Dreamfolks Share Price Jump 7%, Brokerage Bullish, Check Target Price

Dreamfolks Share Price

DreamFolks Services (DFS) Share Analysis: Navigating Market Dynamics and Unveiling Growth Potential

The dynamic world of stock markets often witnesses sudden surges and dips, and one such instance occurred on February 28 when the shares of DreamFolks Services (DFS), an airport service aggregator platform, saw a robust rally of over 7 percent.

This surge in share value, currently trading at Rs 507.60 with a 5 percent rise, was propelled by the initiation of coverage from the esteemed domestic brokerage firm, Motilal Oswal.

The firm bestowed a Buy rating on DFS, leading to increased investor interest and heightened market activity.

This comprehensive analysis delves into the various dimensions of DreamFolks Services’ recent market performance, the factors influencing its trajectory, and the potential it holds for future growth.

Stock Performance Overview:

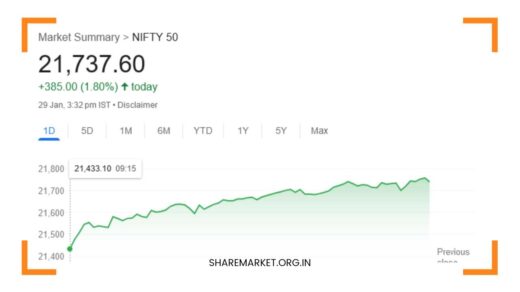

In the past month, DreamFolks Services shares experienced a decline of about 8 percent, reflecting a certain degree of market volatility.

The performance over the last six months tells a story of relative stability, with the stock maintaining a relatively flat trajectory. Over the past year, DFS shares have delivered a return of 16 percent.

However, it’s essential to contextualize these figures by acknowledging that the current trading price is approximately 40 percent below its 52-week high of Rs 846.75, indicating a certain level of fluctuation in market sentiment.

Motilal Oswal’s Coverage Impact and Target Price:

The driving force behind the recent surge in DreamFolks Services’ share prices is undeniably Motilal Oswal’s initiation of coverage.

Not only did the firm start covering DFS, but it also expressed confidence in the stock by assigning it a Buy rating.

Furthermore, Motilal Oswal set a target price of Rs 650 on DFS shares, implying a potential rally of 28 percent from the current levels.

This optimistic outlook is rooted in the brokerage’s assessment of DFS as a dominant player in the domestic airport lounges sector.

DFS Business Model and Market Position:

Motilal Oswal’s coverage report sheds light on the unique strengths of DreamFolks Services, positioning it as a go-to partner for banks seeking to provide complimentary access to lounges alongside paid airport services.

The report underscores DFS’s profitability and asset-light model, making it an attractive investment option.

Furthermore, DFS holds an impressive over 75 percent volume market share in domestic airport lounges and is the exclusive player with 100 percent coverage of airport lounges.

These factors contribute significantly to DFS’s standing as a key player in the sector.

Industry Outlook and Growth Potential:

Motilal Oswal’s coverage report not only highlights DFS’s strengths but also provides insights into the broader industry outlook.

The report indicates a favorable landscape for the domestic aviation and airline industry, aligning with DFS’s strategic positioning.

The continuous growth in air travel, coupled with DFS’s market dominance, positions the company to benefit from the increasing demand for airport services.

The report suggests a scope for rapid growth within the sector, providing a positive backdrop for DreamFolks Services’ expansion plans.

Challenges and Concerns:

While DreamFolks Services appears to be on a positive trajectory, it’s crucial to address the challenges and concerns that the company may encounter.

The 8 percent decline in share value over the last month and the stock’s performance plateau over the last six months indicate that DFS is not immune to market fluctuations.

Additionally, the modest 16 percent return over the past year prompts a closer examination of the factors influencing its overall performance.

Navigating Through Market Fluctuations:

Investors should recognize that market dynamics are inherently unpredictable, and short-term fluctuations are part and parcel of stock market participation.

While the recent decline in share value may raise concerns, it is vital to adopt a long-term perspective. DFS’s strategic partnerships, dominant market position, and Motilal Oswal’s positive coverage collectively contribute to a resilient foundation.

The focus should shift towards understanding the company’s growth prospects and its ability to adapt to changing market conditions.

Future Outlook and Strategic Positioning:

As the aviation industry continues to evolve, and air travel demand remains robust, DreamFolks Services is strategically positioned to capitalize on the opportunities within the airport services sector.

The company’s dominance in domestic airport lounges, coupled with its strategic partnerships with banks, underscores its role as a significant player in the industry.

The positive outlook portrayed in Motilal Oswal’s coverage report aligns with DFS’s potential to leverage its strengths for sustained growth.

Investors’ Perspective and Risk Mitigation:

For investors considering DreamFolks Services as a potential investment, a balanced perspective is crucial. While the recent surge and positive coverage signal optimism, it’s essential to conduct thorough due diligence.

Understanding the company’s financial health, growth strategies, and the competitive landscape will enable investors to make informed decisions.

Mitigating risks through diversification and staying informed about industry trends will contribute to a more resilient investment portfolio.

Final Remarks and Call to Action:

In conclusion, DreamFolks Services has undeniably captured the attention of investors, driven by Motilal Oswal’s favorable coverage and the company’s unique market position.

The optimistic target price set by the brokerage underscores confidence in DFS’s potential for growth within the competitive aviation industry.

However, the recent fluctuations in share value and the stock’s performance over the past year highlight the importance of a nuanced approach to evaluating its future prospects.

The comprehensive analysis presented here aims to provide a thorough understanding of DreamFolks Services’ recent performance and its potential trajectory in the evolving landscape of the aviation industry.

Investors are encouraged to conduct further research, consider their risk tolerance, and stay informed about market developments before making any investment decisions.

As the market continues to unfold, DreamFolks Services stands at the intersection of challenges and opportunities, and prudent investment strategies will play a pivotal role in navigating this dynamic landscape.