Why Market Fall Today: Discover the Five Key Factors Behind Today’s Pressure

Why Market Fall Today

Navigating the Market Downturn: A Comprehensive Analysis

In recent days, the stock market has experienced a significant and persistent decline for the fifth consecutive day.

This extended period of decline has raised concerns among investors and market participants. Over this five-day span, investors have incurred losses totaling more than Rs 14 lakh crore.

The market’s decline is not solely attributed to one factor but is a complex interplay of various elements.

Among these, political tensions in the Middle East, a surge in US bond yields, and underwhelming performance by major companies during the September quarter have emerged as key catalysts for the market’s downward trajectory.

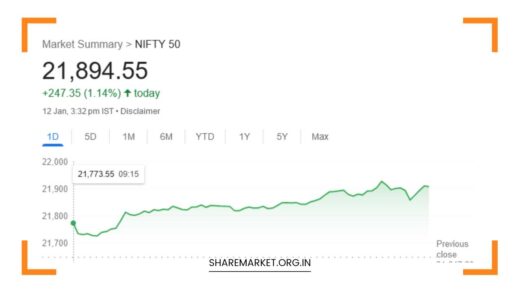

As of the most recent trading session, the domestic equity benchmark indices, including the BSE Sensex and Nifty 50, have painted a grim picture.

The BSE Sensex fell by a significant 64,000 points, and the Nifty 50 index slipped below the 19,100 mark, further exacerbating the concerns of market participants. In this in-depth analysis, we delve into the multifaceted reasons that have contributed to substantial selling pressure in the market, seeking to shed light on the intricacies of the current market dynamics.

Israel-Hamas Conflict: Geopolitical Turbulence

One of the most pressing concerns that have loomed large in the minds of investors is the ongoing conflict in the Middle East between Israel and Hamas.

Geopolitical risks in this volatile region have deepened due to the persistent hostilities. The Middle East is a critical player in the global oil supply chain, with most countries in the region heavily reliant on oil production. Therefore, the ongoing Israel-Hamas war has raised significant concerns about the stability of the global oil supply.

In the event of an escalation of this conflict, it is highly likely that crude oil prices will surge, causing a ripple effect in the form of increased raw material costs.

Such a scenario could potentially trigger a broader inflationary shock, further heightening concerns among investors.

The ongoing selloff in the market can be seen as a direct reflection of investor apprehension and their desire to distance themselves from this escalating geopolitical tension.

Rising US Bond Yields: A Safe Haven Shift

The realm of US bonds, traditionally viewed as one of the safest investment options worldwide, has undergone a transformation. The yield on 10-year US bonds has been steadily increasing, and it has even crossed the 5 percent threshold.

This development has sparked a series of speculations among market analysts. There is growing concern that investors may start to divert their capital from emerging markets and riskier investments.

The reason behind this shift is quite evident – investors are increasingly attracted to the prospect of investing in American bonds.

This is because they offer attractive returns in dollars while minimizing the associated risks. In stark contrast, Indian stocks face the dual challenges of geopolitical risks and currency fluctuations.

These factors have led to foreign investors divesting Indian shares amounting to Rs 10,345 crore during the current month.

Q2 Earnings: Corporate Performance Evaluation

A pivotal element influencing market dynamics has been the performance of Indian companies during the September quarter.

Unfortunately, the results were far from what market participants had anticipated. The performance of major companies, which usually serve as bellwethers for the broader market, has been lackluster, adding significant pressure on the overall market sentiment.

The information technology (IT) sector, which has been a cornerstone of India’s economic growth, is currently grappling with a slowdown, while banks are dealing with the challenges of shrinking profit margins. These negative earnings surprises have weighed heavily on market confidence.

Global Market Interplay: A Worldwide Impact

The influence of the global market on India’s domestic stock market cannot be understated. The correlation between these markets has been prominent in recent times.

On a day when the Indian stock market experienced a significant decline, European markets followed suit, opening with declines across the board.

