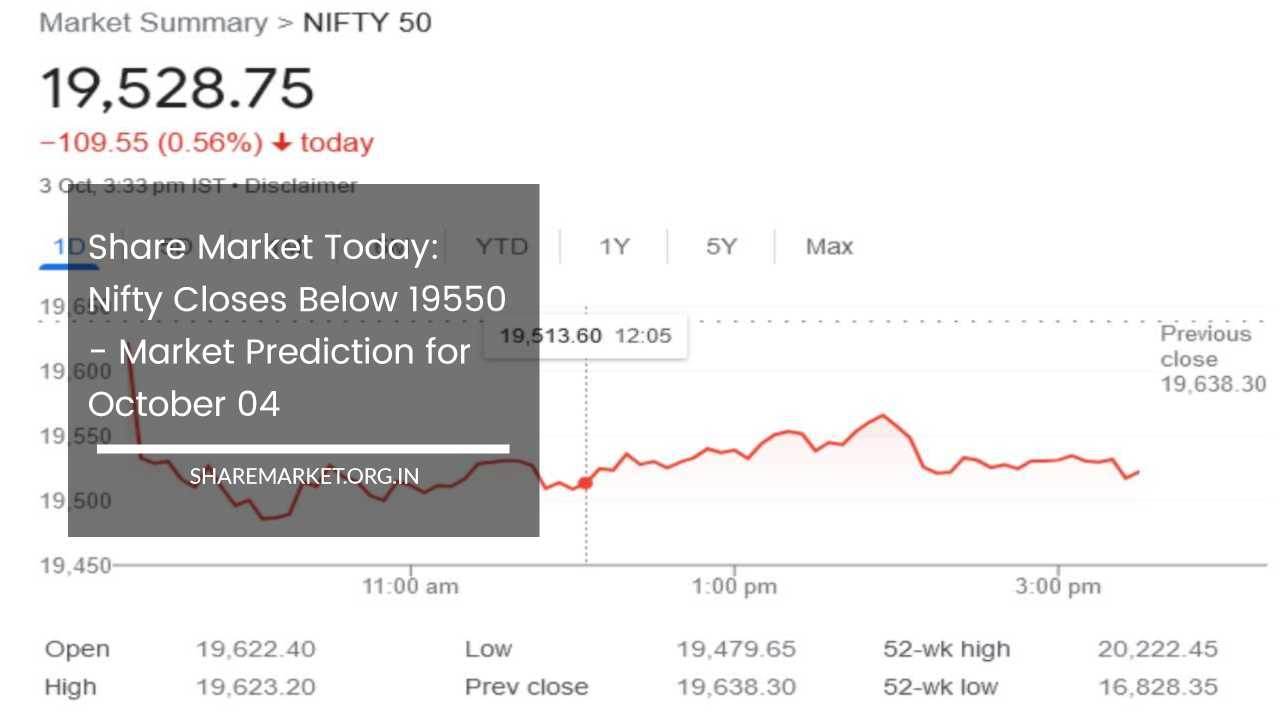

Share Market Today: Nifty Closes Below 19550 – Market Prediction for October 04

Share Market Today

Market Outlook: Consolidation Amidst Global Factors

In the current market outlook, Vinod Nair, an expert from Geojit Financial Services, sheds light on the ongoing dynamics influencing the Indian stock market.

Key factors at play include the rise in US bond yields and the strengthening of the dollar, both of which have contributed to a continued withdrawal of foreign institutional investments (FIIs) from Indian markets.

This, in turn, has led to a phase of consolidation in the market.

Market Performance on October 3

On October 3, Indian benchmark indices, Sensex and Nifty, both closed with declines. Nifty, in particular, experienced a significant drop, slipping below the psychological level of 19550.

Sensex recorded a fall of 316.31 points or 0.48 percent to reach 65512.10, while Nifty dropped 109.50 points or 0.56 percent, closing at 19,528.80. Market activity on that day saw 1816 shares on the rise, 1817 shares in decline, and 189 shares that remained unchanged.

Several noteworthy companies were affected by the market movement. ONGC, Eicher Motors, Hindalco Industries, Maruti Suzuki, and Dr. Reddy’s Laboratories found themselves among the top Nifty losers.

Conversely, Titan Company, Bajaj Finance, L&T, Bajaj Finserv, and Adani Ports were among the top gainers in the Nifty index.

Sectoral Analysis and Currency Impact

To get a more comprehensive picture of the market sentiment, let’s delve into the sectoral indices. FMCG, Auto, Power, Metal, and Oil & Gas all experienced declines ranging from 0.5 to 1 percent.

In contrast, the PSU Bank index closed with a gain of 2.3 percent, while the Capital Goods index recorded a 1 percent increase.

The BSE Midcap index ended the day without significant changes, while the smallcap index showed a gain of 0.6 percent.

The Indian Rupee also faced headwinds as it closed weaker against the Dollar on that day, at 83.20 per dollar, marking a 16 paise drop compared to the previous day’s rate of 83.04.

Factors Driving Market Consolidation

Vinod Nair, from Geojit Financial Services, elaborates on the underlying factors affecting the market.

The primary drivers behind the ongoing consolidation are the rising US bond yields and the strengthening of the US dollar, which have triggered the continued withdrawal of foreign investments from Indian markets. However, there is potential support for the market in the form of falling oil prices.

Additionally, there has been an increase in both the core sector’s output and infrastructure activities within India, with the near-normal monsoon conditions providing optimism for consumption sectors in the short term.

Market Prospects on October 4

Now, let’s turn our attention to the market’s expected movement on October 4. Aditya Gaggar, Director of Progressive Shares, provides insights into the day’s trading.

The week commenced with sluggish movements in the Indian markets. Although there were attempts at recovery during the day, they proved to be short-lived, and by day’s end, Nifty had closed at 19528.75, marking a decline of 109.55 points.

Importantly, Nifty formed a bearish candlestick pattern, raising concerns among traders. Currently, Nifty hovers near a crucial support level at 19450.

A close below this level could potentially lead to a further decline, with a possible downside target of 19200. However, for Nifty to regain momentum, it must secure a strong closing above 19730.

Investor Sentiment Ahead of RBI MPC Meeting

Shrikant Chauhan, an expert from Kotak Securities, offers additional insights into the market’s behavior. In the run-up to the Reserve Bank of India (RBI) Monetary Policy Committee (MPC) meeting scheduled for that week, investors were observed reducing their exposure.

Throughout the trading session, the market remained in a weakened state, and traders lightened their positions in automobile, oil and gas, and metal stocks.

The persistent strength of the US dollar once again had a significant impact on the Indian rupee, prompting foreign investors to exercise caution and pull back from the Indian equity market.

Interestingly, even strong GST (Goods and Services Tax) collection figures for September failed to ignite enthusiasm among investors. Global signals continued to exert a notable influence on the direction of Indian markets.

From a technical perspective, Nifty had formed a bearish candlestick pattern on the daily chart and maintained a lower top formation on the intraday chart, both of which indicated a negative trend.

Conclusion: Key Levels to Watch

To sum up, the immediate outlook for Nifty hinges on key levels. A strong support base exists around 19450, and a break below this level could trigger further declines.

Bulls will be closely watching for a breakthrough at 19580, as surpassing this level could pave the way for an upward move toward 19700-19725.

On the downside, levels of 19450 and 19480 are crucial support zones, and a breach of 19450 could lead to increased selling pressure, potentially causing the index to slide to 19375-19350.

This comprehensive analysis underscores the complex interplay of global and domestic factors that are shaping the Indian stock market’s performance and prospects.