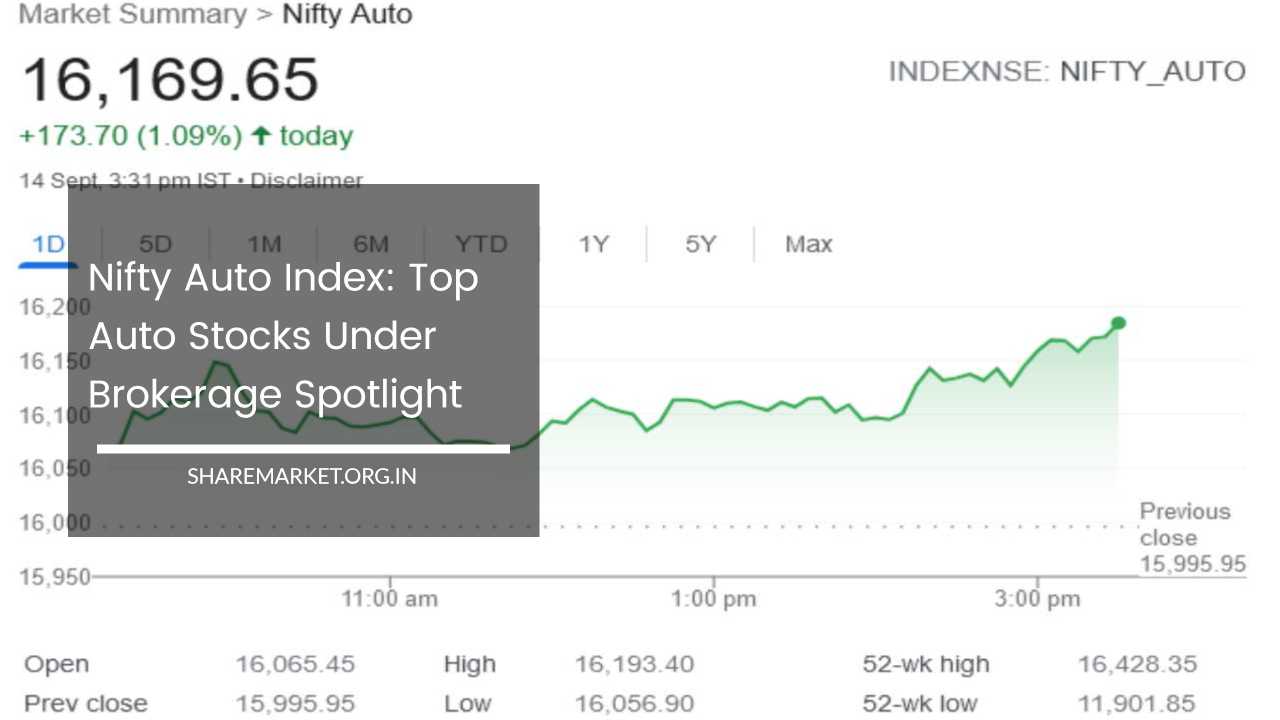

Nifty Auto Index: Top Auto Stocks Under Brokerage Spotlight

Nifty Auto

Revival of Auto Stocks: Maruti and TVS Motors Lead the Way

The automobile industry is experiencing a remarkable resurgence, and two standout players in this revival are Maruti Suzuki and TVS Motors.

As the Nifty Auto Index shifts into fifth gear after four challenging years, Maruti Suzuki and TVS Motors are poised to benefit from a wave of renewed demand, improved profit margins, and favorable product cycles.

This comprehensive analysis delves into the factors driving the resurgence of the auto sector, explores Maruti and TVS Motors’ growth prospects, and examines the broader landscape of the Indian automobile industry.

The Resurgence of the Auto Sector

After four years of turmoil, the Nifty Auto Index has finally gained momentum. It has outperformed the Nifty 50 index in recent times, signaling a much-awaited comeback.

Global brokerage house Jefferies has identified several key factors that have contributed to this resurgence.

- Challenges Faced by the Auto Sector: Prior to this upturn, the auto industry grappled with a multitude of challenges. Increasing operational costs, financial strains stemming from regulatory changes and tightening pollution rules, the repercussions of the COVID-19 pandemic, and rising commodity prices between 2018 and 2021 collectively placed immense pressure on the sector.

- Revival Factors: Jefferies analysts believe that the auto sector has gained new momentum due to the following factors:

- Improved Demand: Renewed consumer demand has injected vitality into the sector.

- Enhanced Profit Margins: Profit margins have improved, indicating better financial health.

- Favorable Product Cycles: Companies are experiencing favorable product cycles, bolstering their competitiveness.

