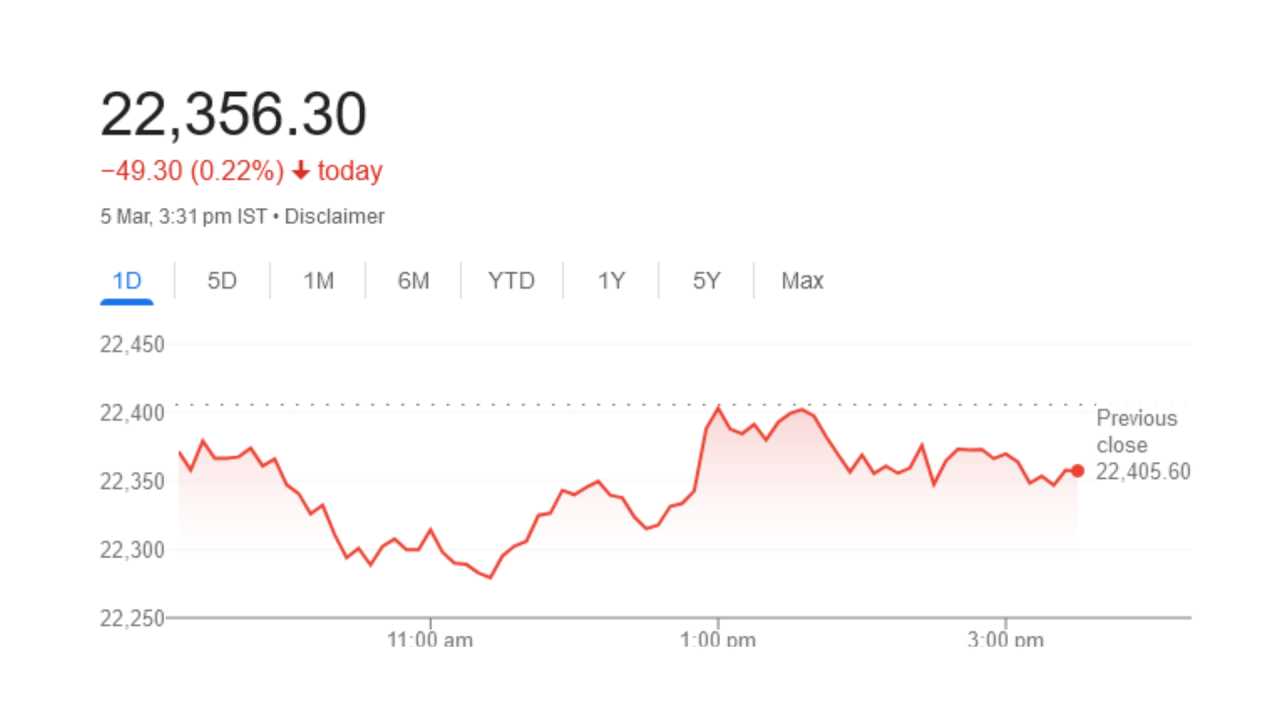

Nifty Closed at 22,356.30; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Unraveling Market Dynamics: Nifty’s Complex Journey Amid Sectoral Shifts

In the intricate landscape of the Indian equity market, the recent trading day unfolded with the Nifty opening on a flat note, only to witness a downward trajectory during the initial hour of the session.

A positive shift in momentum was observed in the second trading session, but the day concluded with the market closing in the red, down 49 points.

This marked the end of a four-day bullish streak, primarily attributed to selling pressure in IT and FMCG shares. As we delve deeper into the market dynamics, scrutinize individual stock movements, and analyze expert opinions, we aim to understand the current scenario and project potential future trends.

Market Overview:

The Sensex, a key benchmark index, closed down by 195.16 points or 0.26% at 73,677.13, while the Nifty recorded a decline of 49.30 points or 0.22% at 22,356.30.

The market’s initial negative trend persisted throughout the day, accentuating the fall. However, the downward momentum was curtailed to some extent by buying activities in the second trading session.

This seesawing movement of the market reflects the inherent volatility and unpredictability that characterizes financial markets.

Top Gainers and Losers:

Tata Motors, Bharti Airtel, Bajaj Auto, SBI, and ONGC emerged as the top gainers in the Nifty, showcasing resilience in the face of market headwinds.

Conversely, Bajaj Finserv, Bajaj Finance, Nestle India, Infosys, and SBI Life Insurance found themselves among the top losers.

This diverse performance underscores the selective nature of market movements and the varying degrees of impact across different sectors.

