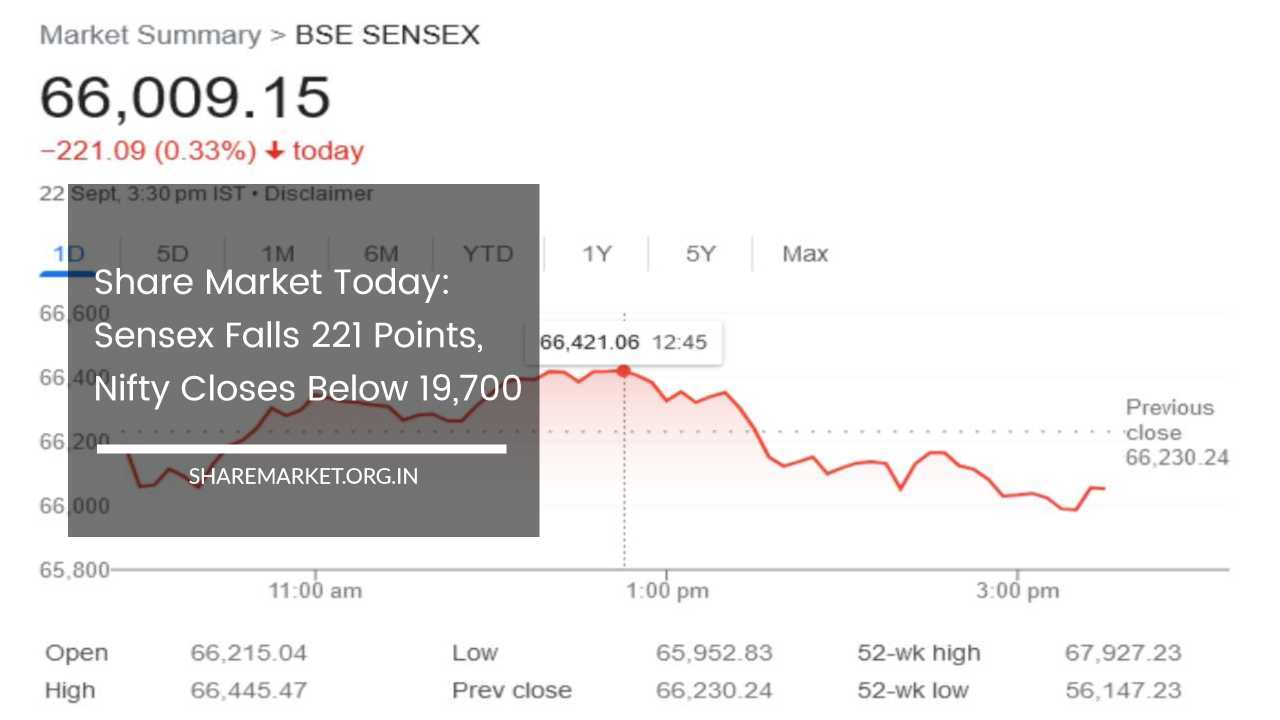

Share Market Today: Sensex Falls 221 Points, Nifty Closes Below 19,700

Share Market Today

Indian Stock Market Analysis and Economic Context

On the trading day in question, the Indian stock markets exhibited a mixed performance, with various indices and sectors experiencing both gains and losses.

Let’s delve deeper into the factors that might have influenced this fluctuation and provide a broader economic context for the day’s events.

1. Market Indices Performance:

- Sensex and Nifty: The Sensex, which is the 30-share flagship index of the Bombay Stock Exchange (BSE), closed at 66,009.15, down 221.09 points or 0.33 percent. Meanwhile, the Nifty, representing the National Stock Exchange (NSE), ended at 19,674.30, marking a decline of 68.00 points or 0.34 percent. Both indices displayed intraday rallies but failed to maintain their gains.

- Bank Nifty: The Bank Nifty, a key sectoral index, showed resilience by closing at 44,644.15 with a marginal gain of 0.05 percent. Banking stocks often have a significant impact on market movements, given their weight in the indices.

- Midcap and Smallcap Stocks: Midcap stocks faced weakness during the trading session, with BSE’s midcap index declining by 0.14 percent. Nifty’s midcap 100 index also registered a 0.15 percent decline. On the other hand, smallcap stocks managed to record marginal gains, as BSE’s smallcap index closed marginally higher by 0.04 percent. These trends suggest a diverse performance across different segments of the market.

2. Sectoral Performance:

- Selling Pressure: Several sectors experienced selling pressure during the trading session. This ranged from 0.01 percent to 1.47 percent and included sectors such as FMCG (Fast-Moving Consumer Goods), Financial Services, IT (Information Technology), Metal, Pharma, PSU Bank (Public Sector Undertaking Banks), Private Bank, Realty, Healthcare, Consumer Durables, and Oil & Gas. Selling pressure in these sectors can be indicative of profit-taking or concerns within specific industries.

- Strength in Banking and Auto Sectors: On a positive note, the banking and auto sectors showed some strength during the trading session. These sectors are vital components of the Indian economy, and their performance often reflects broader economic sentiment.

3. Individual Stock Movements:

- Declining Stocks: Notable stocks that saw declines included Wipro, Dr. Reddy’s, UPL, Cipla, Bajaj Auto, HDFC Bank, Ultratech Cement, and Power Grid. These companies represent diverse industries, and their declines may have been influenced by a variety of factors, such as quarterly earnings reports, market sentiment, or global economic conditions.

- Rising Stocks: Conversely, there were stocks that posted gains on the trading day. These included IndusInd Bank, Maruti Suzuki, SBI (State Bank of India), M&M (Mahindra & Mahindra), Asian Paints, Tech Mahindra, and Bajaj Finserv. The positive performance of these stocks might have been driven by factors like strong financial results, positive news, or sector-specific developments.

4. Factors Influencing Market Movements:

- Global Economic Conditions: Indian stock markets are often influenced by global economic conditions, including factors like international trade tensions, geopolitical events, and changes in global commodity prices.

- Domestic Economic Indicators: Domestic economic data, such as GDP growth, inflation, and industrial production, can have a significant impact on market sentiment. Positive economic indicators can boost investor confidence, while negative data can lead to caution.

- Corporate Earnings: The quarterly earnings reports of listed companies are closely watched by investors. Companies exceeding or missing earnings expectations can drive stock price movements.

- Government Policies: Government policies related to taxation, regulation, and economic stimulus packages can also impact market sentiment. Investors often monitor government actions for potential market implications.

5. Broader Economic Context:

- Economic Growth: The performance of the stock market is closely tied to the overall economic growth of the country. India’s economic growth has been a topic of interest for investors, policymakers, and analysts. Positive economic growth can boost investor confidence and attract foreign investments.

- Inflation and Monetary Policy: Inflation levels and the actions of the Reserve Bank of India (RBI) to control inflation through monetary policy can influence interest rates and, consequently, investment decisions.

- Global Trade: India’s position in global trade and its trade relationships with other countries play a significant role in its economic performance. Trade agreements and trade tensions can affect various industries and, in turn, stock market sectors.

Final Thoughts:

In conclusion, the mixed performance of the Indian stock markets on the day in question reflects the complex interplay of various factors, both domestic and global.

Investors and analysts closely monitor these factors to make informed investment decisions.

The stock market’s daily fluctuations are a dynamic reflection of the ever-changing economic landscape, making it essential for participants to stay informed and adaptable in response to market developments.