The data supports this positive sentiment, with the Nifty Auto Index surging by 36 percent during the 2021-2022 period, in stark contrast to the Nifty’s 5.6 percent growth. Jefferies further predicts double-digit earnings per share (EPS) for auto sector stocks under its coverage during the financial years 2023-2026, indicating a prolonged period of growth and profitability.

Maruti Suzuki: Driving Forward

Maruti Suzuki, a stalwart in the Indian automobile industry, stands at the forefront of the sector’s revival. The company is well-positioned to capitalize on several key growth drivers.

- New Sport Utility Vehicles (SUVs): Maruti is set to benefit from the launch of new sport utility vehicles (SUVs) like Invicto and Jimny. These offerings cater to the ever-growing demand for SUVs in the Indian market. The introduction of these models not only expands Maruti’s product portfolio but also helps safeguard its market share.

- Recovery in the Passenger Vehicle Segment: India’s passenger vehicle segment is showing signs of recovery after enduring its worst phase in four years. Strong replacement demand is also expected to bolster the industry. As prosperity continues to rise in the country, the demand for passenger vehicles is poised to further increase, providing a fertile ground for Maruti’s growth.

- Earnings Growth Potential: Jefferies anticipates that Maruti may witness robust earnings growth in the financial years 2023-2026. This is underpinned by expectations of strong volume growth and margin recovery.

- Market Presence: Maruti Suzuki has a significant presence in the Indian market, and its brand is synonymous with reliability and value. This reputation has allowed the company to maintain a loyal customer base and continue attracting new buyers.

TVS Motors: Leading the Two-Wheeler Segment

TVS Motors is another prominent player in the Indian auto sector, with a focus on two-wheelers. The company has been identified by Jefferies as a top pick, with several factors contributing to its positive outlook.

- Uptick in Demand: TVS Motors is poised for growth in the coming quarters, driven by an uptick in demand. The company has a strong presence in both the scooter and premium bike segments, positioning it to capitalize on evolving consumer preferences.

- Scope for Margin Expansion: TVS Motors has significant potential for margin expansion. This can be attributed to factors such as efficient cost management and ongoing product innovation.

- Product Portfolio: TVS Motors boasts a diverse and attractive product portfolio that appeals to a wide range of consumers. The company’s offerings cater to different segments of the market, from scooters to premium motorcycles.

- Market Competitiveness: TVS Motors competes effectively in the Indian two-wheeler market, often vying for market share alongside other industry giants. The company’s ability to maintain competitiveness contributes to its strong growth prospects.

Auto Sector Valuation and Broader Trends

Jefferies’ bullish stance extends to the broader auto sector, reflecting optimism about its valuation and growth prospects. Currently, Jefferies has ‘buy’ ratings on 9 out of 11 auto stocks in its coverage, emphasizing the sector’s attractiveness.

Margin Stability and Expansion: Axis Securities, a leading brokerage firm, has projected that auto companies are likely to maintain stable margins in the financial year 2024, with the potential for further expansion.

Key drivers for this outlook include a more favorable product mix, higher realizations, and positive operational leverage.

Cost of Raw Materials: The cost of raw materials has significantly reduced in recent months. This reduction contributes to the improved profitability of auto companies, as lower input costs can boost margins.

Two-Wheeler Market: Axis Securities also highlights the continued sales of two-wheelers, especially in the premium category, due to the launch of new vehicles.

This suggests that the trend of premiumization, where consumers opt for higher-end models, is expected to persist into the financial year 2024/25.

Government Initiatives: Government initiatives aimed at promoting electric vehicles (EVs) and sustainable transportation are reshaping the Indian auto industry.

As the nation moves towards a greener future, auto companies are investing in EV technologies and expanding their EV product portfolios.

Final Remarks

In conclusion, the Indian auto sector is experiencing a remarkable resurgence, and companies like Maruti Suzuki and TVS Motors are leading the charge. Maruti’s strategic focus on new SUVs and its enduring market presence make it a formidable contender in the passenger vehicle segment.

TVS Motors, with its strong presence in the two-wheeler market and a diverse product portfolio, is well-poised for growth in the coming quarters.

The broader auto sector is also attracting significant attention, with Jefferies’ ‘buy’ ratings on multiple stocks reflecting the sector’s favorable valuation and growth prospects.

Margin stability and expansion, along with reduced raw material costs, are bolstering the industry’s profitability.

As the Indian government promotes sustainability and electric mobility, auto companies are aligning their strategies to meet these evolving consumer demands.

The auto sector’s resurgence, driven by strong fundamentals and favorable market dynamics, bodes well for both investors and consumers alike.

The road ahead for the Indian automobile industry is paved with promise, innovation, and growth.