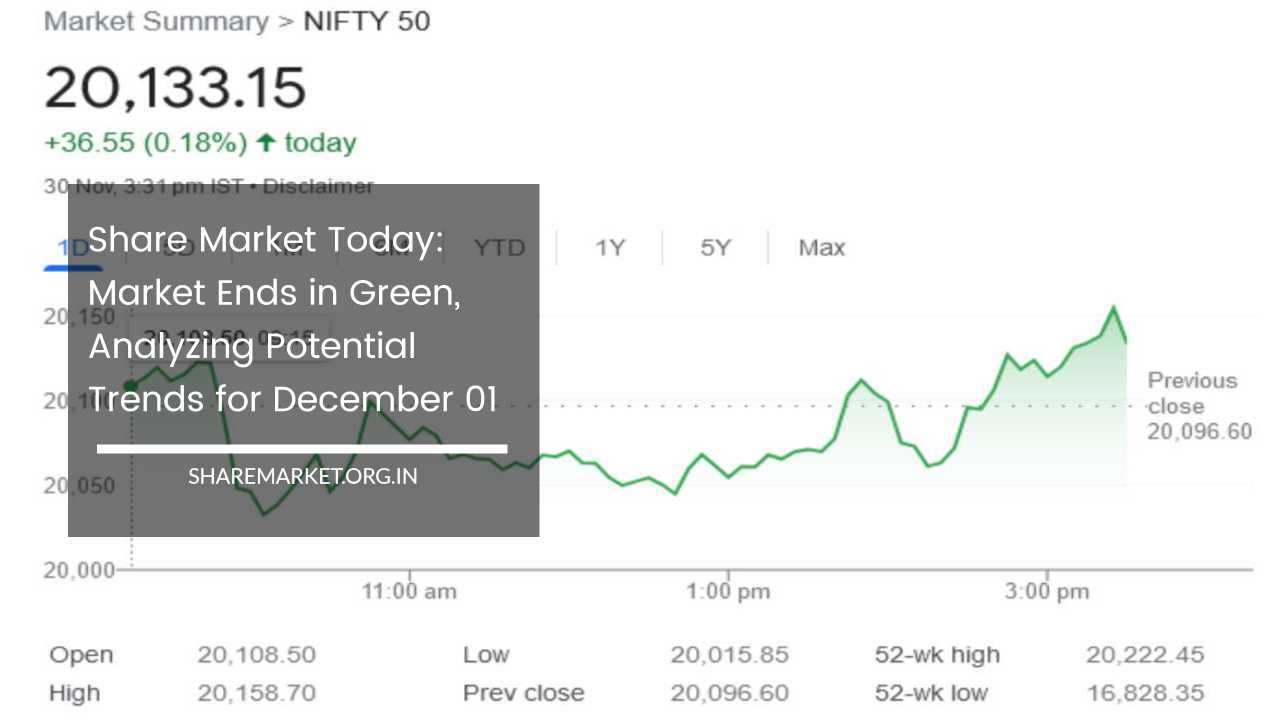

Share Market Today: Market Ends in Green, Analyzing Potential Trends for December 01

Share Market Today

In today’s comprehensive market analysis, we delve into the intricate details of the stock market’s performance on September 30th and explore the insights provided by experts regarding potential movements on December 01.

The day witnessed notable developments, ranging from support zones for Nifty to sector-specific shifts and top gainers and losers in the market.

Support and Open Interest Analysis:

As the day unfolded, market analysts observed crucial support for Nifty in the range of 20050-20100. Delving into open interest data, it was identified that the highest open interest resided on the call side at 20400, followed by the strike price of 20300.

This information sets the stage for understanding the potential resistance levels and key areas of interest for traders and investors.

Market Recap – September 30th:

The market showcased its resilience on September 30th, navigating through ups and downs to ultimately close in the green. Nifty managed to secure a closing position above 20100, marking a positive trajectory.

The Sensex concluded the day at 66,988.44, gaining 86.53 points or 0.13%, while Nifty closed at 20,133.20, reflecting a rise of 36.60 points or 0.18%. This dynamic movement in the indices captured the attention of market participants.

A closer look at the market breadth reveals that about 1838 shares witnessed an increase, 1752 experienced a decline, and 130 remained unchanged.

