Share Market Today: Market Slumps for 6th Consecutive Day, What to Expect on October 27

Share Market Today

Ongoing Market Challenges: Analysis and Outlook for October 27th

The stock market faced yet another challenging day on October 26th, with the decline marking the sixth consecutive day of losses. Kunal Shah from LKP Securities reported that heavy selling persisted in Bank Nifty, resulting in a decline of 1.29%.

What’s particularly concerning is that Bank Nifty is currently trading below its critical 200-day Exponential Moving Average (200EMA) at 43,264.

This is a sign that the recessionary environment is set to continue, which has broader implications for the entire market.

The next significant support level for Nifty is situated at 42,000. If this support doesn’t hold, there’s a possibility of a further decline towards the range of 41,500 to 41,200.

Market Overview:

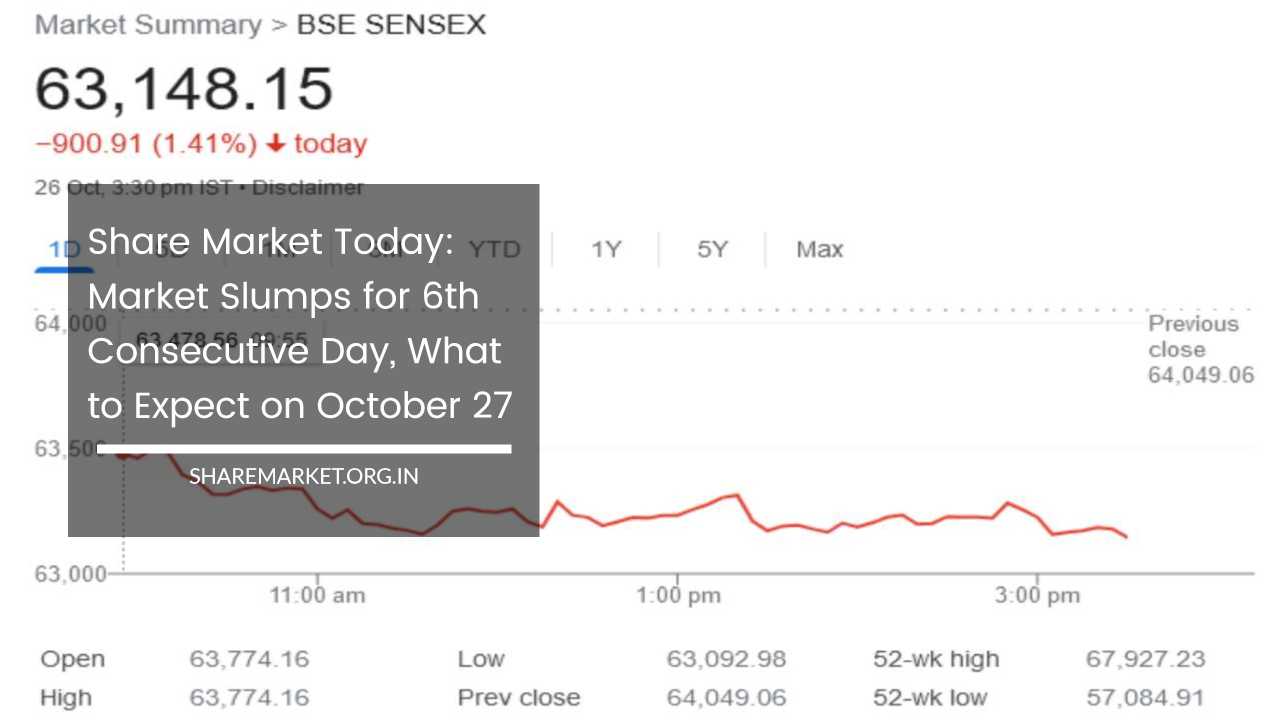

On October 26, both Sensex and Nifty exhibited a decline of over 1%, marking the sixth consecutive day of losses. At the close of the trading session, Sensex retreated by 900.91 points, representing a 1.41% drop to reach 63,148.15, while Nifty dipped by 264.90 points, a 1.39% decrease, to land at 18,857.30.

The market witnessed 1,211 shares gaining momentum, whereas 1,943 shares experienced declines. Concurrently, 101 shares remained unchanged.

In a day marked by losses, even small and medium-sized stocks were under pressure, as the BSE Midcap index recorded a 1% fall, and the Smallcap index experienced a 0.3% drop. Notably, with the exception of the power sector, all other sectoral indices were observed trading in the red.

Top Losers and Gainers:

The notable decliners on Nifty included M&M, Bajaj Finance, Asian Paints, UPL, and Bajaj Finserv. Conversely, Axis Bank, HCL Technologies, Adani Ports, IndusInd Bank, and ITC were among the prominent gainers.

Market Analysis:

Vinod Nair from Geojit Financial Services points out that the second-quarter results have thus far been weaker than expected, reflecting a global trend seen in developed countries as well.

Increasing geopolitical tensions and rising interest rates are fueling fears of a looming recession, thereby increasing the risk of earnings downgrades and valuation adjustments for companies. Moreover, market pressure was compounded by selling on the expiry day.

