Nifty Closed at 21,982; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Market Analysis: February F&O Expiry and Outlook for March 1

In the dynamic world of financial markets, the day of the monthly expiry often brings about significant fluctuations.

The latest instance during the February Futures and Options (F&O) expiry was no exception, as the market experienced notable ups and downs before managing to close the day with a slight gain.

This article delves into the specifics of the market performance on that day, focusing on the Indian stock market, benchmark indices Sensex and Nifty, individual stock movements, and sectoral indices.

Furthermore, market analysts’ perspectives on the potential trajectory for March 1 will be explored.

Market Performance on February F&O Expiry:

The stock market witnessed substantial volatility on the day of the February F&O expiry. Despite the oscillations, Indian benchmark indices Sensex and Nifty managed to close the trading session with slight gains.

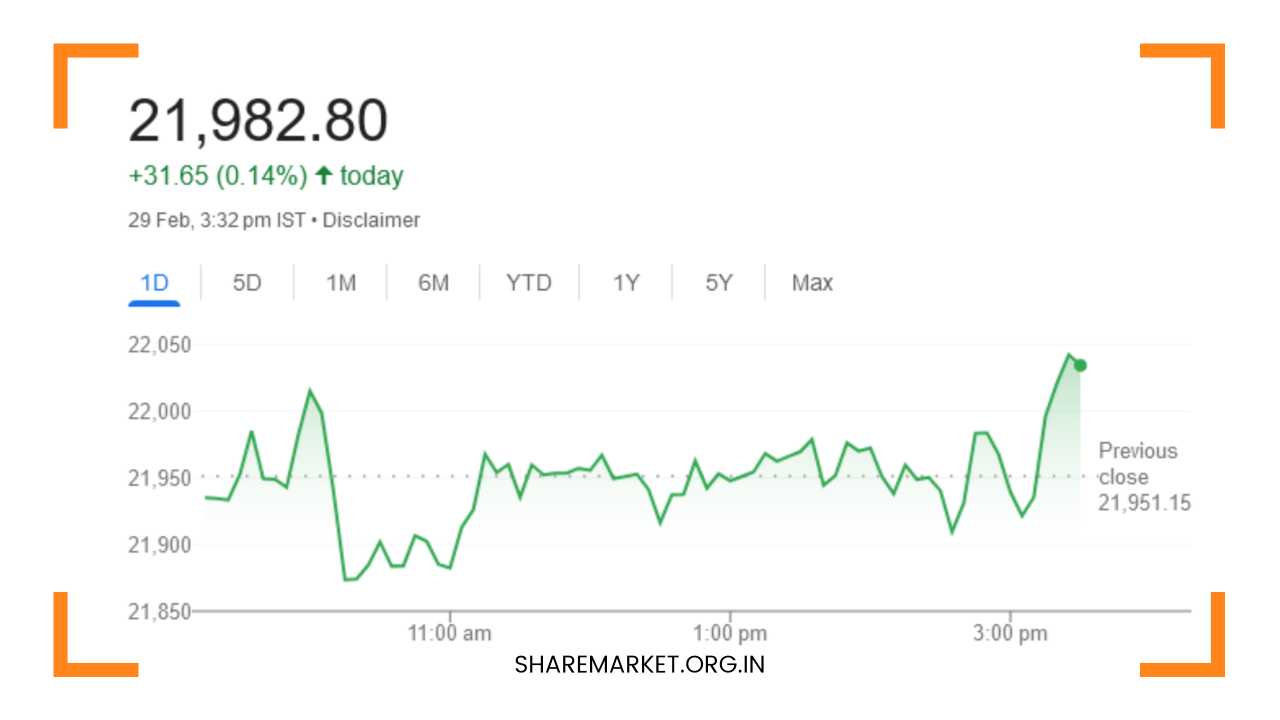

Nifty reached a closing level of around 22,000, while Sensex concluded at 72,500.30, marking a gain of 195.42 points or 0.27 percent. Nifty, in particular, closed at 21,982.80, reflecting an increase of 31.65 points or 0.14 percent.

For the entire month of February, the Nifty 50 index displayed a commendable 3 percent gain during the expiry period. In contrast, both Sensex and Nifty accrued a one percent gain for the month.

This mixed bag of performance indicates the underlying complexity and variability in the market conditions, necessitating a closer examination of specific stocks and sectors.

Stock Movements:

Individual stocks played a crucial role in shaping the day’s market performance. Among the top gainers on Nifty were Adani Enterprises, Tata Consumer, M&M, IndusInd Bank, and Adani Ports.

These stocks showcased positive momentum, contributing to the overall gain in the benchmark indices.

On the flip side, Apollo Hospitals, Bajaj Auto, LTIMindtree, Eicher Motors, and UPL found themselves among the top losers on Nifty for the day.

The divergent movements of these stocks indicate the diverse factors influencing different sectors and companies.

Sectoral Indices:

A comprehensive analysis of the market extends to sectoral indices, providing a deeper understanding of the overall market dynamics.

In this context, it is noteworthy that, barring health services, all other sectoral indices closed in the green on the day of the February F&O expiry.

Sectors such as Bank, Capital Goods, Metal, and Power observed a rise ranging from 0.5 to 1 percent. This broad-based positive movement suggests a sector-specific resilience that contributed to the overall market gain.

The BSE Midcap index also displayed positive momentum, closing with a gain of about 1 percent. Similarly, the Smallcap index recorded a 0.5 percent increase, further emphasizing the breadth of the market rally.

These observations highlight the nuanced nature of market movements, with midcap and smallcap stocks making meaningful contributions to the overall positive sentiment.

Outlook for March 1:

As investors and traders turn their attention to the future, market analysts provide insights into the potential movements expected on March 1.

Ajit Mishra of Religare Broking notes the ongoing struggle in Nifty around the 21,900 mark, which is situated near the short-term moving average, the 20-day exponential moving average (20 DEMA).

According to Mishra, this situation suggests that, during any recovery, Nifty may encounter obstacles around the zone of 22,100-22,250.

Mishra also highlights the increasing concern among traders due to growing volatility and unsuccessful attempts at breakout.

In light of these factors, he advises caution, recommending that traders avoid aggressive trades and consider lightening their positions in the event of any upswing. Mishra’s cautious approach underscores the importance of risk management in navigating the current market conditions.

Rupak De of LKP Securities offers an additional perspective on the market outlook. He observes that on the day of the weekly expiry, Nifty closed flat amid fluctuations, just above the 21-day exponential moving average (21EMA).

De points out the possibility of weakness in Nifty in the short term and identifies the support level at 21,950. As long as Nifty remains above this support level, there is a potential for recovery.

However, De issues a cautionary note that a breach below 21,950 could intensify the weakness, potentially leading to a decline towards 21,800.

Traders are urged to closely monitor these critical support and resistance levels, as they can serve as key indicators for potential market movements in the coming days.

Final Remarks:

In conclusion, the analysis of the market on the day of the February F&O expiry provides a comprehensive understanding of the various factors influencing stock and sectoral movements.

The mixed performance of individual stocks, coupled with sectoral resilience, contributed to the overall gain in benchmark indices.

As investors and traders gear up for March 1, the insights from market analysts Ajit Mishra and Rupak De offer valuable perspectives on potential hurdles and opportunities.

The market’s complex interplay of factors, including volatility, support and resistance levels, and breakout attempts, necessitates a cautious approach.

Risk management strategies become paramount in navigating the current market conditions, emphasizing the importance of staying informed and adaptable in the ever-evolving landscape of financial markets.