Nifty Closed at 22,212; Nifty Prediction for Monday

Nifty Prediction for Monday

Comprehensive Analysis: Unraveling the NSE Market Trends and Future Projections

The closing bell on the last trading day of the week painted a complex picture of the National Stock Exchange (NSE), reflecting a market in consolidation with a subtle negative bias.

As we delve into the intricacies of individual stock performances, sectoral indices, and expert opinions, a comprehensive understanding of the day’s market activity emerges, providing valuable insights for investors. Additionally, an exploration of the prospective outlook for February 26th adds depth to our analysis.

Stock Performance on Nifty:

The performance of individual stocks on the Nifty index presented a diverse landscape. Noteworthy gainers included Bajaj Finserv, SBI Life, HDFC Life, LTIM, and Dr. Reddy’s, underscoring the resilience of these entities amidst the prevailing market dynamics. On the flip side, BPCL, HCL Tech, Maruti,

Asian Paints, and ONGC found themselves among the top losers, grappling with challenges that influenced their market standing.

The National Stock Exchange recorded a nuanced sentiment, with a rise in 1,367 shares, a decline in 1,181 shares, and no change in 113 shares, indicating a market grappling with varied forces.

Sensex-Nifty Overview:

A panoramic view of the market revealed a consolidation scenario with midcap-smallcap shares attracting buying interest, while banking, FMCG, and PSE shares faced discernible downward pressure.

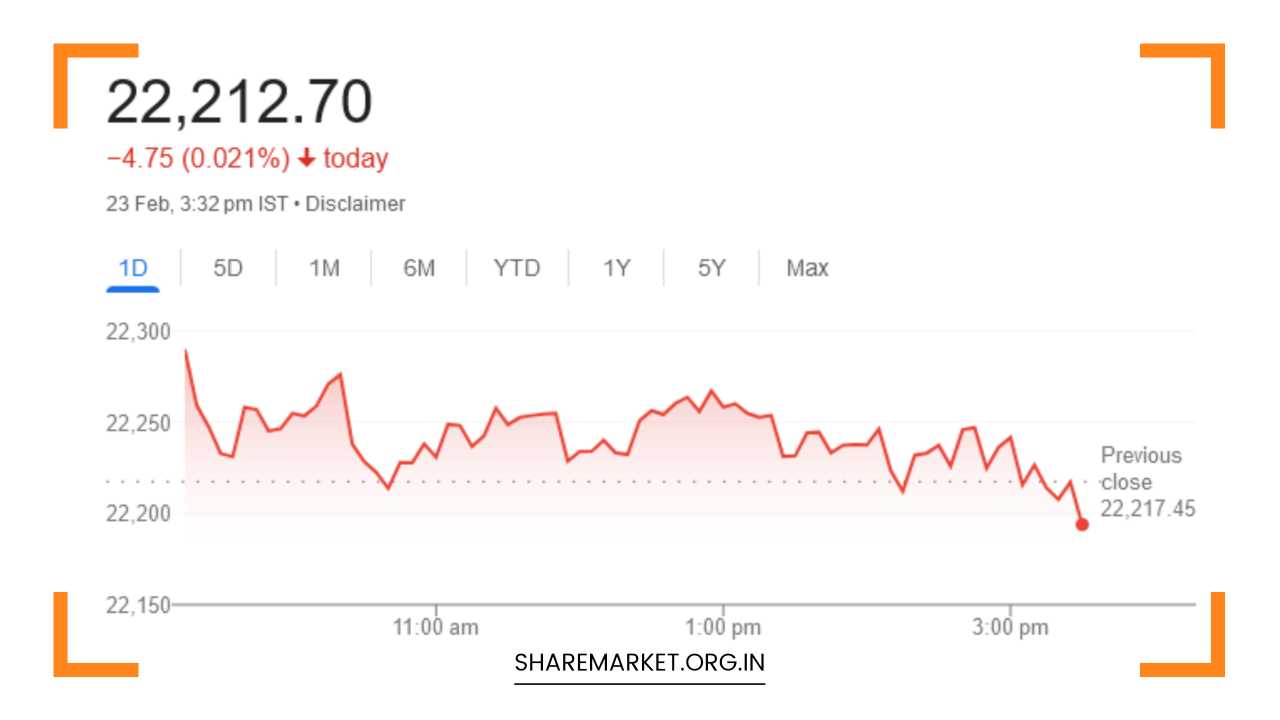

The Sensex closed at 73,142.80, experiencing a marginal decline of 15.44 points or 0.02 percent. Simultaneously, the Nifty concluded at 22,212.70, reflecting a weakness of 4.75 points or 0.02 percent.

These figures, while seemingly marginal, encapsulate the intricate dynamics at play, where the market grappled with conflicting forces, resulting in a finely balanced close.

Sectoral Indices:

The performance of sectoral indices played a pivotal role in shaping the narrative of the trading day. Nifty Media emerged as the leader, showcasing a gain of 1.2 percent and highlighting the robustness of media stocks.

Following closely were Nifty Realty and Nifty Consumer Durables, closing with gains of 1 percent and 0.6 percent, respectively.

Conversely, Nifty PSU Bank took a hit with a decline of 1.1 percent, trailed by Nifty IT, Nifty Bank, and Nifty Metals, each recording a 0.2 percent decrease.

These sectoral movements underscored the selective nature of market enthusiasm, revealing pockets of strength and weakness.

Individual Expert Opinions:

Insights from financial experts Rupak Dey of LKP Securities and Jatin Gedia of Sharekhan provided a nuanced understanding of the market dynamics.

Rupak Dey’s analysis highlighted the discrepancy between the positive opening of Nifty and its failure to sustain the morning momentum, leading to a close at the day’s low due to profit booking.

Despite this, Dey noted that the short-term market sentiment remains positive as Nifty closed above the crucial resistance level of 22,200.

Anticipating the next resistance at 22,400, with immediate support at 21,900, Dey suggested that, as long as Nifty remains above 21,900, the strategy of buying on dips appears to be a viable approach.

Jatin Gedia’s analysis centered on Nifty’s consolidation at upper levels after robust growth in previous trading sessions.

Despite a slight fall of 4 points by the end of the day, Gedia highlighted the overall positive trend in the market. He identified any decline towards the support zone of 22,130–22,090 as a potential buying opportunity.

Emphasizing that the market’s overall trend remains positive, Gedia pointed to immediate resistance at 22,300–22,350, with support in the zone of 22,130–22,090 for Nifty.

Market Outlook for February 26th:

As investors look toward the future, the market outlook for February 26th hinges on crucial support and resistance levels.

Rupak Dey’s analysis suggests that the short-term positive sentiment could continue, with the next resistance at 22,400.

Jatin Gedia’s perspective aligns with a positive overall trend, emphasizing buying opportunities on any potential decline towards the support zone of 22,130–22,090.

The key takeaway from these expert opinions is the importance of vigilance around support and resistance levels.

The market’s sensitivity to these levels underscores the need for a dynamic and adaptive approach to trading, especially in an environment characterized by nuanced movements.

Final Remarks:

In conclusion, the market on the last trading day presented a mosaic of trends, with individual stocks, sectoral indices, and expert opinions contributing to the overall narrative.

The contrasting views of financial experts Rupak Dey and Jatin Gedia provide investors with valuable perspectives to navigate the market dynamics.

As traders prepare for the upcoming session on February 26th, the key lies in closely monitoring support and resistance levels for Nifty and staying attuned to sectoral movements.

The market’s dynamic nature necessitates a proactive and informed approach, where investors can leverage the insights provided by experts to make strategic decisions in an ever-evolving financial landscape.