Market Outlook: Nifty Closes Near 20,000 – What to Expect in Market Movement on September 13

Market Outlook

Market Outlook: Analyzing Nifty’s Recent Performance and What to Expect on September 13th

The Indian stock market has been a hub of activity recently, with significant fluctuations in benchmark indices and notable movements in various sectors.

As investors closely monitor market trends, it’s crucial to understand the dynamics that are shaping these shifts.

In this analysis, we’ll take a comprehensive look at the recent performance of the market, top gainers and losers, and what the future might hold for Nifty on September 13th.

Recap of Recent Market Performance

As the Indian stock market grapples with volatility, it’s essential to review the recent performance of benchmark indices.

On September 12, the market witnessed a mixed day of trading, with most sectors registering losses except for the Information Technology (IT) sector. Here’s a summary of the key developments:

- Sensex closed at 67,221.13, marking a gain of 94.05 points or 0.14 percent.

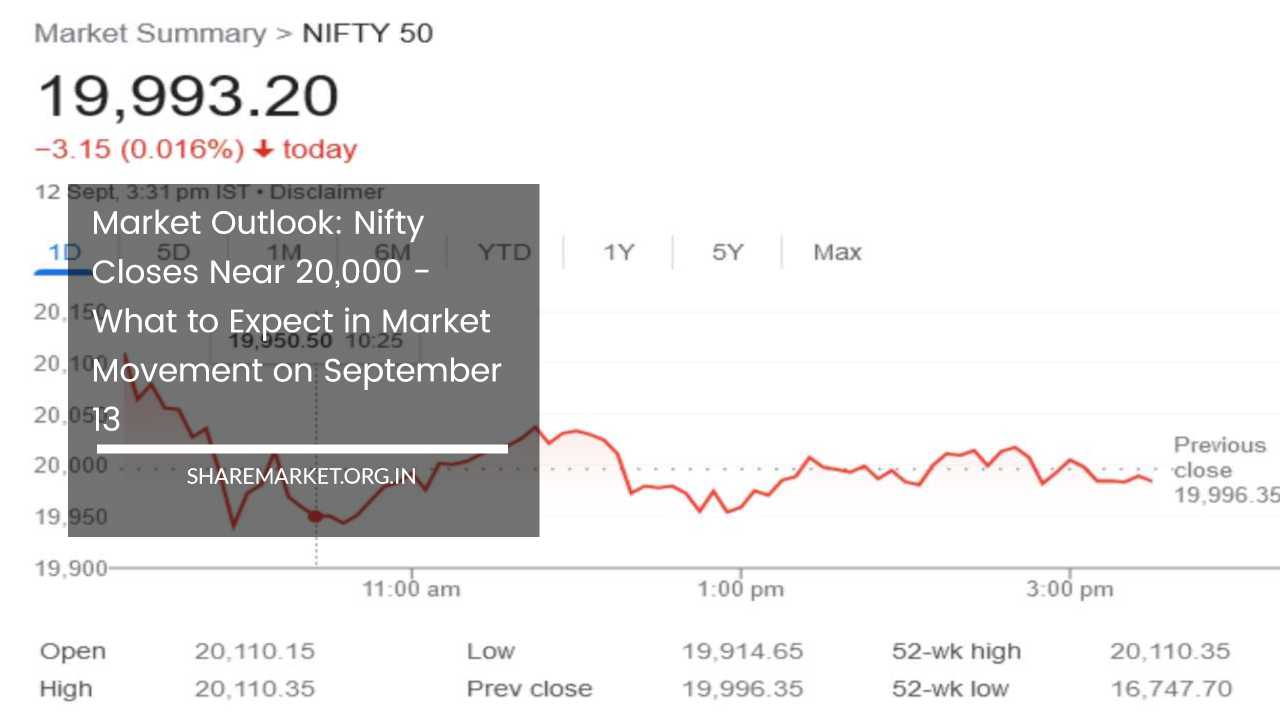

- Nifty closed at 19,993.20, displaying weakness with a decline of 3.10 points or 0.02 percent.

