SRM Contractors IPO Listing: Stock lists at 7% premium over IPO price

SRM Contractors IPO Listing

SRM Contractors IPO Makes a Grand Entry on Dalal Street

Jammu-based engineering and construction firm SRM Contractors, specializing in building roads, bridges, and tunnels, marked a successful debut on the Indian stock market today.

Founded in 2008, the company witnessed a phenomenal response from investors, with its Initial Public Offering (IPO) being subscribed a staggering 86 times.

This strong investor confidence translated into a robust listing day performance, with the stock surging significantly above its issue price.

A Stellar Debut with Impressive Gains

The IPO, priced at Rs 210 per share, saw a strong opening on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

On BSE, shares debuted at Rs 225.00, translating to a healthy 7% premium for IPO investors. On NSE, the listing price was Rs 215.25, offering a decent 2.50% premium.

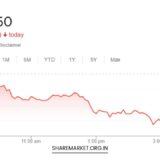

The positive momentum continued after the opening bell. SRM Contractors’ stock witnessed strong buying pressure, propelling it to hit the upper circuit limit on BSE.

The stock closed the day at Rs 236.20, a significant 12.47% gain from the issue price. This translates to a substantial profit for investors who participated in the IPO.

Exceptional Investor Response Across Categories

The SRM Contractors IPO, open for subscription from March 26th to 28th, garnered overwhelming interest from all investor segments. The total issue size of Rs 130.20 crore was subscribed a remarkable 86.57 times, highlighting the strong demand for the company’s shares. This enthusiastic response was witnessed across all investor categories:

- Qualified Institutional Buyers (QIBs): The portion reserved for QIBs, typically consisting of large institutions like mutual funds and insurance companies, saw robust participation, with a subscription of 59.59 times. This signifies institutional confidence in SRM Contractors’ long-term growth prospects.

- Non-Institutional Investors (NIIs): This category, comprising high net-worth individuals and corporate entities, displayed exceptional enthusiasm, with a subscription of a staggering 214.94 times. This strong demand from NIIs reflects their belief in the company’s potential for value creation.

- Retail Investors: Retail investors, the backbone of the Indian stock market, actively participated in the IPO, subscribing to their allotted portion 46.97 times. This broad-based investor interest underscores the appeal of SRM Contractors’ IPO story.

Fueling Growth: Strategic Use of IPO Proceeds

The funds raised through the IPO (Rs 130.20 crore) will be strategically deployed by SRM Contractors to fuel its growth ambitions. The company has outlined a clear roadmap for utilizing the proceeds:

- Enhancing Operational Efficiency: A significant portion of the funds will be directed towards acquiring new and modern equipment and machinery. This investment will enhance the company’s operational efficiency and enable it to undertake larger and more complex infrastructure projects.

- Strengthening Financial Health: The company plans to utilize a portion of the proceeds to repay existing loans. This will improve its financial health by reducing debt burden and freeing up resources for future investments.

- Ensuring Smooth Operations: The IPO proceeds will also be used to meet the company’s working capital requirements. This ensures the smooth day-to-day operations of the company and facilitates uninterrupted project execution.

- Expanding Project Portfolio: SRM Contractors intends to strategically invest in project-specific joint ventures. This approach allows them to expand their project portfolio and potentially gain access to expertise or resources not readily available in-house.

- Investing for the Future: Funds will also be allocated for general corporate purposes, which could include strategic investments or business expansion initiatives. This flexibility allows the company to capitalize on potential growth opportunities that may arise in the future.

A Legacy of Excellence in Infrastructure Development

Established in 2008, SRM Contractors has built a solid reputation for excellence in the infrastructure construction sector.

As of March 2024, the company boasts a successful track record of completing 37 infrastructure projects with a total value of Rs 770.88 crore. This impressive portfolio showcases their diverse expertise and experience in:

- Road Construction: Road projects form the core of SRM Contractors’ business, with a successful completion of 31 projects. This experience positions them well to capitalize on the government’s focus on infrastructure development, particularly in rural and remote areas.

- Tunnel Projects: Their ability to handle complex engineering challenges is evident in their successful execution of 3 tunnel projects. This expertise allows them to participate in tenders for prestigious infrastructure projects involving tunnels.

- Slope Stabilization Works: Completing 1 slope stabilization project demonstrates their commitment to providing comprehensive infrastructure solutions. This capability allows them to offer clients a wider range of services and potentially win larger contracts encompassing various aspects of infrastructure development.

Financial Strength and Growth Trajectory

SRM Contractors has exhibited a healthy financial performance with a clear growth trajectory:

- Profitability on the Rise: Net profit has shown a steady upward trend, rising from Rs 8.27 crore in FY2021 to Rs 17.57 crore in FY2022 and further to Rs 18.75 crore in FY2023. This consistent profitability demonstrates the company’s operational efficiency and ability to generate healthy returns.

- Impressive Revenue Growth: The company’s revenue has witnessed impressive growth, compounding annually at a rate exceeding 36% to reach Rs 300.65 crore in FY2023. This significant revenue growth indicates increasing demand for SRM Contractors’ services and their successful execution of projects.

- Strong Start to FY2024: For the period April-December 2023, the company has already achieved a net profit of Rs 21.07 crore and revenue of Rs 242.28 crore. This indicates continued momentum in their financial performance, suggesting a promising outlook for the current fiscal year.

Capitalizing on India’s Infrastructure Boom

The Indian government’s continued focus on infrastructure development presents significant growth opportunities for companies like SRM Contractors.

The company’s experience in road construction, tunnels, and slope stabilization positions them well to participate in various government projects aimed at improving national infrastructure.

Additionally, their proven track record and strong financial performance make them an attractive partner for private sector entities involved in infrastructure development.

A Well-Positioned Company for the Future

The strong investor response, robust listing day performance, and impressive track record solidify SRM Contractors’ position as a promising player in the Indian infrastructure construction sector.

With a focus on growth, strategic utilization of IPO proceeds, and a commitment to excellence, SRM Contractors appears well-equipped to capitalize on the burgeoning infrastructure development opportunities in India.

Their ability to adapt to evolving market dynamics and expand their service offerings will be crucial for their long-term success.

Investors who participated in the IPO can be cautiously optimistic about the company’s future prospects, considering the positive initial performance and the company’s strong fundamentals.

However, close monitoring of the company’s financial performance, project execution capabilities, and overall industry trends will be essential for making informed investment decisions in the long run.