Best Ways to Double Your Money

Money Double Investment Option: If someone wants to double his invested money then how long will it take? This is a question every investor would like to know the answer to.

There are many options in which investment money can be doubled. But you shouldn’t expect any magic in terms of duration.

Rather wait for a longer period. Here we will give you information about the best 5 such options, by investing in which you can double your money in a few years.

Mutual Fund (MF)

There are many Mutual Funds like ELSS (Equity Linked Savings Scheme), Debt Oriented, Equity Oriented, Balanced or Hybrid Mutual Funds.

Though mutual funds carry market risk, they can give higher returns as compared to other investment options available.

The rate of return for mutual funds depends on the tenure of the fund chosen by the investor. Long term mutual funds can give 12% to 15% annual rate of return. In this way, it will take about 5 to 6 years to double the money through mutual funds.

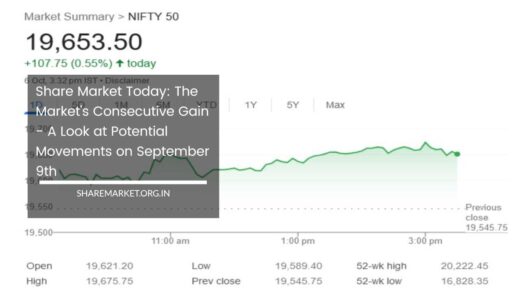

Share Market

Investing in the stock market always gives a high rate of return. In the last decade, the annual rate of return from the stock market has been 15%.

Investing in blue chip companies can double your money in a span of 3 to 5 years. However, to reduce the risk, it is necessary to have stock market knowledge.

Gold ETF

Gold is a special commodity in India. Gold is a good option for investment. But investing in gold can be done in many ways.

One of these is the Gold Exchange Traded Fund (ETF), which was launched in India in 2002. It is one of the easiest ways to invest in gold, which can offer 22% returns annually.

Gold ETFs can give 22% CAGR returns during the tenure of 5 years as the stock market is volatile, which means the invested money will double in 3 to 4 years.

Bank FD

FD is an easy investment option offered by banks. The Reserve Bank of India (RBI) recently kept the interest rates unchanged.

The interest rate on FD has come down over the years. So it can take around 8 to 9 years to invest in any bank fixed deposit to double the money.

Corporate Deposits / Non-Convertible Debentures (NCDs)

There are many investment avenues that can double your money. Corporate Deposit is one of them.

Non-convertible debentures and corporate deposits can fetch you higher interest rates as compared to FDs from Non-Banking Finance Companies (NBFCs) and corporate banks.

The rate of return in these deposits can be around 9 to 10% depending on the ICRA rating and the tenure of the deposit.

The money invested in such schemes will take around 8 years to double. Corporate deposits are offered by companies while NCDs on the other hand are issued by companies including NBFCs.