Share Market Today: Market Gains for Second Consecutive Day, Insights on October 31 Trends

Share Market Today

The current state of the stock market suggests that the Nifty has demonstrated strength, particularly as long as it remains above the pivotal level of 19000 points.

This has raised expectations that the ongoing upward momentum will continue, potentially propelling the Nifty to the range of 19200-19225.

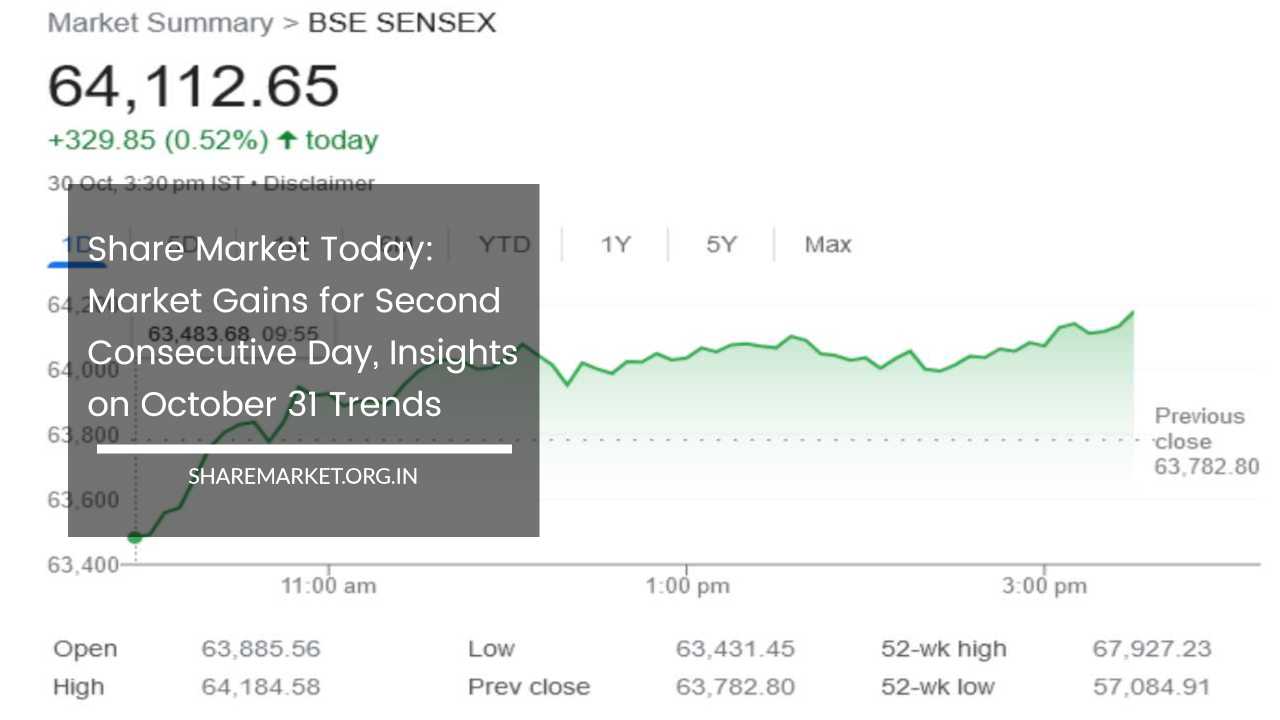

In recent market news, on October 30, the market witnessed a second consecutive day of positive growth. The Nifty closed around the 19150 mark, and the Sensex concluded the trading session at 64112.65, marking a gain of 329.85 points or 0.52 percent.

Nifty, on the other hand, ended the day at 19140.90, with a gain of 93.60 points or 0.49 percent. A detailed analysis of the day’s trading activities reveals that 1863 shares experienced an increase in value, while 1741 shares recorded a decline. Additionally, 192 shares remained unchanged.

Examining the notable performers of the day, BPCL, UltraTech Cement, ONGC, Reliance Industries, and SBI Life Insurance stood out as the top gainers on Nifty.

Conversely, UPL, Tata Motors, Maruti Suzuki, Bajaj Auto, and Axis Bank were the top losers, facing downward pressure.

Delving further into the sectoral performance, most sectoral indices managed to close with gains, with the exception of the Auto and FMCG sectors.

Notably, the oil-gas and realty sectors both exhibited a 1 percent increase, contributing positively to the overall market performance. Meanwhile, the mid and smallcap indices of BSE closed the day with a relatively stable performance.

As we look ahead to October 31, market experts are offering their insights and predictions:

Aditya Gaggar, Director of Progressive Shares:

Aditya Gaggar highlighted the market’s dynamics for the week, noting that it commenced on a relatively slow note, with bears initially exerting pressure on the market.

However, the bulls managed to fend off the bearish sentiment. Notably, heavyweight stocks like Reliance played a pivotal role in driving Nifty higher.

Banking stocks also contributed to the market’s upward momentum, particularly in the latter half of the trading session. The realty sector emerged as the best-performing sector, followed by gains in the energy and pharma stocks.

