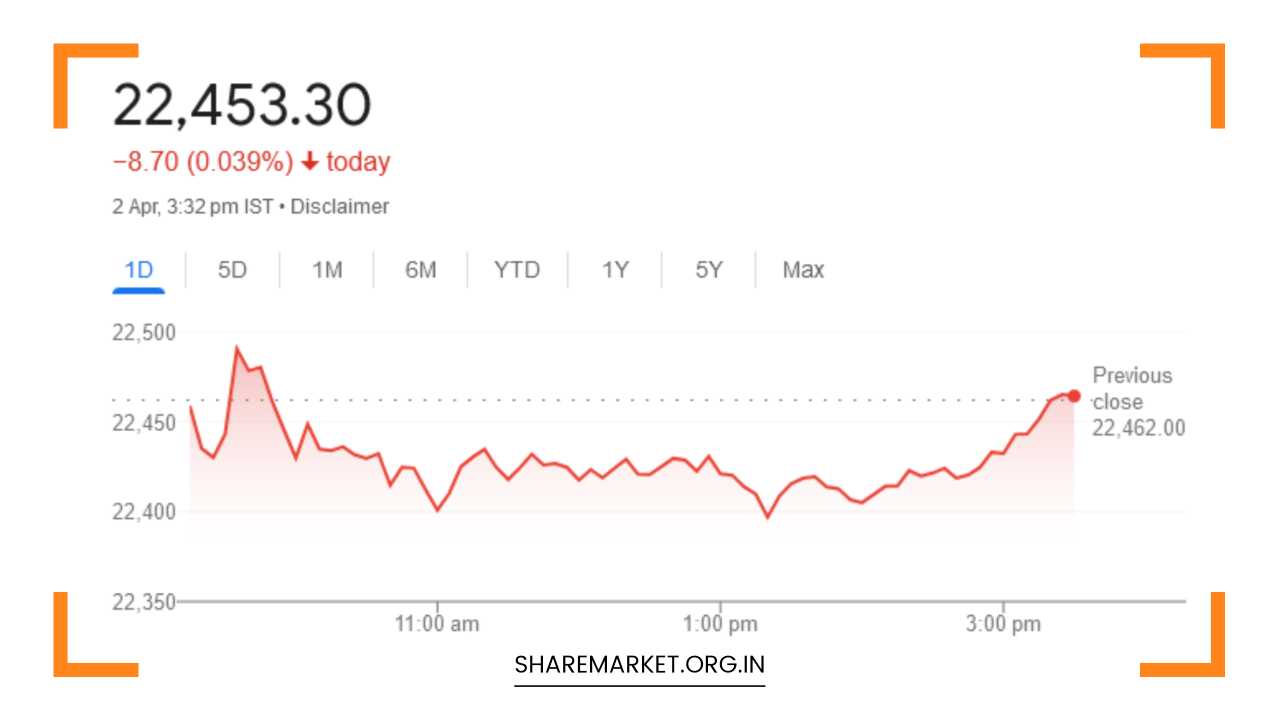

Nifty Closed at 22,453; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Indian Stock Market Analysis: A Deeper Dive

The Flight of FIIs and Market Repercussions

Recent trading sessions in the Indian stock market have witnessed a significant trend: the exodus of Foreign Institutional Investors (FIIs).

This phenomenon can be traced back to the rising US bond yields, which have become increasingly attractive compared to Indian equities.

This shift in investor preference has instilled a sense of caution, leading to a volatile trading session that culminated in a modest decline by the closing bell.

The market closed with the Sensex retreating by 0.15%, settling at 73,903.91. Similarly, the Nifty index experienced a marginal decline of 0.04%, concluding the session at 22,453.30. While these represent slight dips, they highlight the cautious sentiment prevailing in the market.

Beyond Headline Numbers: Dissecting Market Breadth

A deeper analysis reveals a more nuanced picture than the headline numbers suggest. Market breadth, which reflects the number of advancing and declining stocks, indicated mixed sentiments.

There was selling pressure in some prominent stocks, particularly in sectors sensitive to interest rates like banking and IT. However, buying interest was also observed in other sectors, suggesting a selective approach by investors.

Sectoral Performance: A Tale of Two Sides

Sectoral analysis further underscores this nuanced picture. While the overall market witnessed a modest decline, several sectors defied the trend:

- Resilient Sectors (1-2% Gains): Realty, metal, oil and gas, media, power, and auto sectors exhibited underlying strength, potentially driven by positive sector-specific developments, attractive valuations, or anticipation of future growth. This performance suggests potential buying opportunities for investors with a sector-specific focus.

- Underperforming Sectors (0.5% Decline): IT and telecom indices experienced profit booking or a cautious wait-and-see approach from investors. This could be due to concerns over rising US bond yields impacting valuations in growth-oriented sectors like IT, or uncertainties surrounding potential policy changes in the telecom sector.

