Share Market Today: Nifty Surpasses 19,900, Unraveling Market Trends and Anticipating Movements for November 29th

Share Market Today

Market Overview: Resistance at 19,800 Amidst Stable Oil Prices and Sectoral Movements

In the current landscape of the Indian market, a notable resistance is being observed above the crucial level of 19,800.

This resistance coincides with a period of stability in oil prices, especially in anticipation of an OPEC meeting, where Oil Marketing Companies (OMCs) are expected to benefit from a potential softening in oil prices.

Recent Market Performance (November 28th): Nifty Surpasses 19,900 Amidst Sectoral Variations

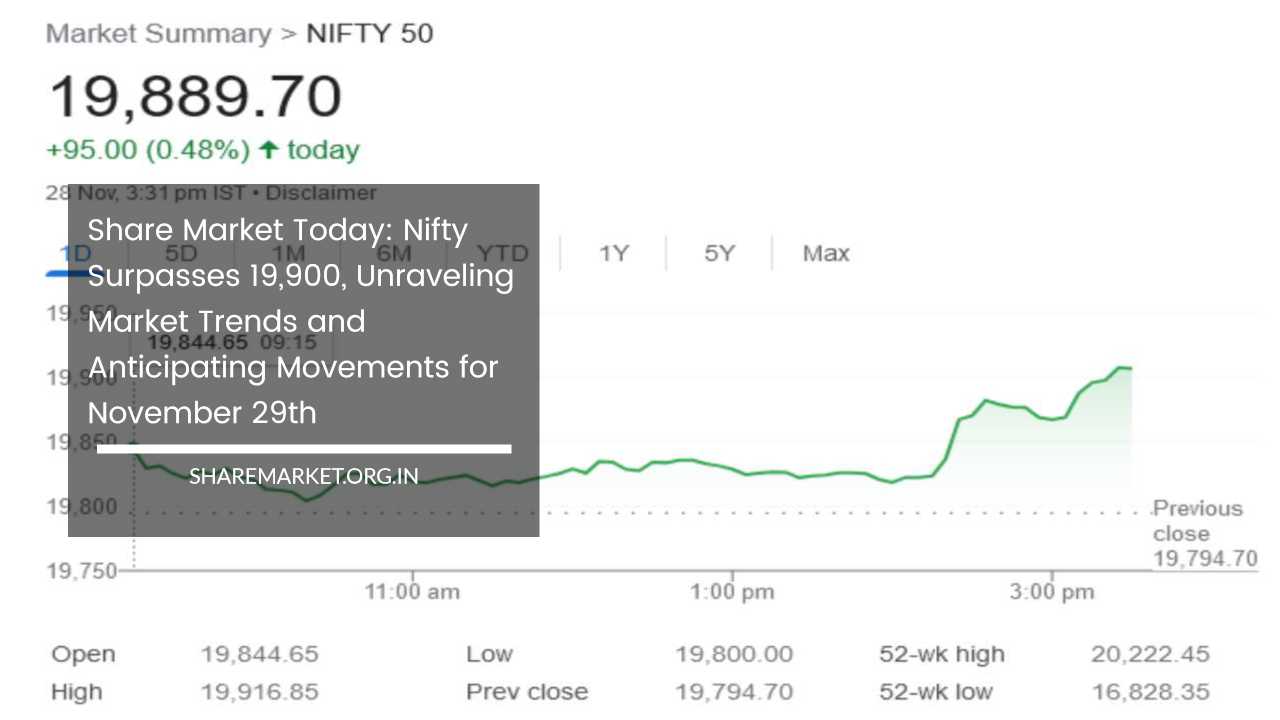

As of November 28th, the Nifty has shown positive momentum by closing beyond the 19,900 mark. The Sensex, at the conclusion of the trading session, stood at 66,174.20, securing a gain of 204.16 points or 0.31 percent.

Simultaneously, the Nifty witnessed an uptick of 95.00 points or 0.48 percent, closing at 19,889.70. These figures signify a market characterized by fluctuations, with 1872 shares experiencing an increase, 1750 shares facing a decline, and 159 shares maintaining their status quo.

The BSE Midcap Index managed to close 0.3 percent higher, while the Smallcap Index closed on a relatively flat note.

Stock Movements: Gainers and Losers

Analyzing the specific stocks contributing to these movements, noteworthy gainers on Nifty include Adani Enterprises, Adani Ports, Tata Motors, BPCL, and Coal India. On the flip side, notable losers comprised Eicher Motors, Apollo Hospitals, ICICI Bank, ITC, and Cipla.

Sectoral Analysis: Varied Movements Across Industries

Examining different sectors, there was a notable 3 percent increase in the Power and Oil and Gas indices. Additionally, the Metal, Auto, and PSU Bank indices recorded gains of 1 percent each.

On the other hand, some sectors, such as capital goods, FMCG, and pharma stocks, experienced selling pressure.

Foreign Institutional Investors (FIIs): Gradual Comeback Amidst Resistance

Vinod Nair of Geojit Financial Services sheds light on the behavior of Foreign Institutional Investors (FIIs). He notes a gradual comeback of FIIs in the month of November following a period of selling from August to October.

Despite this positive development, the Indian market is currently grappling with resistance above the 19,800 level.

Oil Price Stability and Sectoral Momentum: Key Drivers

A significant factor influencing market dynamics is the stability in oil prices leading up to the OPEC meeting. This stability is expected to be advantageous for Oil Marketing Companies (OMCs). Furthermore, the metal sector has gained momentum, driven by expectations of a relief package in China.

PSU banks are also exhibiting positive performance. Nair highlights that the market is closely monitoring the results of state elections, anticipating them to provide further signals in the short term.

Market Outlook for October 29th: Technical Analysis and Pattern Recognition

Looking ahead to October 29th, Aditya Gaggar, Director of Progressive Shares, offers a nuanced perspective on the market’s recent performance.

Despite a strong start to the week, the market witnessed constraints due to a lack of follow-through. However, a sudden surge in the final part of the trading session propelled the index to close at 19,889.70, registering a gain of 95 points.

In terms of sectoral participation, the Energy, Metal, and PSU Banking sectors were notable contributors to the rally, while the Pharma and FMCG sectors experienced corrective movements.

Analyzing the daily chart, Gaggar identifies the formation of a strong bullish candle and the much-anticipated range breakout in the form of an Ascending Triangle formation.

According to the pattern analysis, the target for Nifty appears to be 20,170, indicating potential upward movement. Immediate resistance is identified at 20,045, while on the downside, support is visible at 19,800.

This technical analysis provides traders and investors with valuable insights into potential price movements, helping them make informed decisions.

Final Thoughts: Navigating Market Complexities and Anticipating Future Trends

In summary, the Indian market is navigating a landscape of resistance, with various sectors and stocks exhibiting diverse movements.

The stability in oil prices, the resurgence of FIIs, and sector-specific dynamics contribute to the overall narrative. The upcoming OPEC meeting, expectations of a relief package in China, and state election results add layers of complexity to the market outlook.

As traders gear up for October 29th, the technical analysis points towards a potential target of 20,170 for Nifty, contingent on the observed patterns and levels of support and resistance.

Investors and market participants are advised to stay vigilant and responsive to evolving market conditions. The interplay of global economic factors, geopolitical events, and domestic developments underscores the importance of a comprehensive approach to market analysis and decision-making.

As the market continues to evolve, staying informed and adaptable will be key for those seeking to navigate and capitalize on emerging opportunities.