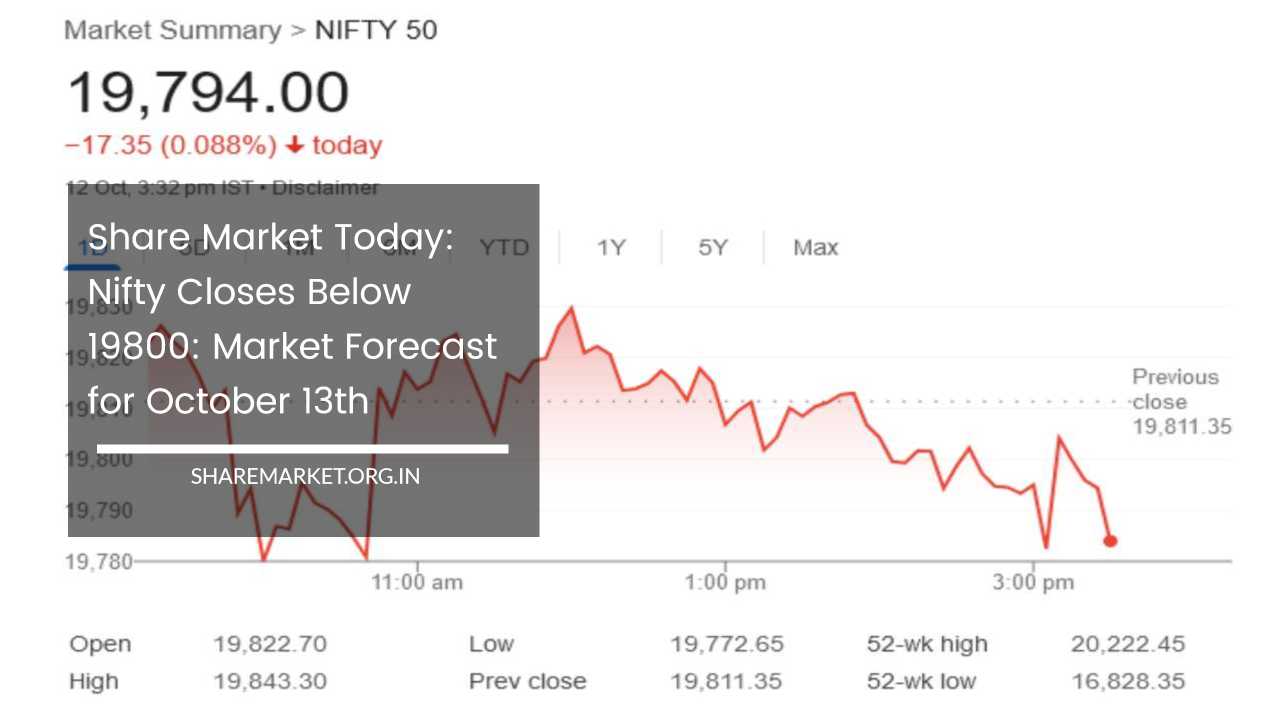

Share Market Today: Nifty Closes Below 19800: Market Forecast for October 13th

Share Market Today

Indian Stock Market Analysis – October 12, 2023

A Day of Market Decline Amid Volatility

On October 12, 2023, the Indian stock markets experienced a day of decline marked by high volatility.

In this comprehensive analysis, we will explore the key market indices, sectoral performance, top gainers and losers, and expert opinions on the market outlook for October 13, 2023.

Market Performance

Nifty Closes Below 19800

One of the most significant developments of the day was Nifty closing below the crucial 19800 mark. This decline was notable in the context of the ongoing market trends, which we will delve into further in this analysis.

The Sensex, the other major Indian stock market index, also saw a modest decline, adding to the overall sentiment of the day.

At the end of trading on October 12, 2023, the Sensex fell by 64.66 points or 0.10 percent to close at 66408.39.

Similarly, Nifty, which represents the National Stock Exchange (NSE), decreased by 17.30 points or 0.09 percent to finish at 19794.00.

This suggests a cautious market sentiment, hinting at the need for a closer examination of the factors influencing this decline.

Market Breadth

Gains and Losses in Share Counts

A comprehensive market analysis includes an exploration of the market breadth, which measures the number of shares that experienced gains, losses, or remained unchanged during the trading session.

On October 12, 2023, approximately 2086 shares closed with gains, while 1459 shares experienced losses. In contrast, there was no change in 125 shares.

This data provides insights into the overall sentiment in the market on that particular day, with more shares closing with gains than losses.

Top Gainers and Losers

Key Performers on Nifty

A closer look at the top gainers and losers on the Nifty index provides a glimpse into which sectors and stocks were driving market movements.

Top Gainers:

- BPCL: Bharat Petroleum Corporation Limited

- Coal India

- Maruti Suzuki

- Grasim Industries

- Power Grid Corporation

These companies emerged as the top gainers on Nifty on October 12, 2023, indicating relative strength in their stocks and positive market sentiment.

Top Losers:

- Tech Mahindra

- Apollo Hospitals

- Tata Consultancy Services (TCS)

- HCL Technologies

- Infosys

Conversely, the stocks of these companies witnessed declines, reflecting potential challenges or adverse sentiment in their respective sectors.

Sectoral Performance

A Sector-Wise Breakdown

To gain a comprehensive understanding of the market, it’s essential to analyze sectoral performance. Each sector has its own dynamics, and on October 12, 2023, there were noticeable shifts within different sectors.

