Nifty Closed at 22055; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Navigating Market Volatility: A Look Back and Ahead

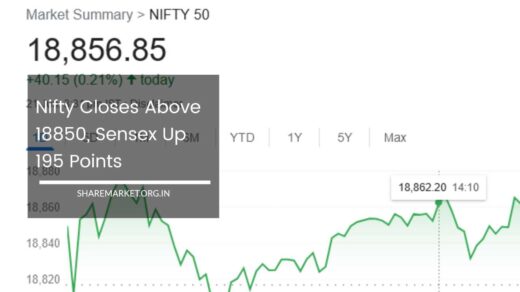

The Indian stock market experienced a welcome respite today, reversing its recent downward trend and closing in the green. This positive turn of events can be attributed to strong signals from foreign markets, which triggered a wave of short covering in domestic markets. The Nifty index, a key benchmark, rose by around 90 points, reflecting a broader market rally.

Beyond the Headline: A Deeper Look at Sectoral Performance

While the headline paints a picture of a positive day, a closer look reveals a more nuanced picture. The rally wasn’t confined to large-cap stocks, often referred to as the “biggies.” Small and mid-cap stocks, representing smaller but potentially high-growth companies, also witnessed significant gains.

The mid-cap index, a gauge of their performance, climbed by a noteworthy 1%. This broad-based rally indicates investor confidence spreading beyond established players.

Diving deeper, specific sectors emerged as leaders. Consumer staples (FMCG), a defensive sector known for its resilience during economic downturns, witnessed strong buying activity. This suggests investors may be seeking safe havens amidst ongoing uncertainties.

Additionally, sectors like metals, oil & gas, and power, which have been under pressure recently, saw a welcome uptick. This could be a response to positive global cues or anticipation of increased demand in these sectors.

Even sectors like auto, pharma, and consumer durables, which have faced headwinds lately, managed to register positive movement. This indicates a more optimistic outlook across various segments of the market.

Profit Booking and the Delicate Balance

However, the day wasn’t without its counterpoints. Profit booking, a natural tendency of investors to sell securities after a price increase to lock in gains, dampened the performance of IT, realty, and banking stocks.

The Bank Nifty, an index focused on banking stocks, even fell despite buying activity in some of its constituents. This highlights the delicate balance between buying and selling pressures that constantly influence market movements.

Weekly Performance and Investor Sentiment: A Cause for Concern

While today’s gains offer a temporary sigh of relief, it’s important to view them in the context of wider market trends. On a weekly basis, the Sensex and Nifty remain down by a concerning 1.8% and 2% respectively. This reflects ongoing investor anxieties related to several factors:

- Expensive Valuations: A lingering concern is that the market is currently overvalued, meaning stock prices may not accurately reflect underlying company fundamentals. This can make some investors cautious about further buying, fearing a potential correction in the future.

- Election Jitters: The recent Lok Sabha elections have introduced an element of uncertainty into the market. The low voter turnout has fueled election nervousness among investors, who are apprehensive about the potential impact of the outcome on government policies and regulations.

- Foreign Investor Outflows: Foreign Institutional Investors (FIIs), a significant source of liquidity in the Indian market, have been net sellers recently. This trend is attributed to factors like a delay in anticipated rate cuts by the Reserve Bank of India (RBI), concerns about rising inflation, disappointing corporate earnings reports, and the perceived high valuation of Indian stocks.

Looking Ahead: Key Events and Investor Strategies

As the market navigates these uncertainties, several upcoming events will be closely monitored by investors:

- US Inflation Data: The release of inflation data from the United States could have a ripple effect on global markets, including India. Rising inflation in the US could prompt the Federal Reserve to tighten monetary policy, potentially leading to capital flight from emerging markets like India.

- US Tariff Action: The possibility of the US imposing tariffs on Chinese electric vehicle companies could have a cascading impact. This could disrupt global supply chains and affect Indian companies with exposure to the electric vehicle sector.

Election Results and Policy Implications

The upcoming Lok Sabha election results remain a major source of uncertainty. Political stability and clear policy direction are often seen as positive factors for the stock market.

Analysts believe a clear majority for the incumbent NDA government could lead to policy continuity and potentially new reforms, boosting investor confidence.

Conversely, a hung parliament, where no single party holds a clear majority, could trigger short-term market panic as investors grapple with the potential for political instability and policy uncertainty.

Expert Opinions: Navigating the Uncertainties

Market experts offer valuable insights for investors navigating this period of uncertainty:

- Vinod Nair (Geojit Financial Services): While acknowledging today’s positive performance, Nair highlights concerns about expensive valuations and election-related nervousness impacting financial stocks. He emphasizes the need for investors to be cautious and conduct thorough research before making investment decisions.

- Vipul Bhowar (Waterfield Advisors): Bhowar emphasizes market expectations of an NDA victory and its potential positive impact on policy stability and reforms. However, he acknowledges the concern surrounding a possible weak NDA majority, which could lead to policy paralysis. Bhowar suggests investors consider portfolio diversification across various asset classes to mitigate risk during volatile periods.

- Prashant Tapse (Mehta Equities): Tapse reiterates the role of strong foreign cues in today’s rally but advises caution due to the sharp intraday fluctuations witnessed. He warns of potential negative election news that could trigger significant selling in the coming weeks. Tapse emphasizes the importance of a long-term investment horizon and urges investors to avoid making impulsive decisions based on short-term market movements.

Investment Strategies for Different Risk Appetites

Investors with varying risk tolerances can adopt different strategies in this environment:

- Conservative Investors: These investors may prioritize capital preservation over high returns. They can consider allocating a larger portion of their portfolio to fixed-income instruments like bonds or debt funds, which offer relatively stable returns. Additionally, they may invest in blue-chip stocks with a history of consistent dividends and strong financials.

- Moderate Investors: These investors can strike a balance between risk and reward. They can allocate a portion of their portfolio to growth stocks with the potential for high returns, while also maintaining a buffer of fixed-income securities. Diversification across sectors and asset classes is crucial for this group.

- Aggressive Investors: These investors have a higher tolerance for risk and are comfortable with short-term volatility. They may allocate a larger portion of their portfolio to growth stocks and explore thematic investment opportunities in sectors poised for future growth, such as renewable energy or artificial intelligence. However, careful research and a well-defined risk management strategy are essential for this approach.

The Importance of Financial Planning and Professional Guidance

Regardless of their risk profile, all investors should have a well-defined financial plan that aligns with their individual goals and time horizon.

This plan should factor in their risk tolerance, investment objectives, and future financial needs. Consulting with a registered financial advisor can be beneficial, especially for those new to investing or navigating complex market conditions.

A financial advisor can provide personalized investment recommendations based on individual circumstances and risk tolerance.

Final Word: A Cautiously Optimistic Outlook

The Indian stock market presents a complex picture, with both positive and negative factors influencing its trajectory. While today’s gains offer a temporary reprieve, several uncertainties remain.

Investors are advised to be cautious and conduct thorough research before making investment decisions.

Diversification, a long-term perspective, and potentially seeking professional guidance can be valuable tools for navigating this dynamic market environment. By staying informed, adopting a strategic approach, and maintaining a level head, investors can increase their chances of success in the face of market volatility.

Exciting close today at 22055 for Nifty! Looking forward to seeing where it heads tomorrow. Predictions anyone?