Sensex Gain 759.49 Point; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

A Comprehensive Exploration of the January 15 Stock Market Performance and Future Projections for January 16

January 15 witnessed a spectacular fifth consecutive day of growth in the Indian stock market, culminating in record-high closings for both the Sensex and Nifty.

This remarkable performance was fueled by robust third-quarter results and an overall expansion across sectors, with particular surges observed in Information Technology (IT), oil and gas, and banking stocks.

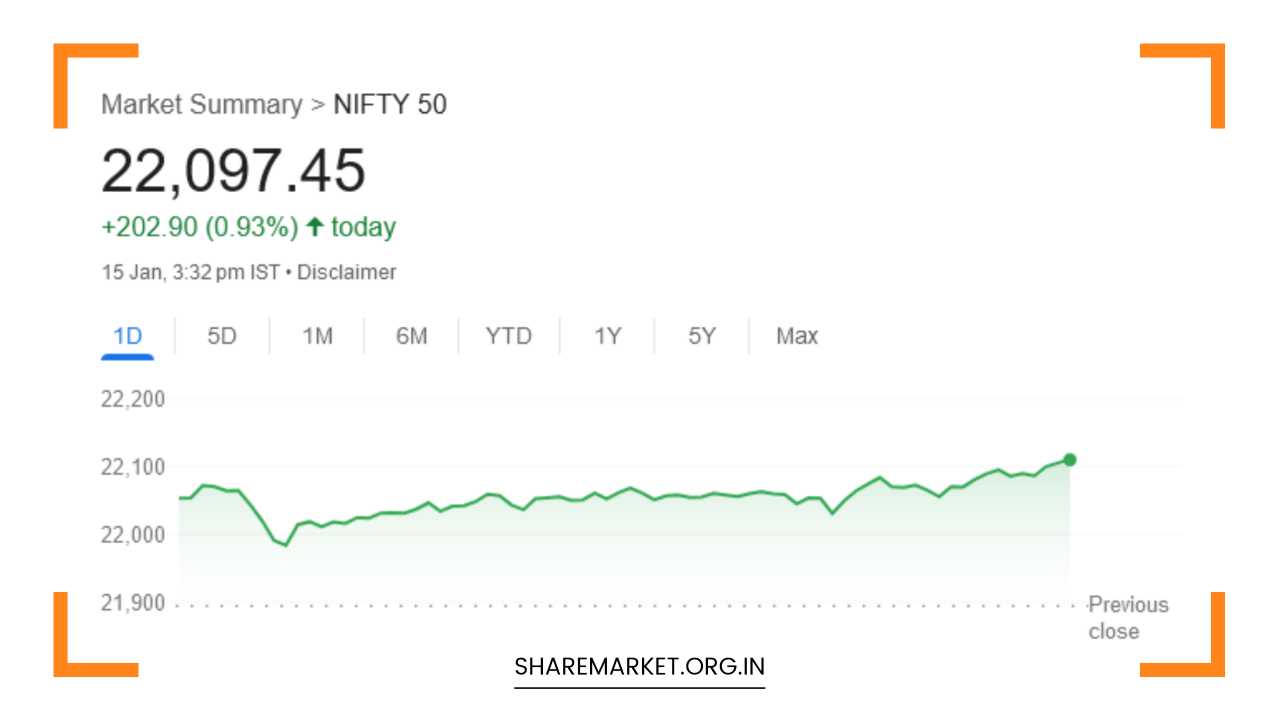

Despite mixed global cues, the market showcased resilience, closing with the Sensex at 73,327.94, up by 1.05%, and the Nifty at an unprecedented 22,097.50, marking a 0.93% surge—a testament to the strength of the Indian stock market.

Market Capitalization and Sectoral Trends:

The collective market capitalization of companies listed on the Bombay Stock Exchange (BSE) experienced a substantial uptick, rising from approximately Rs 3.73 lakh crore to Rs 3.76 lakh crore in the previous session.

Delving into sectoral trends, all indices, except for the metal sector, concluded the day in the green.

Noteworthy performers included Information Technology (IT), Public Sector Undertaking (PSU) Banks, and Oil and Gas, each recording a significant 1% increase.

Stock and Sector-Specific Analysis:

A closer look at individual stocks reveals a mixed bag of top performers and laggards. Wipro, ONGC, HCL Technologies, Infosys, and Bharti Airtel emerged as top gainers on Nifty, showcasing the diversity of sectors contributing to the bullish trend.

In contrast, HDFC Life, Bajaj Finance, Bajaj Finserv, Hindalco Industries, and Eicher Motors found themselves among the top losers, highlighting the nuanced responses of specific stocks to market dynamics.

Insights from Market Experts:

Sharekhan’s Jatin Gedia: Jatin Gedia from Sharekhan offered valuable insights into the day’s proceedings, noting that Nifty displayed strength from the opening bell, maintaining positive momentum throughout the day.

The rally’s leadership remained with IT giants, with notable contributions from the banking and pharma sectors.