Conversely, the Auto and FMCG sectors exhibited weakness. Nifty’s performance was marked by the formation of a bullish candle on the daily chart, which indicates a positive sentiment and upward momentum.

Nifty is now seen as advancing toward the 19200-19250 range. On the downside, support is visible at the 18940 level.

Shrikant Chauhan of Kotak Securities:

Shrikant Chauhan analyzed Nifty’s performance from a technical perspective. He emphasized that Nifty found a strong support level around 18950 and subsequently staged a robust comeback from this level.

This is reflected in the formation of a bullish candle on the daily chart. Moreover, the intraday chart signals a continuation of the existing uptrend.

This implies that as long as Nifty holds firm above the 19000 mark, the ongoing pullback is likely to persist. This pullback could potentially lead Nifty to reach the level of 19200-19225.

However, a scenario in which Nifty falls below the critical 19000 level might exert downward pressure on the market, potentially leading to a correction.

In the context of these insights and market performance, it is essential to understand the significance of these levels and the factors contributing to market movements.

The 19000 level in the Nifty is a critical support level that traders and investors closely monitor. It represents a point at which the market has historically found support and reversed its downtrend.

Therefore, as long as Nifty remains above this level, there is an underlying bullish sentiment and an expectation of further gains.

However, if Nifty were to breach this support level, it could indicate a shift in market sentiment towards bearishness.

The anticipated pullback to the 19200-19225 range is based on technical analysis and market sentiment. This level represents a potential target for the Nifty’s upward movement.

It is essential to recognize that these levels are not guaranteed to be reached, as market conditions can change rapidly based on a multitude of factors, including economic data, geopolitical events, and global market trends.

The specific performance of individual stocks and sectors provides valuable insights into market dynamics. In the mentioned trading day, several stocks showed significant movement.

BPCL, UltraTech Cement, ONGC, Reliance Industries, and SBI Life Insurance were among the top gainers. Understanding the reasons behind their performance can provide valuable information for investors and traders.

For example, BPCL, which is part of the energy sector, saw gains on the back of positive sentiment in the oil and gas sector. This may have been influenced by factors such as changes in global oil prices, geopolitical events affecting oil production, or the company’s specific financial performance.

Similarly, UltraTech Cement, a significant player in the construction and infrastructure sector, could have been influenced by developments in the real estate market or government infrastructure projects. These are just a few examples of the factors that can impact individual stock performance.

Conversely, UPL, Tata Motors, Maruti Suzuki, Bajaj Auto, and Axis Bank were among the top losers on Nifty. These stocks may have been influenced by factors specific to their respective industries.

For instance, Tata Motors and Maruti Suzuki are part of the automotive sector, and their performance can be influenced by factors such as changes in demand for automobiles, production issues, or regulatory changes affecting the industry.

Understanding the performance of different sectors is also crucial for investors. In the mentioned trading day, most sectoral indices closed with gains, indicating a broadly positive market sentiment.

This suggests that investors were favoring sectors such as realty, oil-gas, and pharma, which were showing strong performance.

Meanwhile, the weakness in the Auto and FMCG sectors indicated that investors were perhaps less enthusiastic about these industries on that particular day.

Market experts’ opinions, such as those provided by Aditya Gaggar and Shrikant Chauhan, offer valuable insights for investors and traders.

Aditya Gaggar’s observation of Nifty forming a bullish candle on the daily chart is an important technical indicator that suggests positive sentiment in the market.

A bullish candle is typically seen as a sign that buyers are in control, and it can indicate a potential upward trend.

Additionally, the support level at 18940, as identified by Aditya Gaggar, is a critical point to watch for potential reversals or further support.

Shrikant Chauhan’s technical analysis emphasizes the significance of the 19000 level for Nifty. This level has acted as a strong support in the past, and as long as it holds, the upward momentum is expected to continue.

The formation of a bullish candle on the daily chart further supports the notion of a positive trend. His prediction of a potential pullback to the 19200-19225 range is based on technical analysis and the continuation of the uptrend.

It’s important to note that technical analysis and expert opinions are not guarantees of future market performance.

The stock market is influenced by a multitude of factors, including economic data, geopolitical events, investor sentiment, and global market trends.

Therefore, while these insights provide valuable guidance, investors should always consider a diverse range of information and factors before making trading or investment decisions.

In summary, the stock market on October 30 showed signs of strength, with Nifty and Sensex registering gains. The performance of individual stocks and sectors provided valuable insights into market dynamics, with notable gainers and losers across various industries.

Additionally, expert opinions highlighted the technical analysis of Nifty’s performance and the importance of key support levels.

As we look ahead to October 31, it’s important for investors and traders to closely monitor the market’s performance and stay informed about the latest developments and news that could influence market movements.

While technical analysis and expert opinions offer valuable guidance, market conditions can change rapidly, and it’s crucial to adapt to evolving circumstances in order to make informed decisions in the dynamic world of stock trading.