Information Technology (IT) Sector: Decline by 1.5 percent

The IT sector, a prominent component of the Indian stock market, experienced a decline of 1.5 percent.

This sector includes companies involved in software development, information technology services, and related activities. The decline in the IT sector likely had a substantial impact on the overall market performance for the day.

Auto Sector: Increase of 0.5-1 percent

In contrast to the IT sector, the auto sector witnessed a positive performance, with an increase of 0.5-1 percent.

This sector encompasses automobile manufacturers and related businesses, and the rise in this sector might be attributed to various factors, including increased consumer demand or positive industry developments.

Metal Sector: Increase of 0.5-1 percent

Similar to the auto sector, the metal sector also experienced gains in the range of 0.5-1 percent. The metal sector includes companies engaged in mining, refining, and manufacturing metal products.

These gains could be driven by factors such as global metal prices, supply and demand dynamics, or sector-specific news.

Power Sector: Increase of 0.5-1 percent

The power sector, an integral part of the Indian economy, saw gains in the range of 0.5-1 percent. This sector comprises companies involved in power generation, distribution, and related activities.

Positive developments, such as increased electricity consumption or favorable government policies, may have contributed to the sector’s performance.

Oil and Gas Sector: Increase of 0.5-1 percent

The oil and gas sector, which includes companies engaged in exploration, production, refining, and distribution of petroleum products, also witnessed gains in the 0.5-1 percent range.

Factors such as global oil prices, supply-demand dynamics, and geopolitical events can significantly impact this sector’s performance.

Small and Medium Stocks Shine

Subtitle: Outperformance of Small and Medium Stocks

One noteworthy trend on October 12, 2023, was the outperformance of small and medium-cap stocks.

This trend is significant because it suggests that investors were favoring stocks with smaller market capitalization over the larger, more established companies.

In this trading session, the BSE Midcap Index recorded a 0.3 percent rise, while the Smallcap Index saw a more substantial 0.6 percent increase. Small and medium-cap stocks can be more volatile but also offer the potential for higher returns, and this trend may reflect a shift in investor preferences.

Market Outlook for October 13, 2023

Expert Opinions on the Upcoming Market Movement

To navigate the complex world of stock markets, expert opinions provide valuable insights into potential future trends.

Here, we present the outlook for the market on October 13, 2023, from two market experts, Aditya Gaggar and Jatin Gedia.

Aditya Gaggar’s Perspective

Aditya Gaggar, the Director of Progressive Shares, pointed out that the market started the day with strength but lacked the necessary momentum, leading to trading within a small range.

Eventually, Nifty closed at 19794.00, recording a decline of 17.35 points. Gaggar noted that Nifty found some support from the auto and metal sectors, but the IT sector exerted pressure on the market.

In terms of sectoral performance on October 12, the Media Index showed the highest gain at 3.02 percent. Gaggar highlighted the outperformance of mid and small-cap stocks compared to the frontline indices, indicating a preference for smaller stocks among investors.

He emphasized that Nifty formed a small negative candle in the bearish gap zone, which is a technical indicator.

Gaggar’s outlook for October 13 included the possibility of a rally up to 20000 if Nifty closes strongly above 19880. On the downside, he identified strong support for Nifty in the 19720-19760 range.

Jatin Gedia’s Perspective

Jatin Gedia, a market expert from Sharekhan, observed that Nifty opened flat on October 12 and spent most of the day consolidating.

The consolidation was taking place after a sharp rally of 350 points in recent trading sessions, which Gedia considered a positive sign.

He noted that the Hourly Momentum indicator showed a negative crossover, which could lead to further consolidation.

In such a scenario, Gedia recommended viewing any decline in the zone of 19750-19730 as a buying opportunity. On the downside, he identified short-term support levels at 19718-19757. In the event of a rally, Gedia anticipated that Nifty could reach levels between 19884 and 20030 in the short term.

Turning his attention to Bank Nifty, Gedia highlighted that it appeared to be consolidating within a range on October 12, forming an inside bar pattern.

He also noted a contraction in the hourly Bollinger Band, suggesting reduced volatility. Additionally, the Hourly Momentum indicator had a negative crossover, indicating that consolidation was ongoing. Gedia emphasized that this consolidation phase might continue for the next few trading sessions.

Importantly, he recommended considering any decline in Bank Nifty towards the range of 44400-44300 as a buying opportunity.

Once the consolidation phase concludes, Gedia believed that the market might see a new bullish trend emerging. In this bullish scenario, Bank Nifty could potentially reach levels between 45050 and 45350.

Final Thoughts

The Indian stock market analysis for October 12, 2023, revealed a day of market decline marked by high volatility. Nifty closed below the significant 19800 level, reflecting the cautious sentiment in the market.

A breakdown of sectoral performance indicated a decline in the IT sector, contrasted by gains in the auto, metal, power, and oil and gas sectors.

Small and medium-cap stocks outperformed, and expert opinions provided differing yet valuable insights into the market outlook for October 13, 2023. While Aditya Gaggar anticipated the possibility of a rally if Nifty closed strongly above 19880, Jatin Gedia highlighted the consolidation phase and the potential for a new bullish trend.

Investors and market participants should closely monitor these developments, consider the expert opinions, and conduct thorough research before making investment decisions in the dynamic world of the Indian stock market.

Market conditions can change rapidly, and staying informed is essential for making well-informed choices.