Nifty Closed at 22,643; Tomorrow Nifty Prediction

Tomorrow Nifty Prediction

Indian Stock Market Deep Dive – April 29th, 2024 and Potential Scenarios for April 30th

Market Recap: A Rebound Led by Banking Strength

The Indian stock market witnessed a much-needed correction on April 29th, 2024, reversing the losses incurred in the previous session. Both benchmark indices, the Sensex and Nifty, closed significantly higher, indicating a return of investor confidence.

- Sensex Surge: The broader Sensex index climbed a noteworthy 941.12 points (1.28%) to settle comfortably at 74,671.28.

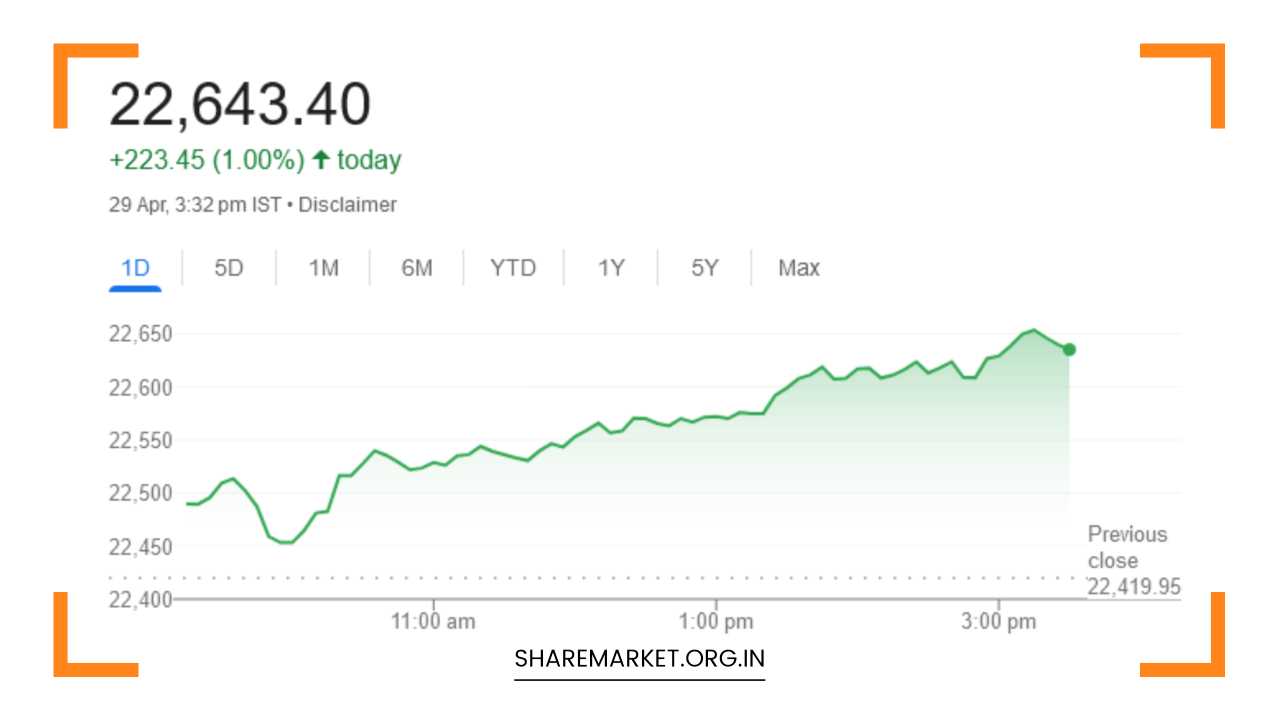

- Nifty Gains Traction: The Nifty index, representing the National Stock Exchange of India, mirrored the positive sentiment, gaining 223.40 points (1.00%) and closing at 22,643.40.

Decoding the Drivers: Banking Takes the Center Stage

A closer look reveals the banking sector, particularly private sector banks, as the driving force behind today’s rally.

- ICICI and Axis Bank Lead the Charge: These two banking giants spearheaded the surge, their strong performances significantly impacting the overall market sentiment. Their positive financial results or strategic announcements could have contributed to this rise.

- PSU Banks Join the Party: Later in the day, state-owned Public Sector Undertaking (PSU) banks also joined the rally, further solidifying the market’s bullish stance. This suggests a potential improvement in the health of the Indian banking sector as a whole.

Beyond Banking: A Broad-Based Rally

While banking undoubtedly played a pivotal role, it wasn’t the only sector to witness growth. Today’s trade saw a welcome change with most sectoral indices closing in positive territory.

- Sectoral Winners: Healthcare, Metal, Power, Oil & Gas, and crucially, Bank indices emerged as the clear winners, registering gains ranging from a healthy 0.4% to a significant 2%. This indicates a broader market revival and investor interest spreading beyond just a single sector.