The Strength of the Broader Market: A Silver Lining

A reassuring sign amidst the recent market volatility is the continued strength observed in the broader markets. Both the BSE midcap and smallcap indices managed to post gains exceeding 1%. This suggests that investor interest remains focused on these segments, potentially due to several factors:

- Attractive Valuations: Mid and small-cap companies often offer higher growth potential compared to large-cap counterparts, and their valuations might be seen as more attractive, particularly in a scenario where large-cap stocks are experiencing selling pressure by FIIs.

- Growth Prospects: The Indian economy is expected to experience robust growth in the future, and mid and small-cap companies from sectors aligned with this growth could benefit significantly.

- Diversification: Investing in broader market segments can help investors diversify their portfolios and potentially mitigate risks associated with overexposure to large-cap stocks.

Analyst Insights: Charting the Course Ahead

Market analysts offer valuable insights to help investors navigate the current environment and anticipate the potential direction of the market.

Experts like Aditya Gaggar point towards a possible recovery led by metal and auto stocks. While the Nifty closed with a minor dip, the robust performance of media and realty sectors indicates pockets of strength.

They also emphasize the sustained momentum in mid and small-cap segments, which could fuel further optimism.

Technical analysis also plays a role in market predictions. The formation of a DOJI candlestick pattern on the Nifty daily chart presents a potential turning point.

If the index manages to break above the 22,500 mark, it could pave the way for an upward movement. However, a strong support base exists at 22,340, providing a cushion in case of a downside correction.

Macroeconomic Factors and the Wait-and-See Approach

Prashant Tapse of Mehta Equities highlights the upcoming Reserve Bank of India (RBI) monetary policy announcement as a key factor influencing market sentiment.

The uncertainty surrounding potential policy changes, particularly interest rate decisions, can trigger cautious behavior among investors.

This explains the observed profit booking in banking and IT stocks, which are typically sensitive to interest rate fluctuations. Investors are likely to adopt a wait-and-see approach until clarity emerges regarding the RBI’s monetary stance.

Opportunities and Challenges: A Balanced Perspective

Looking ahead, the Indian stock market presents both opportunities and challenges for investors.

- Challenges:

- The ongoing exit of FIIs and rising US bond yields create headwinds for the market, potentially leading to continued volatility.

- Uncertainty surrounding global economic factors and geopolitical tensions can further impact investor sentiment.

- Opportunities:

- The renewed momentum in mid and small-cap stocks, coupled with expectations of robust economic growth, presents potential opportunities for investors willing to take on calculated risks and conduct thorough due diligence.

-

- Focus on Domestic Investors: The Indian domestic investor base has been growing steadily, and this can help mitigate the impact of FII outflows. Increased participation from retail investors and domestic institutions can provide stability to the market.

- Focus on Undervalued Sectors: Sectors like pharma, FMCG (Fast Moving Consumer Goods), and select PSU (Public Sector Undertaking) stocks might be relatively less impacted by rising US bond yields and could offer value opportunities. Analyzing company fundamentals and long-term growth prospects can help identify potential investments in these sectors.

- Focus on Themes and Trends: Investing based on thematic trends like digitalization, renewable energy, or infrastructure development can be a way to tap into sectors poised for future growth.

Risk Management Strategies: Navigating Uncertainty

Given the current market environment, it’s crucial for investors to employ effective risk management strategies:

- Diversification: Diversifying across asset classes (equities, debt, commodities) and sectors can help mitigate risk associated with any single asset class or sector experiencing a downturn.

- Staggered Investment: Instead of a lump-sum investment, consider a staggered approach (Systematic Investment Plan or SIP) to average out the cost of acquisition and potentially benefit from rupee-cost averaging.

- Focus on Long-Term Goals: Short-term market volatility should not overshadow long-term investment goals. Aligning investment decisions with long-term financial goals and risk tolerance is essential.

- Staying Informed: Continuously monitoring market developments, company news, and macroeconomic factors through credible financial news sources can help investors make informed investment decisions.

Final Thoughts: A Market Ripe for Selective Investment

The Indian stock market is currently undergoing a period of adjustment due to the exodus of FIIs and rising US bond yields.

However, this presents opportunities for discerning investors who can identify undervalued sectors, promising themes, and strong companies within the broader market.

By employing effective risk management strategies and remaining focused on long-term goals, investors can navigate the current market environment and potentially achieve their financial objectives.

Additional Considerations:

- This analysis is for informational purposes only and should not be considered financial advice. Investors are advised to consult with a qualified financial advisor before making any investment decisions.

- The impact of upcoming events like the RBI monetary policy announcement and global economic developments can significantly influence market direction. Close monitoring of these events is crucial for investors.