The day started with gains, but the market couldn’t sustain these levels, leading to a mixed closing. Nifty hovered around the crucial 20,000-point mark throughout the trading session, reflecting the ongoing volatility in the market.

Gainers and Losers

A closer look at the top gainers and losers within Nifty provides insights into the sectors that performed well and those that faced challenges on September 12.

Top Nifty Gainers:

- TCS: Tata Consultancy Services, a leading IT services company, demonstrated strong performance and contributed to Nifty’s gains.

- L&T (Larsen & Toubro): L&T, a diversified conglomerate with interests in construction, technology, and engineering, experienced positive momentum.

- Infosys: Another IT giant, Infosys, contributed to the overall gains in Nifty.

- Divis Laboratories: This pharmaceutical company showcased resilience in a challenging market environment.

- UltraTech Cement: The cement sector also saw gains, with UltraTech Cement making it to the list of top Nifty gainers.

Top Nifty Losers:

- BPCL (Bharat Petroleum Corporation Limited): BPCL faced headwinds and emerged as one of the top losers in Nifty.

- Power Grid Corporation: The power sector encountered challenges, impacting Power Grid Corporation’s performance.

- NTPC (National Thermal Power Corporation): NTPC, a prominent player in the energy sector, faced losses on this trading day.

- Adani Enterprises: Adani Enterprises, a conglomerate with diverse interests, struggled in the market.

- Coal India: The mining sector, represented by Coal India, also registered losses.

It’s evident that the IT sector stood out as a resilient performer amidst the broader market challenges.

Market Outlook for September 13th

As investors prepare for the next trading session on September 13th, it’s essential to consider expert opinions and technical analysis to gauge potential market movements.

Jatin Gedia of Sharekhan offers insights into Nifty’s recent performance. While the day started with gains, it eventually closed in the red with a marginal decline of about 3 points.

Notably, mid and small-cap indices experienced more significant declines, with losses of approximately 4 percent.

This suggests that after the robust growth witnessed in the preceding seven trading sessions, the market may enter a consolidation phase. The anticipated consolidation range for Nifty is between 20,100 and 19,800.

Momentum indicators on both daily and hourly timeframes are sending mixed signals, indicating the possibility of a slight market downturn.

However, both price and momentum indicators suggest that consolidation might be on the horizon in the coming trading sessions.

Overall, the short-term outlook remains positive, and this consolidation could be viewed as an opportunity for buying. Key support levels for Nifty are expected at 19,865-19,810, while initial resistance can be observed at 20,200-20,250.

Shrikant Chauhan of Kotak Securities adds his perspective to the market outlook. After seven consecutive trading sessions of growth, the market displayed signs of a slowdown on the analyzed day.

Sensex and Nifty closed mixed, reflecting early trade fluctuations. From a technical standpoint, the mid-term outlook remains positive, but a short-term consolidation phase might be on the horizon.

For traders, support levels are identifiable at 19,900-19,850, while immediate resistance zones exist at 20,100-20,150.

Final Thoughts

In conclusion, the Indian stock market continues to be a dynamic arena, influenced by various factors and sectors.

The recent performance of Nifty, with gains in IT and losses in other sectors, underscores the importance of diversification and risk management in investment strategies.

As investors approach the trading session on September 13th, they should be prepared for potential market consolidation within specified ranges.

Expert opinions suggest that despite short-term fluctuations, the overall outlook remains positive, and consolidation phases can be viewed as opportunities for strategic buying.

It’s crucial for market participants to stay informed, conduct thorough research, and consider technical analysis alongside expert insights to make well-informed investment decisions.

The Indian stock market, with its resilience and adaptability, continues to offer opportunities for investors seeking to navigate its ever-evolving landscape.