The Asian markets presented a mixed picture, with the markets in Singapore and South Korea closing in the red while some others exhibited signs of recovery. The interconnectedness of global markets magnifies the impact of international events on domestic stock performance.

Equity Valuations: Elevated Levels in India and the United States

India and the United States share a common issue – elevated stock valuations. Both countries are currently in the midst of an environment where stock prices are relatively high, thus raising concerns about a potential abrupt correction.

This phenomenon is particularly pronounced in the small and mid-cap segments. As VK Vijayakumar, the chief investment strategist at Geojit Financial Services, pointed out, valuations in the mid-cap and small-cap sectors have significantly outpaced those in the large-cap segment.

This implies that the potential for a market downturn was already on the horizon. During these uncertain times, it would be prudent for investors to consider placing their bets on large-cap stocks, particularly within the banking sector, where valuations appear to be more rational.

In summary, the recent downturn in the stock market is a multifaceted challenge, shaped by a combination of factors.

These factors encompass political tensions in the Middle East, rising US bond yields, disappointing Q2 earnings from major corporations, global market pressures, and elevated equity valuations in India and the United States.

While the fall in US bond yields and softer crude oil prices may offer a glimmer of hope for market recovery, a long-lasting rebound depends heavily on the resolution of issues in the Middle East. Investors are staying vigilant, closely monitoring these factors as market conditions remain uncertain in the short term.

The Role of Investor Sentiment

In addition to these fundamental factors, it’s crucial to consider the role of investor sentiment in market dynamics. The emotional aspect of investing often plays a significant role in driving short-term market fluctuations.

Fear and greed can lead to impulsive decision-making, causing sharp market movements that may not necessarily be rational.

During times of market turmoil, it’s common for fear to take hold. When investors see the market consistently trending downward, it can trigger a sense of panic and prompt them to sell their holdings to minimize losses. This herd mentality can exacerbate market declines, creating a self-fulfilling prophecy.

On the other hand, periods of market optimism, often driven by positive news or economic indicators, can lead to a buying frenzy. Investors become more willing to take risks and jump into the market, driving prices upward. This, too, can create irrational market conditions, as assets become overvalued.

Investor sentiment can be influenced by various factors, including news headlines, economic data, geopolitical events, and even social media.

It’s essential for investors to maintain a level head, conduct thorough research, and have a well-defined investment strategy to navigate both bullish and bearish markets successfully.

Market Volatility and Risk Management

Market volatility is an inherent aspect of investing, and it’s crucial for investors to understand how to manage and mitigate risks effectively.

Volatility refers to the degree of variation in the price of an asset over time. While it can present opportunities for profit, it also carries the risk of significant losses.

One essential aspect of risk management is diversification. Diversifying a portfolio by investing in different asset classes, industries, and regions can help spread risk and reduce the impact of a market downturn in one area. A well-diversified portfolio is often less vulnerable to severe losses.

Additionally, setting stop-loss orders can be a valuable risk management tool. These orders automatically sell an asset when it reaches a specified price, helping investors limit potential losses.

While stop-loss orders can protect against downside risk, they also need to be set thoughtfully, as they can lead to selling assets prematurely if not carefully considered.

Another key component of risk management is having a clear investment plan and adhering to it. Emotional decisions often lead to poor investment outcomes. A well-defined plan should include investment goals, risk tolerance, and a strategy for both bull and bear markets.

The Role of Long-Term Investing

For many investors, the key to navigating market volatility and downturns is adopting a long-term investment perspective. While short-term market movements can be unpredictable and anxiety-inducing, a long-term view allows investors to ride out market fluctuations and benefit from the power of compounding.

Long-term investors are less concerned with day-to-day price fluctuations and are more focused on the overall growth of their investments over several years or decades.

They understand that markets will have their ups and downs, but historical data shows that, over time, markets tend to trend upward.

