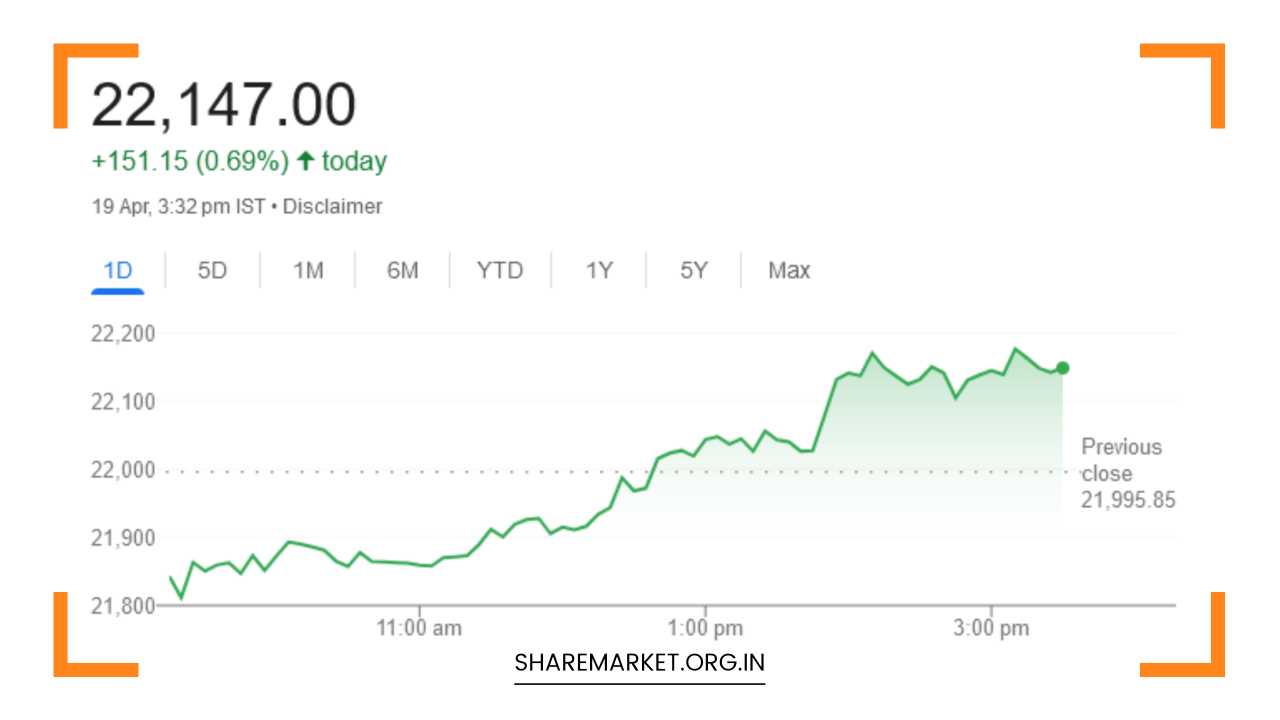

Nifty Closed at 22,147; Nifty Prediction for Monday

Nifty Prediction for Monday

Market Rebounds After Four-Day Slump: A Deep Dive and Future Outlook

Market Recap (April 19th, 2024):

Indian equities breathed a sigh of relief today, finally snapping their four-day losing streak. A potent combination of short covering and strategic buying in frontline banking stocks orchestrated a sharp recovery.

The benchmark Sensex closed slightly lower at 73,088.33, marking a marginal decline of 0.83%. The broader Nifty index, however, managed to eke out a gain of 0.69%, settling at 22,147.

Dissecting the Day’s Action:

-

Short Covering Triggers Upward Momentum: After a relentless decline over the past few days, investors who had previously engaged in short selling (borrowing and selling shares in anticipation of a price drop) were compelled to repurchase those shares. This phenomenon, known as short covering, injects a surge in demand into the market, causing stock prices to rise.

-

Banking Bonanza: Leading names in the banking sector like Bajaj Finance, HDFC Bank, and M&M emerged as the day’s champions on the Nifty, their impressive gains acting as a catalyst for the broader market’s upward trajectory. This targeted buying in banking stocks could be attributed to several factors, including:

- Value Investing: After a period of correction, some investors might perceive these banking stocks as undervalued, presenting an attractive entry point.

