Nifty Closed at 22,096; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

The Indian stock market has exhibited a fascinating interplay of resilience and correction in recent days. Following a doji formation on the daily chart, traditionally interpreted as a sign of market indecision, Nifty witnessed a two-day recovery, hinting at a potential bullish reversal pattern .

This positive sentiment continued on March 20th, with a broad-based rally encompassing all sectors except IT.

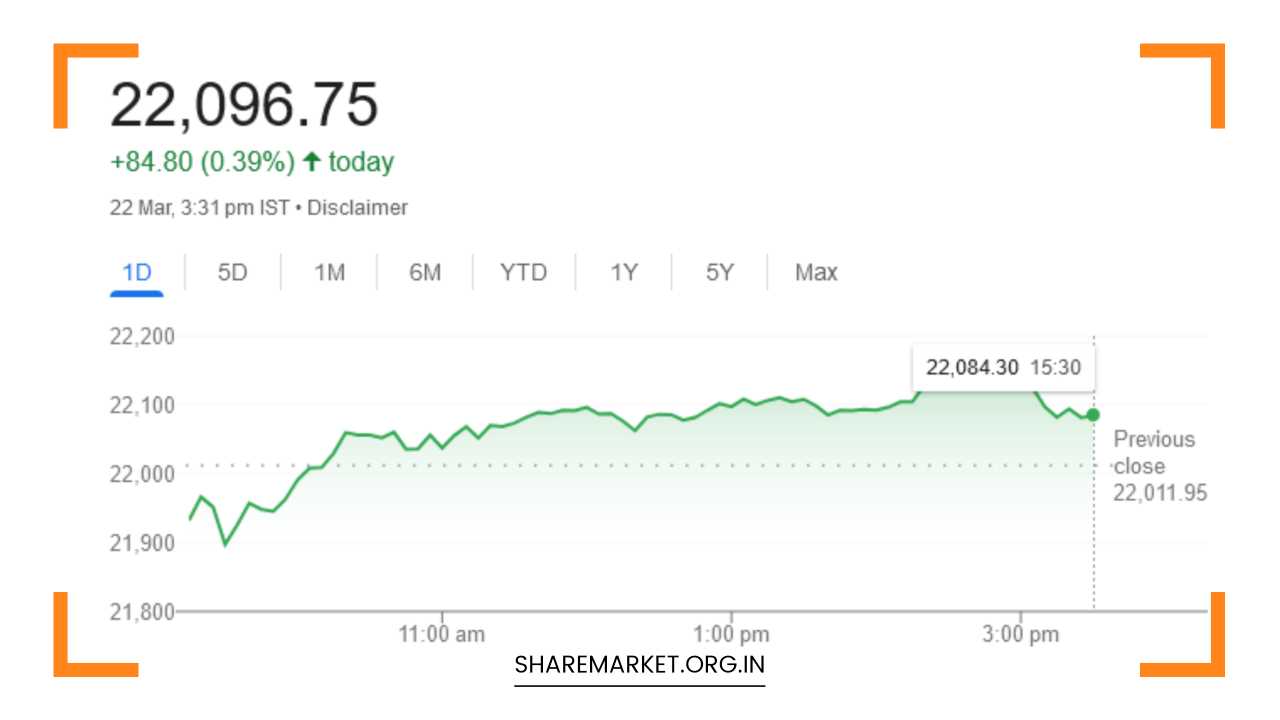

Both Sensex and Nifty closed with gains for the third consecutive day, solidifying the market’s bullish tilt. Sensex ended at 72,831.94, up 0.26%, while Nifty reached 22,096.80, marking a 0.39% increase. Sectoral indices like Metal, Auto, Realty, FMCG, and Healthcare displayed significant strength, registering gains ranging from 0.5% to 1%.

Dissecting the IT Sector Correction:

However, the IT sector, a historically strong performer in the Indian market, experienced a 2% decline. This pullback can be attributed to the weak guidance issued by technology giant Accenture.

This event serves as a reminder of the interconnectedness of the global market and the potential for external factors to impact specific sectors within the Indian landscape. Although the IT sector witnessed a correction, the broader market displayed remarkable resilience.

Gains in other sectors effectively offset the IT losses, highlighting the market’s diversification and ability to absorb sector-specific setbacks. Notably, both Sensex and Nifty registered slight gains on a weekly basis, showcasing a degree of stability amidst the recent volatility.

Top Gainers, Losers, and Broader Market Sentiment:

UPL, Maruti Suzuki, Hero MotoCorp, Bajaj Auto, and Sun Pharma emerged as the top gainers on the Nifty index, reflecting investor confidence in these sectors.

Conversely, Wipro, Infosys, LTIMindtree, HCL Technologies, and TCS were the major losers, mirroring the concerns surrounding the IT sector’s future performance.

This divergence in performance underscores the importance of analyzing sector-specific trends alongside the broader market movement.