Gedia anticipates that sector rotation will likely persist in the future, potentially driving further increases in Nifty.

He sets a short-term target for Nifty at Rs 22,350-22,500, underlining the overall positive trend. Gedia suggests that any pullback towards the support zone of Rs 21,900 – 21,850 should be perceived as a strategic buying opportunity.

Bank Nifty’s Bullish Momentum: Analyzing Bank Nifty’s performance, Gedia highlighted a positive trend characterized by higher highs and higher lows on the daily chart, indicative of sustained bullish momentum.

The index successfully closed above 48,000 points, and the 20-day moving average further supports optimistic sentiments.

In the short term, Gedia anticipates that Bank Nifty may reach levels of 48,650, with the potential to surge further to 50,000.

Aditya Gaggar’s Perspective: Aditya Gaggar, Director at Progressive Shares, provided a nuanced perspective, noting that after a breakout following the flag and pole pattern, subsequent buying during the trading day strengthened the market.

Gaggar anticipates a continuation of the rise in Nifty, setting a target of 22,330. He identifies immediate support for Nifty at 21,920, with resistance hovering around 22,275.

Kunal Shah’s Analysis: Kunal Shah of LKP Securities emphasized the sustained momentum of Nifty bulls, propelling the index to new highs beyond the 22,000 mark.

He identifies a crucial support level at 21,800, and the breach of this support could signal weakness in the market.

Shah sets a short-term target for Nifty at the levels of 22,200-22,300, with the potential for further gains if the index surpasses these levels, possibly reaching 22,500.

Bank Nifty’s Prominent Breakthrough and Future Outlook:

Bulls maintained control over Bank Nifty, successfully crossing the major resistance of 48,000 on a closing basis.

The market is now eagerly awaiting the results of HDFC Bank, a pivotal factor that could significantly influence Bank Nifty’s trajectory.

A positive outcome in HDFC Bank’s results might propel Bank Nifty towards the 50,000 points mark. However, caution is advised, as a breach of the downside support at 47,700 could intensify weakness in the market.

In-Depth Analysis:

Expanding on the day’s events, it is essential to delve into the overarching market dynamics that propelled such robust growth.

The positive sentiment was underpinned by strong third-quarter results across various sectors, with IT, oil and gas, and banking stocks emerging as primary drivers of the upward trajectory.

Additionally, the market’s ability to weather mixed global cues showcases its resilience and the confidence investors have in the domestic economic landscape.

The significant surge in market capitalization, particularly the increase from approximately Rs 3.73 lakh crore to Rs 3.76 lakh crore in the previous session, underscores the broader market’s bullish sentiment.

This surge is reflective of heightened investor confidence, translating into increased valuations for listed companies.

The sector-specific analysis sheds light on the diverse responses of individual stocks to market forces. While IT stocks like Wipro, HCL Technologies, and Infosys recorded substantial gains, certain financial and industrial stocks faced losses.

This divergence highlights the importance of a nuanced and diversified investment approach, acknowledging the varied performance of sectors in response to different market dynamics.

Future Projections:

Looking ahead to January 16, market experts are cautiously optimistic, foreseeing potential continued gains, albeit with considerations for potential corrections and sector rotations.

The consensus among experts is that the positive momentum in Nifty is likely to persist, driven by sustained sectoral rotations and contributions from key sectors like banking, IT, and pharma.

Sharekhan’s projection of a short-term Nifty target at Rs 22,350-22,500 aligns with the overall positive trend observed.

Jatin Gedia’s anticipation of sector rotations suggests that the rally may broaden, with potential contributions from auto and FMCG sectors in the future.

Bank Nifty’s bullish trend, as highlighted by Gedia and supported by technical indicators like higher highs and higher lows, sets the stage for further upward movement.

The anticipation of reaching levels of 48,650 and potentially 50,000 in the short term underscores the market’s bullish sentiment.

Aditya Gaggar’s expectation of Nifty reaching 22,330 and immediate support at 21,920 provides investors with specific levels to watch, guiding strategic decision-making. Meanwhile, Kunal Shah’s emphasis on Nifty’s sustained momentum and the crucial support level at 21,800 adds depth to the overall analysis, emphasizing the need for vigilance amid potential fluctuations.

Concluding Thoughts:

In conclusion, the stock market’s performance on January 15 was marked by resilience, robust growth, and optimism among investors.

The record-high closings for Sensex and Nifty, coupled with the diverse sectoral responses, paint a nuanced picture of the market’s dynamism.

Insights from market experts offer valuable perspectives, providing investors with a roadmap for navigating the evolving landscape.

As investors chart their course into January 16, a strategic and diversified approach is crucial. The positive outlook for Nifty and Bank Nifty, supported by expert opinions and technical indicators, presents opportunities for those willing to navigate potential fluctuations.

However, the market’s unpredictable nature calls for a balanced approach, incorporating risk management strategies and staying attuned to emerging trends.

In this ever-evolving financial landscape, informed decision-making and adaptability remain key to successful navigation of the stock market.