A long-term perspective can also help investors avoid the pitfalls of market timing. Trying to predict when the market will peak or trough is notoriously difficult, and even seasoned professionals often get it wrong.

Long-term investors stay the course regardless of short-term fluctuations, benefiting from the upward trajectory of markets over time.

Market Recovery and Future Prospects

While the recent market downturn has presented challenges, it’s important to recognize that financial markets are inherently cyclical.

Periods of decline are often followed by periods of recovery and growth. Historically, markets have rebounded from downturns, and it’s reasonable to expect a similar trend in the future.

The prospects for market recovery and future growth are closely tied to the resolution of the factors that have contributed to the recent downturn.

If political tensions in the Middle East ease, US bond yields stabilize, and corporate earnings show signs of improvement, these could act as catalysts for market recovery.

Additionally, the proactive measures taken by investors to manage risk and maintain a long-term perspective can contribute to their success in navigating market challenges.

In conclusion, the recent market downturn has been a complex interplay of factors, and understanding the market dynamics involves a mix of fundamental analysis and an awareness of investor sentiment and risk management.

While markets remain uncertain in the short term, a long-term investment perspective, combined with a well-defined investment plan and prudent risk management, can help investors navigate these challenging times and position themselves for potential future growth.

The Role of Government and Economic Policies

The role of government and economic policies cannot be overlooked when analyzing the state of the stock market. Government decisions and policies can have a significant impact on market dynamics, both in the short and long term. Let’s explore some of the ways in which government actions can influence the market.

Monetary Policy

Central banks play a crucial role in influencing the stock market through their monetary policy decisions. Central banks, such as the Federal Reserve in the United States or the Reserve Bank of India, can impact interest rates and the money supply.

For instance, when central banks raise interest rates, borrowing becomes more expensive, which can lead to reduced consumer spending and business investment. This, in turn, can affect corporate earnings and stock prices.

Conversely, when central banks lower interest rates, borrowing becomes cheaper, stimulating economic activity. Lower interest rates can make stocks more attractive relative to fixed-income investments, potentially driving stock prices higher.

Quantitative easing (QE) is another tool central banks use. QE involves the purchase of government securities and other financial assets to inject liquidity into the financial system. This can help lower long-term interest rates, further influencing stock market behavior.

Fiscal Policy

Government fiscal policies, including taxation, public spending, and budget deficits, can also shape market conditions.

Changes in tax policies, such as reductions in corporate tax rates, can impact corporate profits and, consequently, stock prices.

Government spending on infrastructure projects or stimulus programs can stimulate economic growth, benefiting various industries and potentially leading to stock market gains.

Conversely, concerns about high budget deficits or tax increases can introduce uncertainty into the market and may lead to a more cautious investment environment.

Regulatory Policies

Government regulations and policies can have a direct impact on specific industries and companies, thus influencing stock prices.

For example, environmental regulations may affect energy companies, while healthcare policies can impact pharmaceutical and healthcare-related stocks.

Regulatory changes can create both opportunities and challenges for investors, depending on how industries and companies adapt to new rules.

Trade Policies

Trade policies, particularly in an era of globalization, can significantly influence the stock market. Trade tensions, tariffs, and trade agreements can affect international trade and global supply chains.

Companies with substantial international exposure can be particularly sensitive to trade policy changes. Positive developments, such as trade agreements, can boost investor confidence, while trade disputes can lead to uncertainty and market volatility.

Geopolitical Events

Geopolitical events, such as conflicts and diplomatic relations between nations, can also impact the stock market.

Tensions in regions that are vital for energy production or global trade can lead to fluctuations in oil prices and disruptions in supply chains, affecting various sectors and stock prices.

Geopolitical events can create a risk premium that investors must consider when making investment decisions.

Economic Data and Reporting

Government agencies release economic data and reports that provide insights into the health of the economy. Key indicators include gross domestic product (GDP) growth, employment figures, inflation rates, and consumer confidence.

