Nifty Closed Around 21,550 Today; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Stock Market News Analysis: Realty Sector Leads as Markets Experience Consecutive Gains

In the dynamic world of stock markets, the latest developments have seen the realty sector emerge as the fastest-growing segment, achieving a substantial gain of 2.52 percent.

This growth was closely followed by the pharma and auto sectors, painting a positive picture for investors.

As of January 9, the market demonstrated resilience, marking a second consecutive day of gains for benchmark indices Sensex and Nifty amid intermittent fluctuations.

Market Performance on January 9:

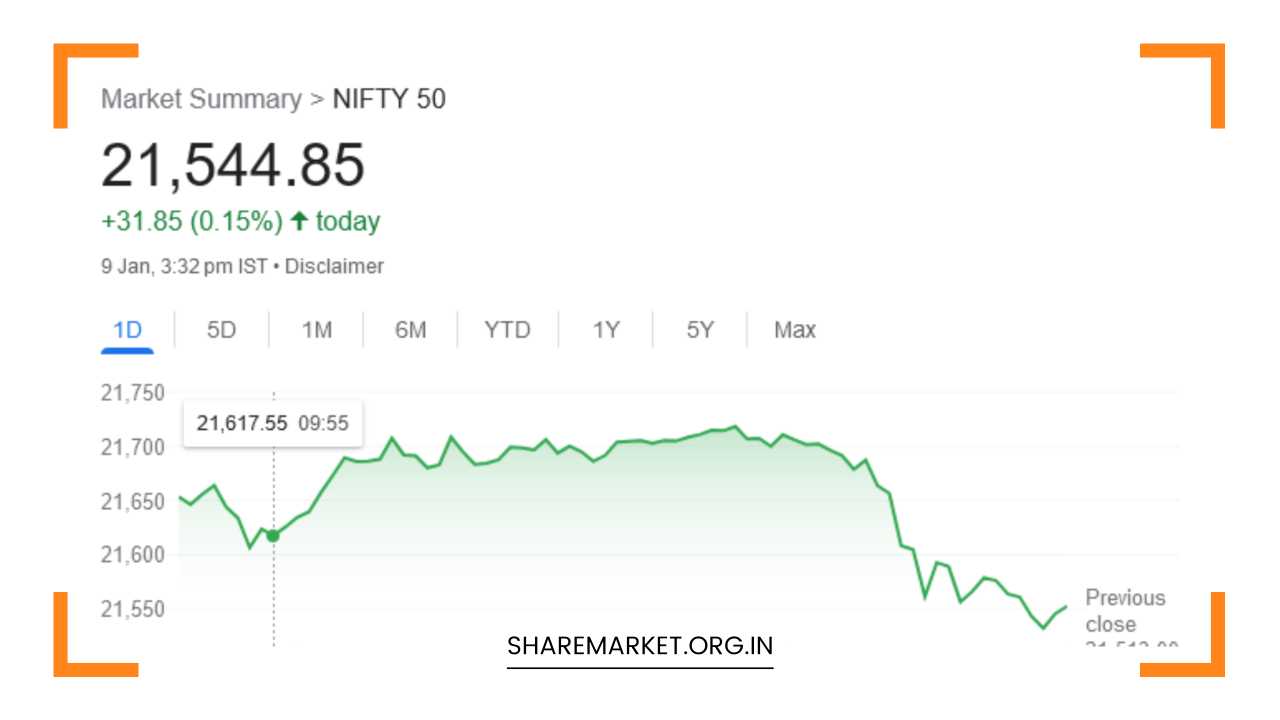

On this particular day, Nifty closed around 21,550, showcasing a consistent upward trajectory. The Sensex, by the end of trading, stood at 71,386.21, registering a modest gain of 30.99 points or 0.04 percent.

Concurrently, Nifty experienced an increase of 31.80 points or 0.15 percent, concluding at 21,544.80. An interesting facet of the market dynamics was the presence of 1984 shares in the green, 1330 in the red, and 71 remaining unchanged.

The BSE Midcap index saw a flat closure, while the small-cap index recorded a gain of 0.3 percent.

Sectoral Performance:

The day’s top gainers on Nifty included prominent names such as Hero MotoCorp, Adani Ports, SBI Life Insurance, Apollo Hospitals, and Adani Enterprises.