Market Outlook for October 27:

Ajit Mishra of Religare Broking notes that Nifty has reached a critical support level at 18,800, which coincides with its long-term 200-day Exponential Moving Average (200EMA). Following the recent downtrend, the market may exhibit some relief, though the prospects for significant upward movement remain limited due to challenges faced by major companies across various sectors.

Consequently, it is advisable to consider a strategy of selling on rebounds and focusing on index heavyweights.

Aditya Gaggar, Director of Progressive Shares, observes that the market broke the psychological support level of 19,000 in the initial hours of trading, furthering the decline.

The formation of another bearish candle on the daily chart signifies the bearish control over the market. The next support for Nifty is anticipated at the 18,600-18,660 range, while 19,000 acts as a resistance level.

Shrikant Chauhan of Kotak Securities emphasizes the technical aspect, highlighting the presence of bearish candles and weak intraday formations on the daily chart, indicative of further weakness from current levels.

As long as Nifty remains below 19,000, the bearish sentiment is expected to persist, potentially driving Nifty down to the 18,800-18,725 range. On the other hand, a break above 19,000 may lead to a potential uptick toward 19,100-19,150.

Expanding on Market Conditions:

The persistent decline in the stock market has raised numerous concerns among investors and analysts alike.

Several factors have contributed to this challenging environment, including economic uncertainties, geopolitical tensions, and rising interest rates. It’s essential to delve deeper into these factors to better understand the market’s current state.

1. Economic Uncertainties: Economic uncertainties are a significant driver of the market’s volatility. Weak second-quarter results, both domestically and in developed countries, have cast a shadow on the market.

Companies are reporting weaker-than-expected earnings, and this trend is not isolated to a single sector. It’s a broader concern that is impacting the valuation of companies and, consequently, stock prices.

As a result, investors are growing increasingly wary of the market’s potential for continued instability.

2. Geopolitical Tensions: Geopolitical tensions have been on the rise, further contributing to the market’s unease.

These tensions can have a profound impact on the global economy, particularly if they escalate to the point of triggering a significant crisis.

Uncertainty in international relations can disrupt trade, create uncertainty for businesses, and negatively affect investor sentiment.

3. Rising Interest Rates: The uptick in interest rates is another significant factor that has been affecting the market.

Higher interest rates can lead to increased borrowing costs for companies and consumers alike. This can slow down economic growth, reduce consumer spending, and impact corporate profitability.

Investors are closely monitoring interest rate developments to gauge their impact on the market.

4. Selling on Expiry Day: Another short-term catalyst for market declines is the practice of selling on the expiry day.

This phenomenon, often associated with options and futures contracts, can lead to heightened volatility and increased selling pressure on specific days, which can further exacerbate market declines.

Market Technical Analysis:

The technical analysis of the market provides additional insights into its current condition. The presence of bearish candles and weak intraday formations on the daily chart indicates that the market is facing significant headwinds.

These bearish signals suggest that the market is likely to continue its downward trajectory. As long as Nifty remains below the critical level of 19,000, there is a high probability that the bearish sentiment will persist.

Support and Resistance Levels:

Support and resistance levels play a crucial role in determining the potential trajectory of the market. For Nifty, the next support level is anticipated at the range of 18,600 to 18,660.

This is a critical level to watch, as a breach could signal further downside potential. On the other hand, the level of 19,000 is acting as resistance, and any attempt to move above it faces challenges due to the prevailing market conditions.

Expert Opinions and Strategies:

The insights and strategies offered by market experts provide valuable guidance for investors navigating these challenging market conditions.

Ajit Mishra of Religare Broking suggests that while the market may experience some relief in the near term, the potential for significant upward movement remains limited.

This limitation is primarily due to the challenges faced by major companies across various sectors. In such an environment, adopting a strategy of selling on rebounds and focusing on index heavyweights is a prudent approach.

Aditya Gaggar, Director of Progressive Shares, highlights the bearish control over the market, signified by the formation of another bearish candle on the daily chart.

He suggests that the next support level for Nifty is visible at the 18,600-18,660 range, while the level of 19,000 acts as a resistance. This bearish outlook suggests caution for investors.

Shrikant Chauhan of Kotak Securities emphasizes the technical aspects of the market. He points out that bearish candles and weak intraday formations on the daily chart indicate further weakness.

The key level to watch is 19,000, as long as Nifty remains below it, the bearish sentiment is likely to persist, potentially leading to a further decline to the 18,800-18,725 range. However, a breakthrough above 19,000 could open the door to a potential rise toward 19,100-19,150.

Final Remarks:

The stock market is currently grappling with a confluence of challenges, including economic uncertainties, geopolitical tensions, and rising interest rates.

These factors have led to six consecutive days of losses in the market. While technical analysis, support and resistance levels, and expert opinions provide guidance, the market’s future remains uncertain.

Investors are urged to exercise caution, employ prudent strategies, and closely monitor key support and resistance levels as they navigate this complex and volatile landscape.

The forthcoming trading day on October 27th will provide further insights into how the market responds to these challenges.