- Defensive Play: Banking stocks are often considered relatively stable compared to other sectors during market downturns. Investors seeking shelter from volatility might have gravitated towards these stocks.

- Sectoral Tailwinds: Positive developments within the Indian banking sector, such as loan growth or favorable regulatory changes, could have also influenced buying decisions.

-

A Tale of Two Sectors: While banking and metal sectors led the charge with gains exceeding 1%, other sectors displayed a mixed performance. The FMCG (Fast-Moving Consumer Goods) sector showcased modest resilience with a 0.5% rise. Conversely, sectors like healthcare, IT, power, and realty witnessed slight declines, ranging from 0.3% to 0.6%. This selective buying behavior indicates that investors might be adopting a cautious approach, focusing on specific sectors perceived as more promising in the current market climate.

Market Outlook for April 22nd:

Analysts remain cautiously optimistic about the market’s near-term direction, with two primary perspectives guiding their forecasts:

-

Technical Analysis: Rupak Dey of LKP Securities draws attention to a technical indicator on the daily chart, the “piercing line pattern,” which has historically signaled potential trend reversals after a correction. Additionally, the Nifty’s move above the 55EMA (short-term moving average) suggests a positive short-term trend. If the Nifty sustains a close above 22,300, it could pave the way for further gains towards 22,600. However, a breakdown below the crucial support level of 22,000 could indicate a continuation of the downward trend.

-

Fundamental Analysis: Prashant Tapse of Mehta Equities emphasizes the presence of significant investable funds within the domestic market. India’s long-term growth story, even after the recent correction, continues to be a magnet for investors seeking lucrative opportunities. This, combined with the outperformance of Indian equities compared to a decline in global markets due to geopolitical tensions and currency fluctuations, paints a potentially positive picture. However, the success of this narrative hinges on the continued resilience of the Indian economy and the stability of the global financial landscape.

Beyond the Headlines: Factors to Consider

While today’s rebound is a welcome development, market participants should be mindful of the following factors that could influence the market’s future trajectory:

- Global Market Volatility: Geopolitical tensions and currency fluctuations in the global arena can trigger significant market movements in India. Investors should closely monitor developments in West Asia and track the movements of major currencies, particularly the US dollar.

- Upcoming Earnings Season: The upcoming earnings season will provide crucial insights into the financial performance of Indian companies. Strong corporate earnings reports can bolster investor confidence and propel the market upwards. Conversely, disappointing earnings reports could dampen investor sentiment and trigger a sell-off.

- Economic Data Releases: Any significant economic data releases scheduled for the coming week, such as inflation figures or GDP growth numbers, could influence market sentiment. Positive economic data could reinforce investor confidence, while negative data might lead to risk aversion and selling pressure.

- Investor Risk Appetite: The overall risk appetite of investors will play a crucial role in determining the market direction. News events, economic indicators, and global market movements can significantly influence this factor. Investors with a high risk tolerance might be more inclined to invest in growth stocks, while those with a lower tolerance might favor safer options like defensive stocks or fixed-income instruments.

Taking Control: Strategies for Investors

Given the inherent uncertainties within the market, investors should adopt a well-defined strategy to navigate the current environment:

- Diversification: Spreading investments across various asset classes and sectors can help mitigate risk. Investors should consider including a mix of equities, bonds, and alternative investments in their portfolios.

- Discipline and Patience: Market fluctuations are inevitable. Investors should maintain discipline and avoid making impulsive decisions based on short-term market movements. Patience is key, especially when pursuing long-term investment goals.

- Fundamental Analysis: Conducting thorough research on individual companies and understanding their underlying fundamentals can help investors make informed investment decisions. Evaluating factors like a company’s financial health, future growth prospects, and competitive landscape is crucial for long-term success.

- Review and Rebalance: Regularly reviewing investment portfolios and rebalancing them as needed is essential. This ensures that the portfolio remains aligned with your risk tolerance and investment goals.

By staying informed about market developments, meticulously analyzing investment opportunities, and implementing a sound investment strategy, investors can navigate the market’s complexities and position themselves to achieve their financial objectives.