Government data can influence investor sentiment and expectations for economic performance. Positive economic data can boost confidence in the market, while negative data can lead to concerns about economic health and future corporate earnings.

Market Regulation and Investor Protection

Government agencies also play a vital role in market regulation and investor protection. Stock exchanges are regulated entities, and the government often sets rules and regulations for fair and transparent trading.

Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, oversee financial markets and implement measures to protect investors from fraud and market manipulation.

The Role of Economic Indicators

Economic indicators are critical tools for analyzing the state of the stock market. These indicators provide valuable insights into the overall health of the economy and can help investors make informed decisions. Let’s explore some of the key economic indicators that investors should monitor:

Gross Domestic Product (GDP)

Gross Domestic Product is one of the most crucial economic indicators. It represents the total value of all goods and services produced within a country’s borders during a specific period. GDP growth is often used as a barometer of economic health.

When GDP is growing, it indicates a healthy and expanding economy, which can be positive for the stock market. However, if GDP growth slows or turns negative, it may signal an economic downturn, which can lead to market declines.

Unemployment Rate

The unemployment rate provides insight into the labor market’s health. A lower unemployment rate suggests that more people are employed, which can be a positive sign for the economy and the stock market. On the other hand, rising unemployment can indicate economic challenges and may weigh on investor sentiment.

Inflation Rate

The inflation rate measures the increase in the prices of goods and services over time. Moderate inflation is generally considered healthy for the economy.

However, high and rapidly rising inflation can erode purchasing power and lead to uncertainty in the stock market. Central banks often aim to maintain a target inflation rate to ensure price stability.

Consumer Confidence

Consumer confidence measures the optimism or pessimism of consumers about the state of the economy. High consumer confidence can lead to increased consumer spending, which benefits many industries and can have a positive impact on stock prices.

Conversely, declining consumer confidence may lead to reduced consumer spending and, consequently, market concerns.

Business Confidence

Similar to consumer confidence, business confidence gauges the sentiment of businesses regarding economic conditions.

High business confidence can lead to increased investment and hiring, contributing to economic growth and stock market strength. Lower business confidence may result in reduced investment and hiring, potentially impacting the stock market negatively.

Interest Rates

Interest rates set by central banks can significantly influence the stock market. Lower interest rates can stimulate economic activity, making stocks more attractive investments.

On the other hand, higher interest rates can lead to higher borrowing costs, potentially affecting corporate profits and stock prices. Investors often closely watch central bank decisions on interest rates.

Trade Balance

The trade balance measures the difference between a country’s exports and imports. A trade surplus (more exports than imports) can have a positive impact on the economy and the stock market, as it signifies global competitiveness.

However, a trade deficit (more imports than exports) may raise concerns about economic imbalances and negatively affect investor sentiment.

Earnings Reports

While not a traditional economic indicator, earnings reports from publicly traded companies are critical for stock market analysis.

Earnings reports reveal a company’s financial health and performance. Positive earnings reports can lead to stock price appreciation, while disappointing reports may result in stock declines. Earnings reports can provide insights into the overall state of specific industries and the broader market.

Housing Market Indicators

Indicators related to the housing market, such as housing starts, home prices, and mortgage rates, can offer insights into consumer sentiment and the health of the real estate sector.

A strong housing market can have positive spillover effects on the broader economy and the stock market. Conversely, a weak housing market can be a red flag for the economy.

Global Economic Conditions

Global economic conditions also play a crucial role in stock market dynamics. Many businesses have international operations and are influenced by global economic trends.

International economic indicators, such as the Purchasing Managers’ Index (PMI) or the World Economic Outlook, can provide insights into global economic health, which can have implications for the stock market.

The Interplay of Economic Indicators and Market Sentiment

Economic indicators do not operate in isolation; they interact with investor sentiment and market psychology. How investors interpret economic data can impact market movements.