Sectoral Trends:

A closer examination of sectoral indices reveals a nuanced trend within the market. The Auto index exhibited resilience, registering a commendable rise of 1.3%, while the PSU Bank index surged by an impressive 2.5%. Oil & Gas, Power, and Realty sectors also displayed positive movements, each rising by 0.5%.

However, the IT and FMCG indices experienced a decline of 1%, indicating a sectoral dichotomy within the market.

This sectoral variation adds an additional layer of complexity for investors and traders, necessitating a keen understanding of the underlying factors influencing each segment.

Midcap and Smallcap Indices:

While the BSE Midcap index closed flat, indicating stability within this segment, the Smallcap index witnessed a decline of 0.6%, suggesting a relative underperformance compared to its larger counterparts.

This divergence between midcap and smallcap stocks highlights the importance of considering market breadth and the overall health of different market segments.

Individual Stock Movements:

Delving into individual stock movements provides a granular perspective on market dynamics. Manappuram Finance, Tata Motors, and Muthoot Finance stand out, exhibiting growth rates exceeding 500%.

These outliers underscore the potential opportunities that exist even in a market marked by broader trends. Long build-up was observed in Samvardhan Motherson International, Tata Chemicals, and Vedanta, indicating positive sentiment and investor confidence.

Conversely, a short build-up was noticed in Piramal Enterprises, RBL Bank, and Bajaj Finance, reflecting a more cautious outlook on these stocks.

52-Week Highs:

On the BSE, the day saw several stocks achieving their 52-week highs, including Bosch, Canara Bank, Capri Global, Castrol India, Algi Equipments, Godfrey Phillips, JSW Holdings, Kirloskar Brothers, LIC Housing Finance, Samvardhan Motherson International, Schneider Infra, SMS Pharma, Tata Investment Corp, Tata Motors, Tata Motors DVR, TVS Motor, Union Bank, and more.

This surge in 52-week highs may indicate underlying strength in these stocks, potentially drawing attention from investors seeking robust performers.

Expert Analysis and Market Predictions:

Jatin Gedia of Sharekhan provides valuable insights, asserting that Nifty, currently echoing the breakout of 22,300 witnessed last week, may find crucial support in the Hourly Moving Average range of 22,369 – 22,264.

Maintaining this support is pivotal for the possibility of the next phase of an uptrend. Immediate resistance levels for Nifty are noted at 22,460 – 22,530.

Gedia’s analysis emphasizes the importance of technical levels and signals for anticipating market movements.

Despite a negative crossover in the Hourly Momentum indicator, it has reached the equilibrium line, signaling the completion of the decline.

This suggests a likely resumption of the uptrend once the ongoing consolidation phase concludes. This detailed technical analysis provides traders and investors with actionable insights, aiding in decision-making amidst market uncertainties.

Bank Nifty’s outperformance compared to Nifty is highlighted by Gedia. The expectation is that this trend will persist unless Nifty IT provides support.

Strong support for Bank Nifty is anticipated at 47,350 – 47,300, with an immediate resistance range of 48,000 – 48,200.

This analysis delves into the interplay between different sectors and indices, offering a comprehensive view of the broader market dynamics.

Aditya Gaggar, Director at Progressive Shares, adds another layer to the market narrative. He emphasizes that after a fall in early trade, banking stocks gained momentum, aiding Nifty in recovering its losses.

However, NBFC shares remained under pressure. Gaggar notes that after testing its robust support of 22,300, Nifty has formed another doji candlestick pattern, indicating a tug of war between bulls and bears.

To regain positive momentum, Nifty must provide a solid closing above 22,420. Gaggar’s insights provide a fundamental perspective, considering the broader economic factors influencing market movements.

Final Remarks:

In conclusion, the day’s market performance reflects the intricate dance between bulls and bears, with Nifty grappling with crucial support levels and resistance zones.

Sectoral variations, individual stock movements, and expert opinions all contribute to the complex landscape of the Indian equity market. Investors and analysts alike will closely monitor the unfolding trends, keeping an eye on key support and resistance levels, as well as the evolving dynamics within different sectors.

As the market continues its ebb and flow, the coming days may provide more clarity on the direction and sustainability of the current trends.

The ability to navigate this complexity requires a multifaceted approach, combining technical analysis, fundamental insights, and a keen awareness of market sentiment.

As market participants adapt to the ever-changing landscape, informed decision-making becomes paramount, ensuring resilience and agility in the face of uncertainties.