The positive momentum extended beyond large-cap stocks, with both BSE Midcap and Smallcap indices closing up 0.3% and 1%, respectively. This indicates a healthy participation from mid-tier and smaller companies, suggesting a more inclusive market rally.

Expert Insights and Navigating the Upcoming Days:

Market experts offer valuable insights into the potential direction for the coming days. Jatin Gedia of Sharekhan emphasizes the significance of the ongoing retracement process on Nifty’s daily chart.

He identifies a crucial zone between 22118 and 22214, where buying activity is likely to resurface if the market dips. Additionally, the 20-hour moving average sits within this zone, providing further technical support.

While the retracement remains incomplete, Gedia suggests the rally might persist. However, conflicting signals from daily and hourly momentum indicators indicate a possibility of consolidation within the range of 22200 – 21900.

Stock-specific activity, driven by company-specific news and fundamentals, is also expected to continue during this period. Investors should closely monitor these developments to identify potential trading opportunities.

Bank Nifty also exhibited consolidation around its important daily moving average. Key retracement levels are anticipated near 47000 – 47200 in the upcoming sessions. Strong support for Bank Nifty is visible at the level of 46500 – 46400.

These support and resistance levels identified by Gedia act as guideposts for investors, helping them gauge potential entry and exit points for their trades.

Bullish Potential and Risks to Consider:

Rupak Dey of LKP Securities emphasizes the significance of the post-doji recovery as a bullish reversal sign. He further highlights Nifty’s successful recapture of the crucial 55-day exponential moving average.

This technical indicator often signals a potential shift in the underlying trend. However, Dey cautions that a decisive break above 22,100 is necessary for Nifty to embark on a fresh rally towards its all-time high of 22,525. This level serves as a key resistance point, and a successful breakout would signify a clear bullish confirmation.

Looking Ahead: Beyond the Short-Term:

While the short-term outlook appears cautiously optimistic, investors should remain cognizant of potential risks that could disrupt the current momentum.

Global economic concerns, geopolitical tensions, and rising interest rates are some of the external factors that could impact the Indian market.

Additionally, domestic factors such as upcoming elections and the performance of the monsoon season can also influence market sentiment.

Crafting an Investment Strategy:

Given the interplay of positive and negative factors, investors should adopt a balanced approach when crafting their investment strategies. Here are some key considerations:

- Sectoral Allocation: The recent performance highlights the importance of sector allocation. While some sectors may experience pullbacks due to external factors, others may offer promising opportunities. Investors should conduct thorough research to identify sectors with strong fundamentals and growth potential. Diversification across sectors can help mitigate risk and capitalize on opportunities across the market spectrum.

- Technical Analysis: Technical indicators like support and resistance levels, moving averages, and momentum indicators can provide valuable insights into potential price movements. As Jatin Gedia suggests, monitoring these indicators can help investors identify entry and exit points for their trades. However, it’s crucial to remember that technical analysis should be used in conjunction with fundamental analysis, not as a standalone strategy.

- Long-Term Perspective: Short-term volatility is an inherent characteristic of the stock market. While the near-term outlook appears cautiously optimistic, investors should maintain a long-term perspective. Focusing on companies with strong fundamentals and a proven track record can help weather short-term fluctuations and achieve long-term investment goals.

- Risk Management: Effective risk management is paramount for any investor. Utilizing stop-loss orders can help mitigate potential losses, while maintaining a diversified portfolio can minimize exposure to sector-specific risks.

Fundamental Analysis: A Deeper Look

While technical analysis provides valuable insights into potential price movements, fundamental analysis focuses on the underlying health and future prospects of a company. Investors should consider the following factors when conducting fundamental analysis:

- Company Financials: A thorough analysis of a company’s financial statements, including revenue, profitability, debt levels, and cash flow, can reveal its financial health and future growth potential.

- Management Team: The experience, competence, and track record of a company’s management team are crucial factors to consider. A strong management team can steer the company towards success, while a weak one can hinder its growth.

- Industry Trends: Understanding the broader industry trends and the competitive landscape can help investors identify companies well-positioned for future success.

- Valuation: Investors should assess whether a company’s stock price is fairly valued based on its fundamentals. Techniques like price-to-earnings (P/E) ratio analysis can help determine if a stock is overvalued or undervalued.

By combining technical analysis with a thorough fundamental analysis, investors can make informed investment decisions and navigate the complexities of the Indian stock market.

Final Thoughts: A Market Poised for Growth?

The Indian stock market presents a compelling investment opportunity. The ongoing economic recovery, a large and growing domestic market, and a young and tech-savvy population are all factors that bode well for future growth.

However, investors should remain mindful of the potential risks and uncertainties that can influence market performance.

By adopting a balanced approach that incorporates both technical and fundamental analysis, investors can position themselves to capitalize on the promising prospects of the Indian market.

Note: This analysis is for informational purposes only and should not be considered financial advice. Investors should always conduct their own research and consult with a qualified financial advisor before making any investment decisions.