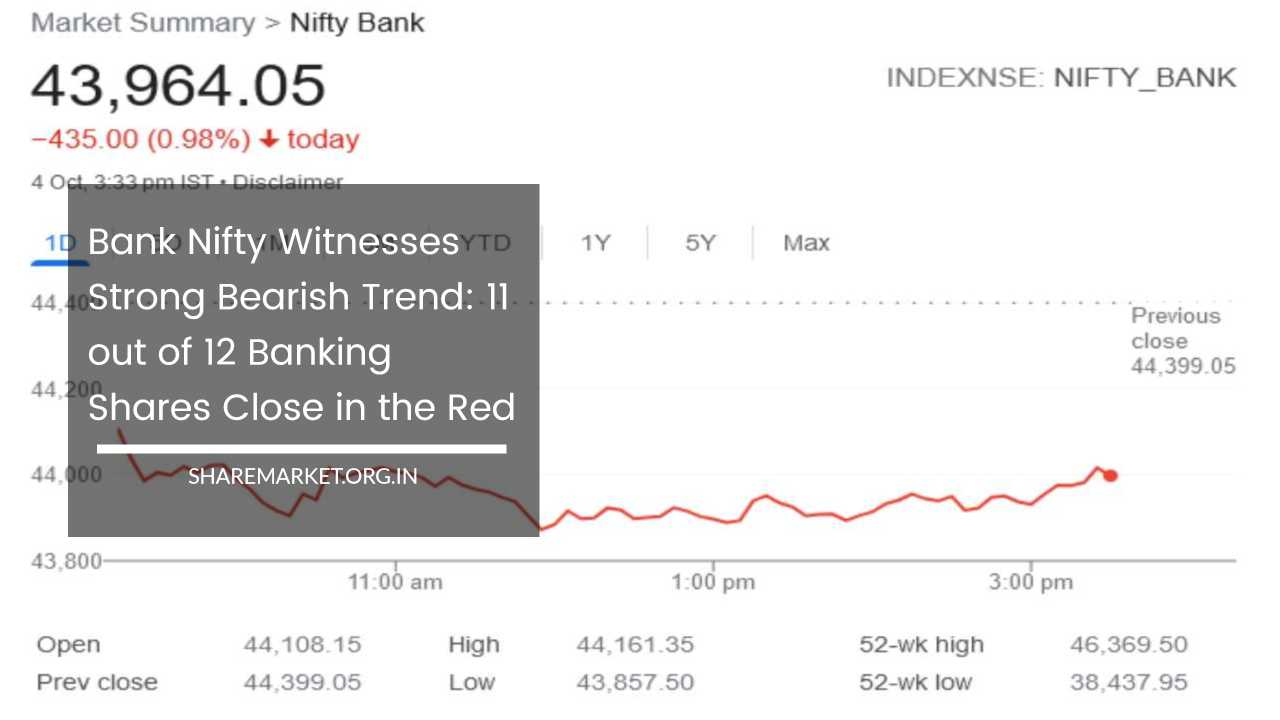

Bank Nifty Witnesses Strong Bearish Trend: 11 out of 12 Banking Shares Close in the Red

Bank Nifty

Market Turbulence and Banking Sector Woes: A Deep Dive into Wednesday’s Events

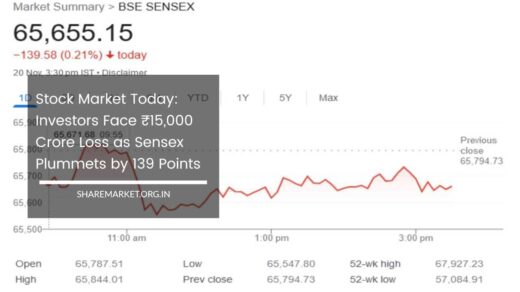

On Wednesday, the Indian stock market experienced a notable decline, with the Nifty-50 index slipping below the crucial 19,400 mark during trading hours.

