Share Market Today: Nifty Achieves New Record High, Nifty Prediction for Tomorrow

Share Market Today

A Day of Records and Market Momentum

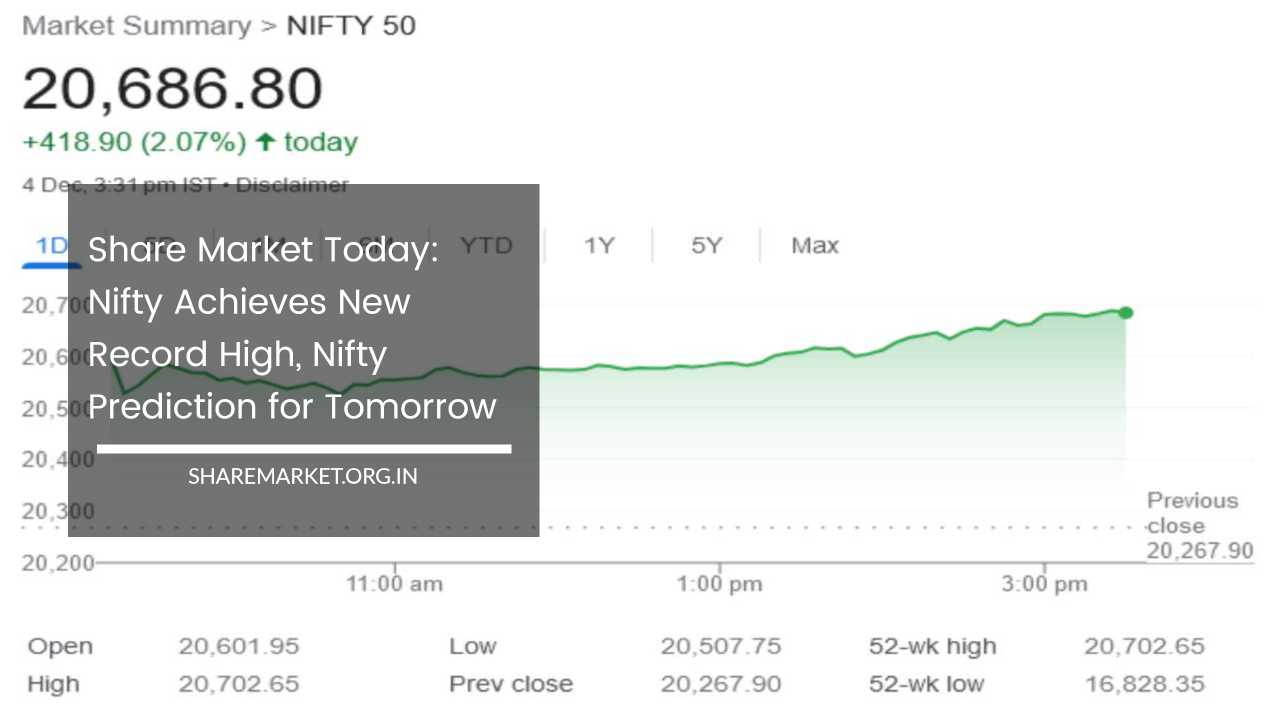

The trading session on December 4 unfolded as a testament to the dynamic nature of the stock market, as benchmark indices soared to new record highs.

The spotlight was on Nifty, the key player, which closed the day above the significant threshold of 20,650. The Sensex, mirroring the bullish sentiment, surged to 68,865.12, marking an impressive gain of 1383.93 points or 2.05 percent.

Nifty, the barometer of market sentiment, closed at 20,686.80, showcasing a substantial gain of 418.9 points or 2.07 percent.

In the midst of this market exuberance, there was a diverse range of gainers and losers. Eicher Motors, Adani Enterprises, Adani Ports, BPCL, and ICICI Bank emerged as the top gainers on Nifty, riding the wave of positive momentum.

On the flip side, HDFC Life, Britannia Industries, Wipro, Sun Pharma, and Titan Company found themselves among the top losers, grappling with the shifts in market dynamics.

The sectoral landscape painted a picture of resilience, with all indices, except Nifty Pharma and Media, closing in the green.

The broader indices of BSE Midcap and Smallcap added to the fervor, recording approximately a 1 percent increase each and achieving record highs.

The day was marked by a palpable sense of achievement and optimism, setting the stage for an intriguing analysis of how the market might unfold on December 5.