Conversely, Nestle India, Britannia Industries, Asian Paints, Bajaj Finserv, and HDFC Bank found themselves among the top losers on Nifty.

Notably, all other indices, with the exception of banks and FMCG, closed in the positive territory. Auto, healthcare, capital goods, metal, power, and realty exhibited growth ranging from 0.5 to 2.5 percent, emphasizing a diversified upswing in the market.

Nifty Prediction for January 10:

As investors and analysts shift their focus to the upcoming trading day on January 10, technical analysis becomes a crucial tool for predicting market movements.

Jatin Gedia, a Technical Research Analyst at Sharekhan, offered insights into Nifty’s trading patterns. Despite witnessing extreme volatility, Nifty continued to move within a wide range of 21,850-21,500.

Gedia identified key support levels at the 20-day moving average (21,453) and 21,406 (50 percent Fibonacci retracement level), providing valuable markers for traders.

Adding to the technical perspective, Aditya Gaggar, Director at Progressive Shares, noted that the Indian equity markets began on a bullish note, buoyed by robust global cues.

However, as the day unfolded, the index saw gains, culminating in Nifty closing at 21,544.85, with a marginal increase of 31.85 points. Gaggar attributed this modest gain to a significant fall in banking stocks, contributing to the market’s overall performance.

Sectoral Insights:

Delving into specific sectors, the realty segment emerged as the star performer, boasting a growth of 2.52 percent.

This bullish trend was propelled by factors such as increased demand, positive sentiment, and perhaps, underlying economic factors.

Following closely were the pharma and auto sectors, both contributing to the overall positive sentiment in the market. On the flip side, the media index experienced the most substantial decline, indicating sector-specific challenges.

Bank Nifty and PSU banking sectors closed in the red, raising concerns about the banking segment’s health. The broader picture, however, revealed that Nifty was navigating within the range of 21,500-21,800.

Analysts emphasized that a breakout in either direction within this range could serve as a decisive indicator of the market’s future trajectory.

Analysts’ Perspectives:

Jatin Gedia, the Technical Research Analyst at Sharekhan, highlighted the extreme volatility characterizing Nifty’s trading session.

Despite this, Nifty’s movement within the range of 21,850-21,500 suggested a degree of stability. Gedia’s technical analysis pinpointed the 20-day moving average (21,453) and 21,406 (50 percent Fibonacci retracement level) as crucial support levels, offering traders valuable insights for decision-making.

Aditya Gaggar, Director at Progressive Shares, contributed a broader market perspective, noting the bullish opening driven by strong global cues.

However, the day concluded with a nuanced performance, and Nifty’s modest gain was attributed to a substantial fall in banking stocks. Gaggar’s insights underscored the interconnectedness of various sectors and the impact of specific stock movements on the broader market indices.

Factors Driving Market Movements:

Vinod Nair of Geojit Financial Services shed light on the underlying factors influencing market sentiment. The rally in tech stocks in the American market, coupled with increasing demand for new technology, prompted a surge in IT stocks.

Auto and realty sectors maintained their popularity due to robust demand, while expectations of a near-term rate cut gained traction amid a potential softening of US inflation. This positive sentiment resonated in the Indian markets, contributing to the overall uptrend.

Nevertheless, profit-booking emerged as a counterforce, driven by concerns surrounding expensive valuations and mixed signals emanating from Asian markets.

The market’s sensitivity to global cues and its intricate dance with both domestic and international factors underscored the complexities of contemporary stock market dynamics.

Final Remarks:

In conclusion, the stock market on January 9 exhibited a mix of positivity and caution. The realty sector emerged as a standout performer, signaling a robust growth trajectory.

However, challenges in the banking sector and sector-specific declines highlighted the nuanced nature of market dynamics. Analysts’ perspectives provided valuable technical and strategic insights, offering investors a roadmap for navigating the intricate world of stock trading.

As the market gears up for January 10, the potential breakout from the established range will be closely monitored, providing a crucial cue for market participants.

The delicate balance between positive sentiment, economic indicators, and global influences continues to shape the trajectory of the stock market in this ever-evolving financial landscape.