Birdy’s IPO Listing: Stock lists at 1% premium on NSE SME

Birdy’s IPO Listing

Birdy’s Takes Flight: A Deep Dive into the Bakery Chain’s IPO Journey

Grill Splendor Services, the parent company behind the popular Birdy’s bakery and pastry chain, recently concluded its IPO on the NSE SME platform.

This report delves deeper into the details surrounding the offering, analyzing its performance, the company’s financial health, future prospects, and potential challenges.

A Well-Received Offering, Despite a Subdued Listing Day

Birdy’s ₹16.47 crore IPO garnered significant interest, with overall subscriptions exceeding 8 times. This robust response can be attributed primarily to the strong participation of retail investors, whose reserved portion witnessed an impressive oversubscription of 12.78 times. This enthusiasm highlights the brand’s recognition and potential for growth.

However, the listing day itself presented a mixed picture. Shares opened at ₹121.30, translating to a mere 1% gain for IPO investors. This initial subdued performance could be due to various factors, such as:

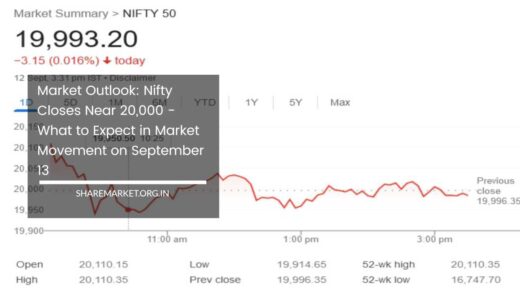

- Market Conditions: The broader market sentiment can significantly impact stock prices. If the overall market was experiencing a downturn, it could have influenced Birdy’s listing price.

- Investor Risk Aversion: New listings on the SME platform can be perceived as riskier by some investors. This cautiousness might have led to a wait-and-see approach, influencing the opening price.

- Pricing Strategy: The company’s IPO pricing strategy could have also played a role. If the offering was priced aggressively, it might have deterred some investors initially.

A Dramatic Reversal: Soaring to the Upper Circuit

Despite the initial sluggishness, the day took an unexpected turn. The share price climbed to ₹124, indicating a positive sentiment towards the company.

However, profit booking triggered a temporary dip back down to ₹120. The true highlight came towards the closing bell, with the stock hitting the upper circuit of ₹127.35. This significant surge resulted in a 6.12% profit for IPO investors by the end of the day.

Several factors could have contributed to this dramatic closing surge:

- Short Covering: Short sellers who had bet on the stock price falling might have been forced to repurchase shares to cover their positions as the price rose, further pushing it upwards.

- Retail Investor Activity: Retail investors, who displayed strong interest during the subscription phase, might have continued their buying spree on the listing day, driving the price up.

- Positive News or Analyst Ratings: Any positive news or analyst ratings released during the day could have also fueled investor optimism and buying activity.

Retail Investors as the Driving Force

The overwhelming response from retail investors deserves further exploration. Birdy’s brand recognition, likely due to its presence in various localities, might have played a crucial role.

Additionally, the bakery and pastry sector in India is experiencing steady growth, potentially attracting investors seeking exposure to this expanding market.

Here’s a deeper look into the potential reasons behind retail investor interest:

- Affordable Investment: The SME platform allows for smaller investment amounts compared to the main NSE board, making it more accessible to retail investors.

- Brand Loyalty: Existing customers of Birdy’s, with a positive experience and affinity for the brand, might have been more likely to invest in the IPO.

- Growth Potential: The bakery sector’s growth trajectory and Birdy’s promising financial performance might have enticed retail investors seeking long-term returns.

Grill Splendor Services: A Company on the Rise

Founded in November 2019, Grill Splendor Services has carved a niche in the bakery and pastry segment under the Birdy’s brand.

The company’s financial performance paints a promising picture. While they incurred a net loss in FY 2021, a turnaround followed, with net profits rising steadily in FY 2022 (Rs 3.46 lakh) and FY 2023 (Rs 1.99 crore). This growth trajectory signifies the company’s improving financial health.

Revenue figures further strengthen this optimistic view. Grill Splendor Services boasts a compound annual growth rate (CAGR) exceeding 36% in revenue, reaching Rs 15.32 crore in FY 2023. This consistent revenue growth indicates a growing customer base and successful business expansion.

The first half of FY 2024 appears equally promising, with a net profit of Rs 61.65 lakh and revenue of Rs 22.11 crore already achieved. These figures suggest that the company is maintaining its upward momentum.

Future Prospects: Soaring High or Hitting Turbulence?

Birdy’s IPO, though experiencing a muted listing day, ended on a positive note. This initial performance reflects a cautious optimism from investors.

The company’s strong financial performance in recent years, particularly its rising net profits and revenue growth, inspires confidence. However, certain factors warrant consideration for Birdy’s sustained flight in the stock market:

Competitive Landscape: The bakery and pastry segment in India is fiercely competitive, with established players like [List established bakery chains in India] and new entrants vying for market share. Here’s a breakdown of the competitive landscape:

- Established Players: These companies possess extensive brand recognition, established distribution networks, and a wider product portfolio. Birdy’s will need to develop strategies to differentiate itself and compete effectively.

- New Entrants: With the growing bakery market, new players are constantly emerging. Birdy’s needs to stay innovative, maintain high product quality, and strategically expand its presence to stay ahead.

Expansion Plans: The company’s use of IPO proceeds for debt repayment, working capital requirements, and general corporate purposes is crucial. Investors will be keen to see how effectively these funds are utilized to fuel further growth. Here are some potential expansion strategies:

- Store Expansion: Opening new stores in strategic locations can increase brand visibility and customer reach. However, careful consideration of operational costs and market saturation will be critical.

- Product Diversification: Expanding beyond traditional bakery offerings to include innovative products, healthier options, or catering services can attract new customer segments and boost sales.

- Online Presence: Establishing a strong online ordering and delivery platform can cater to tech-savvy customers and widen the brand’s reach.

Market Conditions: The broader market sentiment can significantly impact Birdy’s stock price. Here are some key factors to consider:

- Economic Fluctuations: Economic downturns can decrease consumer spending, impacting Birdy’s sales and profitability.

- Commodity Price Fluctuations: The cost of ingredients like flour, sugar, and butter can be volatile. Effective inventory management and pricing strategies will be essential to mitigate risks.

- Regulatory Changes: Changes in government regulations regarding food safety, labor laws, or taxation could affect Birdy’s operations and profitability.

Final Word: A Take-Off with Potential for Further Ascent

Birdy’s IPO journey offers a compelling narrative of strong investor interest coupled with a promising financial performance by the company.

Although the listing day witnessed a subdued start, the closing surge on the upper circuit indicates a positive outlook. The company’s impressive revenue growth and rising net profits paint a bright picture.

However, navigating a competitive landscape, effectively utilizing IPO proceeds, and adapting to market conditions will be crucial for Birdy’s sustained flight in the stock market. Investors should closely monitor these factors to make informed decisions about their holdings.

Additionally, staying abreast of industry trends, such as the growing popularity of organic and artisanal bakery products, will enable Birdy’s to adapt and cater to evolving customer preferences.

By successfully addressing these challenges and capitalizing on its growth potential, Birdy’s can continue its upward trajectory and soar even higher in the bakery industry.