Notably, both large-cap and small-cap stocks exhibited positive momentum. The BSE Midcap Index saw a commendable uptick of 0.8%, and the Smallcap Index surged by 1%, indicating a broad-based market rally.

Top gainers on Nifty included UltraTech Cement, HDFC Life, Sun Pharma, Apollo Hospitals, and Eicher Motors.

Conversely, IndusInd Bank, Adani Enterprises, Adani Ports, Reliance Industries, and Power Grid Corporation found themselves among the top losers. This diverse movement across sectors provided a nuanced perspective on market dynamics.

Sectoral indices played a crucial role in shaping the day’s narrative. The PSU Bank index, for instance, witnessed a decline of 1.5%, underlining specific challenges within that sector.

In contrast, Pharma, Capital Goods, Realty, and Oil & Gas indices demonstrated strength, each recording gains in the range of 1-1.5%. These sectoral shifts added layers of complexity to the overall market analysis.

Small and Medium Stocks Shine:

A notable aspect of the day’s performance was the upward trajectory observed in small and medium stocks. Both the BSE Midcap Index and Smallcap Index outperformed the Frontline Index, recording gains of 0.8% and 1.14%, respectively.

This phenomenon indicated a growing investor appetite for stocks beyond the established giants, contributing to the overall vibrancy of the market.

Top Gainers and Losers:

Understanding the specific stocks that fueled or dampened market performance provides valuable insights. UltraTech Cement, HDFC Life, Sun Pharma, Apollo Hospitals, and Eicher Motors emerged as the top gainers on Nifty, showcasing strength and positive sentiment in these segments.

On the flip side, IndusInd Bank, Adani Enterprises, Adani Ports, Reliance Industries, and Power Grid Corporation faced headwinds, emerging as the top losers.

This duality in performance highlights the diverse nature of the market and the importance of strategic stock selection.

Sectoral Dynamics:

Sectoral analysis revealed nuanced shifts within the market landscape. The PSU Bank index experienced a notable decline of 1.5%, suggesting challenges specific to this sector.

In contrast, Pharma, Capital Goods, Realty, and Oil & Gas indices displayed resilience, each recording gains in the range of 1-1.5%. This sector-specific movement provides valuable information for investors looking to navigate their portfolios strategically.

Outlook for December 01:

To gauge the potential market movements on December 01, insights from market experts are crucial. Aditya Gaggar, Director at Progressive Shares, highlighted the day’s substantial fluctuations and noted that the Nifty 50 index closed at 20,133.15, gaining 36.55 points on the day of the monthly expiry.

The performance of realty and pharma sectors stood out positively, while PSU banking shares faced pressure.

Notably, market participants showed a heightened interest in mid and small-cap stocks, with both indices recording gains of 0.68% and 1.14%, respectively, outperforming the Frontline Index.

The formation of a bullish candle in the Higher High and Higher Bottom configuration for Nifty suggests the possibility of a new upward trend in the coming days.

Deven Mehta, from Choice Broking, provided a critical analysis of the support levels for Nifty, pinpointing the zone of 20050-20100.

Open interest data further revealed significant levels on the call side at 20400 and the strike price of 20300.

On the put side, the highest open interest was observed at the strike price of Rs 20000. For Bank Nifty, support was identified at 44100-43900, with resistance at 44900-45000.

Rupak De of LKP Securities emphasized the significance of Nifty remaining above 20000 for maintaining a strong bullish sentiment.

He highlighted a substantial presence of put writers at the 20000 strike, indicating a defense of this level. However, a fall below 20000 could introduce further weakness in Nifty.

The recommended strategy is to buy on market dips, with resistance levels identified at 20200-20230. Crossing this hurdle could propel Nifty towards 20450-20500.

Final Thoughts:

In conclusion, the market on September 30th exhibited a dynamic interplay of various factors, from support zones and open interest data to sector-specific movements and top gainers and losers.

As we look ahead to December 01, the insights provided by market experts paint a picture of cautious optimism, with attention on key support and resistance levels for Nifty and strategic considerations for both large and small-cap stocks.

Investors and traders can use this comprehensive analysis to inform their decision-making processes and navigate the intricacies of the market landscape.