in the Indian stock market.

As always, it’s crucial for market participants to stay informed, monitor key technical levels, and adapt their strategies to evolving market dynamics.