Share Market Today: The Market’s Consecutive Gain – A Look at Potential Movements on September 9th

Share Market Today

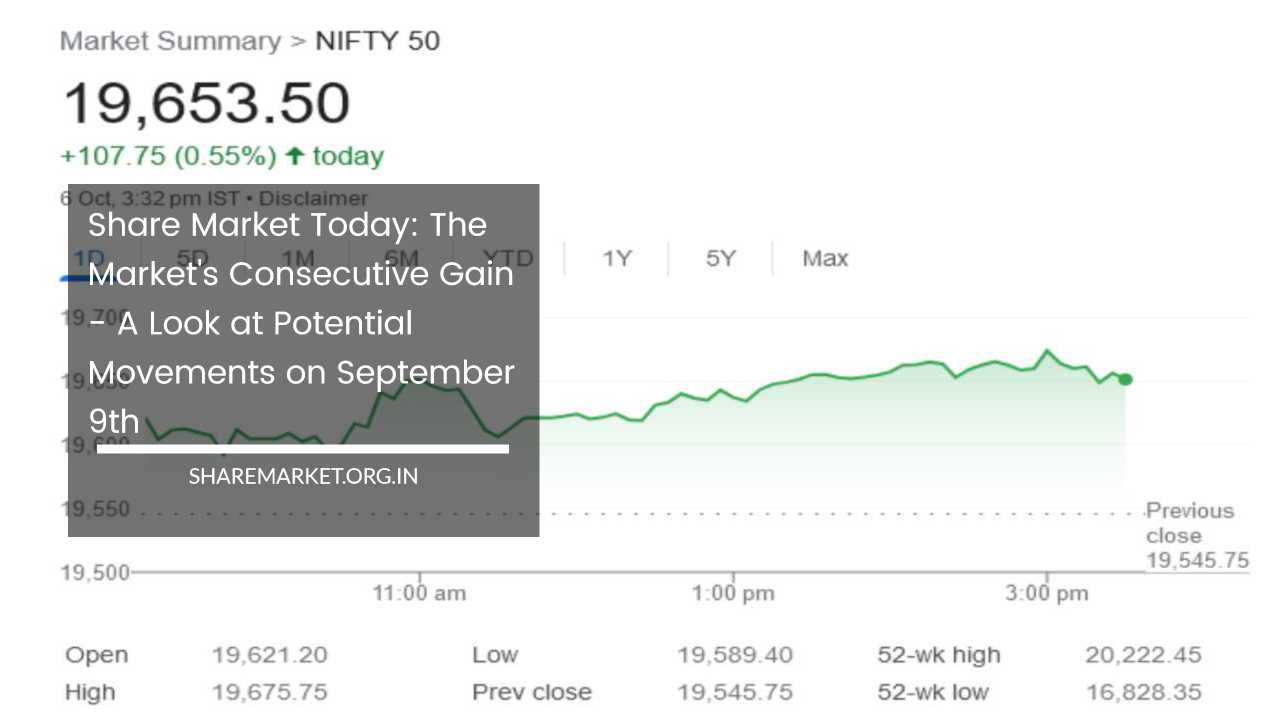

Market Analysis: Nifty’s Second Consecutive Day of Gains on October 6th

In today’s market action, the Nifty index extended its gains for the second consecutive day, maintaining a positive trajectory throughout the trading session. The day concluded with a notable gain of 107 points.

Both Sensex and Nifty managed to finish in the green, marking their second consecutive day of gains on October 6th. Nifty closed at approximately 19,650 points, while Sensex concluded the trading session at 65,995.63, showing a substantial gain of 364.06 points or 0.55 percent. Notably, Nifty also registered a gain of 107.70 points or 0.55 percent.

Market data revealed that 2,229 shares witnessed an increase in their value, while 1,291 shares saw a decline. Additionally, 156 shares remained unchanged. Among the top gainers on Nifty were Bajaj Finserv, Bajaj Finance, Titan Company, IndusInd Bank, and Tata Consumer Products. Conversely, the top losers on Nifty included HUL, ONGC, Coal India, Bharti Airtel, and Asian Paints.

Sectoral Performance: Across the Board Gains

All sectoral indices performed positively, with the Realty index posting an impressive 3 percent increase. Other sectors, including IT, FMCG, Metal, Auto, Power, and Healthcare, also experienced growth ranging from 0.4 to 1 percent.

Notably, even small and medium-sized stocks displayed a rise in their values, with BSE Midcap and Smallcap indices gaining 0.5 percent.