- Midcap and Smallcap Performance: The BSE Midcap index, representing mid-sized companies, displayed positive momentum, climbing 0.8%. However, the smallcap index remained flat, suggesting a cautious approach by investors towards smaller, high-risk, high-reward companies.

Top Gainers and Losers: A Mixed Bag

As with every trading session, there were companies that outperformed the market and others that witnessed some selling pressure.

- Nifty’s Top Performers: ICICI Bank, IndusInd Bank, SBI (State Bank of India), UltraTech Cement, and Axis Bank emerged as the frontrunners on the Nifty index, reflecting the dominance of the banking sector and investors’ renewed faith in these companies.

- Nifty’s Underperformers: Despite the overall positive sentiment, some Nifty constituents like HCL Technologies, Apollo Hospitals, Bajaj Auto, HDFC Life, and LTIMindtree experienced losses. This could be due to company-specific news, profit booking, or sector-specific concerns.

Market Outlook for April 30th: Experts Weigh In

With the positive momentum regained, market analysts are cautiously optimistic about the upcoming session on April 30th, 2024. Here’s a detailed breakdown of their predictions:

-

Rupak De’s Bullish Take (LKP Securities): De anticipates Nifty to scale even higher levels, potentially reaching the 22,800-22,850 zone. He emphasizes the continuous rise and closing above the 21EMA (Exponential Moving Average) as a strong indication of a bullish trend. Additionally, the bullish crossover in the RSI (14) momentum indicator reinforces his positive outlook. He highlights a support level of 22,550 for Nifty in the short term, offering a potential safety net in case of any corrections.

-

Aditya Gaggar’s Focused View (Progressive Shares): Gaggar specifically predicts Nifty to move towards 22,770. He attributes today’s positive sentiment to the robust performance of the banking sector, particularly private banks led by ICICI and Axis Bank. He believes Nifty has successfully breached its immediate resistance of 22,600 and is well-positioned to challenge its previous high of 22,770. He acknowledges a shift in support levels to 22,460, providing a cushion for any potential pullbacks.

Beyond Predictions: Factors to Consider for April 30th

While expert predictions offer valuable insights, it’s crucial to consider external factors that can influence the market’s direction on April 30th:

- Global Cues: The performance of international markets, particularly the US markets, can significantly impact the Indian market. A positive close in the US markets can instill confidence in Indian investors, potentially leading to a continuation of the rally. Conversely, a decline in the US markets could trigger profit booking or a cautious approach in the Indian market.

-

Economic Data Releases: Any significant economic data releases scheduled for April 30th, such as inflation figures or industrial production data, can influence investor sentiment. Positive data releases can bolster confidence and encourage buying, while negative data might lead to risk aversion and selling pressure.

-

News and Events: It’s essential to stay updated with any major news or events, both domestic and international, that could potentially influence the market sentiment on April 30th. For instance, unexpected policy changes by the government, geopolitical tensions, or major corporate announcements can cause sudden shifts in market direction.

Potential Scenarios for April 30th:

Based on the current market analysis and expert predictions, here are two potential scenarios for the Indian stock market on April 30th, 2024:

Scenario 1: Continuation of the Rally (Bullish Case):

- Positive Global Cues: Major international markets, particularly the US markets, close higher, boosting investor confidence.

- Favorable Economic Data: Key economic data released on April 30th paints a positive picture of the Indian economy, further strengthening investor sentiment.

- Absence of Negative News: No major negative news or events emerge to disrupt the market momentum.

In this scenario, we can expect Nifty to potentially reach the target zones predicted by Rupak De (22,800-22,850) or Aditya Gaggar (22,770). Broader market participation is likely, with sectoral indices continuing their upward trajectory. Midcap and smallcap indices might also witness increased buying activity.

Scenario 2: Consolidation with Potential Correction (Neutral/Slightly Bearish Case):

- Mixed Global Cues: International markets close with mixed results, offering little direction to the Indian market.

- Neutral Economic Data: Economic data released on April 30th is neutral, providing no clear catalyst for a significant move.

- Profit Booking or Cautious Approach: Some investors might choose to book profits after the recent gains, leading to a slight correction.

In this scenario, Nifty might experience some consolidation around its current levels or experience a minor pullback towards the support levels mentioned earlier (22,550 or 22,460). Sectoral performance could be mixed, with some sectors continuing to rise while others experience profit booking or sideways movement. Midcap and smallcap indices might remain subdued.

Final Remarks:

The Indian stock market appears to be recovering momentum, with the banking sector playing a pivotal role. While expert predictions offer valuable insights, it’s crucial to consider external factors like global cues, economic data releases, and news events when making investment decisions.

By understanding the potential scenarios for April 30th, investors can be better prepared to navigate the market and make informed choices.

Remember, the stock market is inherently unpredictable, and these scenarios are for informational purposes only. Always conduct your own research and consult with a financial advisor before making any investment decisions.