Market Analysis: Anticipating December 5 Dynamics

As market participants turn their attention to December 5, Aditya Gaggar, Director at Progressive Shares, offers valuable insights into the trends observed in the previous trading session.

The dominance of bulls was evident as they steered the market upward throughout the day. Nifty capped off the session by reaching a new pinnacle at 20,686.80, marking a substantial gain of 418.90 points.

Sectors played a crucial role in shaping the day’s narrative, with banking and energy sectors standing out with the most significant growth.

Meanwhile, mid and small-cap indices seemed to underperform, raising questions about the breadth of the market rally.

Notably, buying activities were concentrated in index-based stocks, showcasing a nuanced dimension to the market dynamics.

Technical Analysis: The Tale of Strong Uptrend and Overbought Conditions

A closer examination of the technical indicators provides a deeper understanding of the market’s current state. The daily chart for Nifty paints a picture of a robust bullish trend, symbolized by a strong bullish candle.

This candlestick pattern is indicative of a potent uptrend, reflecting the market’s resilience and the positive sentiment among investors.

However, the lower time frame, specifically the hourly chart, tells a slightly different story. Here, an overbought situation is revealed, signaling a potential need for either time or price correction in the market.

The juxtaposition of these technical indicators suggests that while the overarching trend remains bullish, a cautious approach is warranted, with a strategic focus on entering the market during declines.

Expert Perspectives and Market Outlook: Insights from Ajit Mishra

Ajit Mishra, from Religare Broking, provides a seasoned perspective on the recent market trends. The beginning of the week witnessed remarkable fireworks in the market, sustaining the current bullish trend with a 2 percent gain on the trading day.

The banking sector emerged as the primary driver of this rally, showcasing its resilience and influence in shaping market dynamics. Meanwhile, other sectors played supporting roles, contributing to the overall positive sentiment.

Global market signals further contributed to a favorable environment, offering relief to traders. The interconnectedness of global markets underscores the significance of external factors in influencing domestic market trends.

Mishra’s insights shed light on the multifaceted nature of market dynamics, where both domestic and international factors converge to shape investor sentiment.

Despite the positive momentum, Mishra suggests a nuanced perspective on the immediate future. After such a substantial rise, a temporary stabilization around 20,750 for Nifty is anticipated.

This projection aligns with the idea that markets, after a significant uptrend, often experience a period of consolidation or stabilization.

Such phases provide an opportunity for the market to catch its breath before potentially resuming its upward trajectory.

In the event of a downturn, Mishra identifies potential support levels around 20,300-20,400. This strategic insight serves as a guide for traders and investors, offering a roadmap for navigating potential market corrections.

It underscores the importance of being prepared for various scenarios and having a well-defined risk management strategy in place.

Tactical Approaches: Navigating Market Corrections

Given the possibility of time or price correction in the market, it is advisable to adopt a strategic approach. Investors and traders should exercise caution and consider entering the market selectively, particularly during decline phases.

The overbought conditions on the hourly chart underscore the importance of prudent risk management and a disciplined approach to trading.

Aligning with the broader trend remains a key principle in navigating market corrections. While short-term fluctuations and corrections are inherent in any market, the long-term trend often provides a more reliable guide for investors.

By staying attuned to the broader trend and using corrections as opportunities to enter the market at more favorable levels, investors can position themselves for sustainable growth.

Final Thoughts: Riding the Waves of Market Dynamics

In conclusion, the market’s recent performance reflects a robust bullish trend, with Nifty and Sensex reaching new record highs.

This achievement is a testament to the resilience and optimism in the market, driven by a confluence of domestic and global factors. However, the technical analysis suggests a potential need for correction, either in terms of time or price.

Traders and investors are urged to approach the market with caution, considering the overbought conditions on the hourly chart.

Expert opinions emphasize the importance of strategic entries during declines, aligning with the broader trend for optimal gains.

As we navigate the market dynamics on December 5, staying attuned to these insights can provide a valuable compass for making informed investment decisions.

The market, akin to the ebb and flow of the ocean, experiences various phases of expansion and contraction. Navigating these waves requires a combination of technical acumen, strategic thinking, and the ability to adapt to changing circumstances.

In the vast sea of financial markets, each wave presents an opportunity for those who are prepared and vigilant. By staying informed and adopting a prudent approach, investors can ride the waves of market dynamics with confidence and resilience.