Central Bank’s Stance: A Factor in Market Sentiment

Vinod Nair, an expert from Geojit Financial Services, noted that concerns regarding higher inflation have led the RBI to adopt a more realistic policy approach.

The central bank maintained a strict stance on cash management and indicated the possibility of Open Market Operations (OMO) to control excess cash flow.

Surprisingly, the market responded positively to these developments, as market sentiment improved, thanks to the maintenance of the growth rate status quo and a further decline in oil prices.

Technical Analysis: Insight into Nifty and Bank Nifty

Looking ahead to October 9th, Jatin Gedia of Sharekhan emphasized that Nifty’s consecutive gains and its closure above the 40-day moving average (19610) signal bullish momentum.

On the weekly chart, Nifty closed in the green, forming the Dragonfly Doji pattern, which is also bullish. Gedia anticipated this pullback to continue towards the 19,778-19,800 range. However, if Nifty retraces towards 19,530-19,580, it could present a buying opportunity.

For Bank Nifty, which started with gains and consolidated during most of the trading day, positive divergence and crossover on the hourly momentum indicator were observed—a bullish signal.

The short-term outlook suggests a potential pullback rally to the range of 44,800-45,000. In case of any decline, a strategy of buying good stocks is recommended.

Amol Athawale of Kotak Securities added a technical perspective, highlighting Nifty’s support around 19,350 after a significant fall and its subsequent rebound.

Currently, Nifty hovers near the 50-day Simple Moving Average (SMA) and has formed a hammer pattern on the weekly chart, indicating a positive trend. Maintaining levels above the 50-day SMA at 19,575 would sustain bullish sentiment, potentially leading Nifty to the 20-day SMA at 19,800 and further to 19,850. However, if Nifty slips below 19,575, it could experience a decline towards 19,450-19,350.

As for Bank Nifty, its crucial support is at 44,000. Remaining above this level could pave the way for the 50-day SMA or levels of 44,800-45,000. Conversely, a drop below 44,000 may result in a more significant decline.

Macro Factors Driving Market Sentiment

To gain a deeper understanding of the market’s current dynamics, it’s essential to consider the macroeconomic factors influencing investor sentiment and trading decisions. Here are some key elements contributing to the market’s performance:

1. Inflation Concerns: The Reserve Bank of India (RBI) has recently expressed concerns about rising inflation. This has prompted the central bank to adopt a more realistic and cautious approach to its monetary policy. Investors are closely monitoring the RBI’s actions and statements for clues on future interest rate adjustments.

2. Liquidity Management: The RBI’s commitment to maintaining prudent liquidity management, including the possibility of Open Market Operations (OMO), has been welcomed by the market. Managing excess liquidity effectively is crucial for maintaining financial stability.

3. Oil Price Volatility: Oil prices have a significant impact on India’s economy, given its reliance on oil imports. Any fluctuations in global oil prices can have ripple effects on various sectors, including energy, transportation, and manufacturing.

4. Corporate Earnings: The performance of companies listed on the stock market plays a pivotal role in driving market sentiment. Positive earnings reports and outlooks can boost investor confidence and lead to higher valuations.

5. Technical Indicators: Technical analysis, as highlighted by experts like Jatin Gedia and Amol Athawale, provides valuable insights into short-term and long-term market trends. Traders and investors often rely on technical indicators to make informed decisions.

6. Global Market Trends: India’s stock market is not isolated from global trends. External factors, such as developments in international markets, trade agreements, and geopolitical events, can influence Indian stocks.

Final Remarks: Navigating Market Volatility

As the market continues its upward trajectory for the second consecutive day, investors and traders are navigating through a landscape of both opportunities and challenges.

While positive sentiment prevails, it’s essential to remain vigilant and consider the impact of macroeconomic factors, technical indicators, and global trends on investment decisions.

The RBI’s cautious approach to inflation and liquidity management reflects the need for a balanced and pragmatic monetary policy.

Investors should monitor these developments closely, as they can have a significant influence on the market’s direction in the coming weeks.

In this dynamic environment, technical analysis can provide valuable guidance for short-term trading strategies. As highlighted by experts, such as Jatin Gedia and Amol Athawale, technical indicators like moving averages and candlestick patterns offer insights into potential support and resistance levels, helping traders make informed decisions.

Ultimately, while market volatility can present challenges, it also offers opportunities for those who are well-prepared and informed.

Whether you are a short-term trader or a long-term investor, staying informed about market developments and employing a diversified and risk-aware strategy is key to success in the ever-changing world of finance.