For example, if unemployment figures come in lower than expected, it may boost investor confidence and drive stock prices higher. Conversely, if GDP growth falls short of expectations, it may lead to concerns about the economy and prompt market declines.

Market sentiment can also be influenced by the forward-looking nature of economic indicators. Investors often use economic data to make predictions about future corporate earnings and overall economic health.

Positive economic data can lead to optimism about future profit growth, while negative data can raise concerns about future economic challenges.

It’s essential to note that market sentiment can sometimes lead to short-term market overreactions. For example, investors may respond strongly to a single economic indicator release, causing significant market volatility. Over time, however, markets tend to digest economic data more rationally, with a focus on long-term trends rather than short-term fluctuations.

The Timing and Release of Economic Indicators

Economic indicators are released on a set schedule, typically by government agencies and institutions. The timing of these releases can have a significant impact on the stock market.

The most closely watched economic indicators, such as the monthly jobs report or GDP figures, are released on specific dates and times, known as “economic calendars.” Investors and traders often prepare for these releases and may adjust their positions based on the data.

The reaction to economic data can be swift, particularly when the data significantly deviates from expectations. In such cases, markets can experience rapid price movements, with stock prices and other asset classes responding immediately.

However, it’s important to understand that economic indicators are just one piece of the puzzle. Other factors, such as corporate earnings, geopolitical events, and global market trends, also influence stock market movements. As a result, investors and analysts use a comprehensive approach that considers a range of factors when making investment decisions.

Analyzing the Economic Indicators in Practice

Let’s consider a practical example of how economic indicators can impact the stock market and how investors might respond:

Scenario: The Monthly Jobs Report

One of the most closely watched economic indicators is the monthly jobs report, which provides data on employment figures, including the unemployment rate and the number of new jobs created. Let’s assume the following scenario:

Expectation: Economists and market analysts have predicted that the jobs report will show a significant increase in new jobs created, with the unemployment rate expected to remain low.

Actual Data: When the jobs report is released, it reveals that the number of new jobs created is well below expectations, and the unemployment rate has increased slightly.

Market Reaction: In response to the disappointing jobs report, the stock market experiences a sharp decline in the immediate aftermath of the release. Investors are concerned about the implications of slower job growth for consumer spending, corporate earnings, and overall economic health.

Investor Sentiment: Investor sentiment becomes more cautious as concerns about the economic outlook intensify. Many investors shift their focus to safer assets, such as government bonds or defensive stocks. Some may even decide to reduce their exposure to equities until more positive economic data emerges.

Long-Term Perspective: Over time, as more economic data becomes available, investors gain a broader perspective on the labor market and the overall economy. While the disappointing jobs report initially led to market declines, subsequent data releases reveal a more nuanced picture. Economic conditions may improve in the following months, mitigating the initial concerns.

Investment Strategy: Investors who maintain a long-term perspective recognize that economic indicators are just one piece of the puzzle. They continue to diversify their portfolios and stick to their investment plans. Over the long term, market sentiment stabilizes, and stocks may recover.

Interplay with Other Factors: Economic indicators do not act in isolation. Their impact on the stock market is influenced by other factors, such as corporate earnings, monetary policy decisions, and geopolitical events. Investors must consider the broader context when interpreting the significance of economic data.

Final Remarks

Economic indicators are vital tools for investors and analysts, offering valuable insights into the state of the economy and potential market movements.

These indicators provide a foundation for making informed investment decisions. However, it’s important to recognize that economic data should be viewed in conjunction with other factors that influence the stock market.

Investor sentiment, monetary policy decisions, corporate earnings, and global events all play a role in shaping market dynamics.

Successful investors take a comprehensive approach, considering a range of factors and maintaining a long-term perspective.

Economic indicators provide valuable data points, but their interpretation and impact on the stock market can be influenced by market sentiment, timing, and the broader context in which they are released.

By analyzing economic indicators alongside these other factors, investors can make well-informed decisions in a dynamic and ever-changing financial landscape.