While several factors contributed to this downward trend, one of the most significant influences was the performance of banking shares. Heavyweight banking stocks such as Axis Bank, ICICI Bank, and the State Bank of India (SBI) played a pivotal role in driving down the indices.

In particular, the Bank Nifty index bore the brunt of the bearish sentiment, with an alarming 11 out of its 12 constituent stocks trading in the red around noon.

Banking Giants in the Red: Axis Bank, ICICI Bank, and SBI Take a Hit

Around 2 pm on the National Stock Exchange (NSE), Axis Bank shares were trading at Rs 1,002.2, representing a sharp decline of 3.73 percent.

Similarly, SBI shares witnessed a substantial drop of 2.57 percent, settling at Rs 587.45. ICICI Bank’s shares were not immune to the downward trend, experiencing a decline of 0.96 percent with a trading value of Rs 931.3.

IndusInd Bank also faced a downturn, with its shares plummeting by 2.59 percent to Rs 1,398.20.

Bajaj Finance’s Paradox: Strong Business Results Amidst Market Volatility

Among the notable losers in the index on that fateful Wednesday were Axis Bank and ICICI Bank. Interestingly, even though Bajaj Finance had recently reported robust business results for the September quarter, its stock suffered a decline of 1.4 percent.

This divergence between performance and market sentiment highlighted the uncertainty that investors were grappling with during this period.

Analyst Projections and the Banking Sector’s Resilience

Leading up to the release of the September quarter results, analysts had anticipated that banks would post a relatively modest earnings per share (EPS) growth of approximately 12-13 percent.

This level of growth was considered achievable without exposing the sector to any major risks. However, despite this moderate outlook, the banking sector continued to be a favored area for analysts and investors alike.

Bullish Sentiments: Buy Ratings for HDFC Bank, SBI, and ICICI Bank

Notably, HDFC Bank, one of the banking giants in India, received an impressive 44 buy ratings from analysts in September.

Similarly, the State Bank of India (SBI) garnered 47 buy ratings, and ICICI Bank secured 46 buy ratings during the same period.

These buy ratings reflected the continued optimism and confidence in the long-term potential of these banking institutions, even in the face of short-term market fluctuations.

SBI’s Strength Among Government Banks: A Closer Look

A report by ICICI Securities shed light on the strong position of SBI among government-owned banks.

Several factors contributed to SBI’s favorable standing, including its ability to maintain a stable market share, its robust digital capabilities, a strong liability base, a solid retail franchise, and effective management practices.

As a result of these factors, ICICI Securities recommended buying SBI stock with a target price of Rs 730, underscoring the bank’s resilience in challenging market conditions.

Technical Analysis: Insights from Deven Mehta, Equity Research Analyst

Deven Mehta, an Equity Research Analyst at Choice Broking, provided valuable insights into the technical aspects of the market.

Mehta observed that Bank Nifty had managed to rebound from the support level of 44,200 and closed near 44,400.

According to his analysis, the index had key support levels at 44,000-44,200, while resistance levels were anticipated at 44,750-44,900.

This technical perspective offered traders and investors a roadmap for navigating the volatile market environment.

The Broader Economic Context: Banking Shares as Economic Indicators

While the short-term market movements can be influenced by various factors, it’s essential to keep in mind the broader economic context.

The banking sector’s performance is often seen as a barometer of the overall health of the economy. When banking shares experience a downturn, it can raise concerns about credit quality, liquidity, and economic stability.

Therefore, market participants closely monitor banking stocks as indicators of broader economic trends.

Navigating Market Volatility

In conclusion, the events of that Wednesday highlighted the dynamic nature of financial markets and the impact of various factors on stock indices.

The decline in banking shares, led by prominent institutions like Axis Bank, ICICI Bank, and SBI, played a pivotal role in driving down the Nifty-50 and Bank Nifty indices.

Despite the short-term fluctuations, analysts remained optimistic about the banking sector’s long-term prospects, underscoring the resilience and strength of key players like SBI.

As investors and traders navigate the markets, they rely on both technical analysis and broader economic indicators to make informed decisions in an ever-changing financial landscape.