Expert Nifty Prediction: Nifty May Fall to 21400

Nifty Prediction

Navigating Market Uncertainty: HDFC Bank’s Impact, Sectoral Strategies, and Analyst Insights

The Indian stock market, on January 17, witnessed a substantial downturn, with both Sensex and Nifty experiencing a sharp decline of over 2 percent.

This abrupt market correction was primarily attributed to the lackluster performance of HDFC Bank in the third quarter, sending shockwaves across the financial landscape.

This article aims to provide an in-depth analysis of the factors contributing to the market turmoil, the repercussions of HDFC Bank’s performance, and the strategic considerations for investors amidst the ongoing volatility.

Market Overview:

Immediate Fallout:

The swift and substantial decline in both Sensex and Nifty on January 17 caught the attention of market participants and analysts alike.

This decline, exceeding 2 percent, can be largely attributed to the disappointing performance of HDFC Bank, a heavyweight in the Indian banking sector.

The repercussions of this downturn were felt across various segments of the market, triggering concerns about the overall health of the economy.

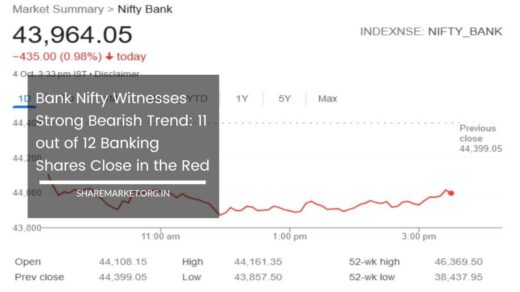

Banking Stocks Bear the Brunt:

As the market witnessed a selloff, banking stocks took the forefront of the downturn. HDFC Bank, Kotak Mahindra Bank, Axis Bank, and ICICI Bank, all major players in the private banking sector, experienced significant losses.

The financial sector, a critical pillar of the market, faced headwinds, contributing to the overall cautious sentiment prevailing among investors.

Volatility Projection:

Market experts foresee heightened volatility persisting in the coming days, exacerbated by uncertainties surrounding the ongoing corporate results season.

Ajit Mishra of Religare Broking noted that Nifty’s re-entry into the 21,700-800 support zone resulted in a rapid loss of market control. Banking stocks, in particular, bore the brunt of this selloff, pushing Nifty down to the 21,400-200 level.

The current market environment is characterized by unpredictability, and investors are advised to exercise caution as the corporate results season unfolds.

Investor Strategies Amidst Market Uncertainty:

Cautionary Approach Advised:

Given the prevailing volatility and the potential for increased selling pressure during the corporate results season, market experts are strongly advocating for a cautious approach.

Chokkalingam G, founder of Equinomics Research, recommends adopting a “wait-and-see” strategy, advising investors to hold off on making significant investment decisions until the third-quarter results are revealed.

This cautious approach aims to shield investors from the unpredictable market dynamics that may unfold in the coming weeks.

Technical Analysis and Support Levels:

Ajit Mishra emphasizes the importance of technical analysis in navigating through volatile market conditions.

The breach of crucial support levels, such as the 21,700-800 zone for Nifty, triggered a cascade effect, highlighting the significance of understanding and monitoring these technical indicators.

Mishra further warns that maintaining the 45,700 support level is critical for the Bank Nifty. Failure to sustain this level may result in a substantial decline of over 1,000 points, indicating potential challenges for the banking sector.

HDFC Bank’s Role in the Market Downturn:

Marginal Q3 Performance:

HDFC Bank, India’s largest private bank, played a pivotal role in the market decline. The bank reported flat margins quarter-on-quarter in Q3FY24, primarily attributed to a higher cost of funds.

Despite indications from the bank’s management that margins might lean towards the lower end, the overall sentiment among analysts remains mixed.

Analyst Perspectives on HDFC Bank:

Shantanu Chakraborty, Head of BFSI Research at BNP Paribas, remains cautious about HDFC Bank’s near-term prospects. He expressed skepticism about the bank’s margins reaching 4.3 percent in the foreseeable future.

In a conversation with CNBC-TV18, Chakraborty highlighted the challenges faced by HDFC Bank and the potential implications for its stock performance.

HSBC analysts responded to HDFC Bank’s performance by reducing the target price from Rs 2,000 per share to Rs 1,950.

This downward revision reflects the concerns surrounding the bank’s ability to navigate the current economic landscape and maintain its historical performance.

Contrary to the cautionary views, Gaurang Shah of Geojit Financial Services maintains a bullish stance on HDFC Bank.

Shah argues that evaluating the stock based on a single quarter’s performance is unfair, considering its robust history spanning 16-17 years.

He not only suggests holding onto HDFC Bank but also recommends a long-term investment in IndusInd Bank.

Assessing the Third Quarter:

The third quarter performance of HDFC Bank has brought to light concerns about the stability of its margins and overall financial health.

The flat margins, coupled with indications of potential challenges ahead, have prompted analysts and investors to reassess their outlook on the bank.

The differing views among analysts underscore the complexity of interpreting short-term fluctuations in a stock’s performance against its broader historical context.

Sectoral Strategies Amidst Market Volatility:

IT Stocks Shine Amidst Turmoil:

While the overall market experienced a downturn, IT stocks emerged as a bright spot. Even amidst the market weakness on January 17, IT shares showcased resilience.

AK Prabhakar of IDBI Capital acknowledges the positive third-quarter results in the IT sector, which exceeded Street estimates. However, he advises investors to wait for fundamental triggers before making investment decisions.

Tier-2 IT Stocks: An Opportunity?

Gaurang Shah suggests a nuanced approach within the IT sector. While acknowledging the overall positive sentiment, he advises investors to consider tier-2 IT stocks for potential better performance.

Shah specifically mentions Cyient, KPIT Tech, and LTI Mindtree as potential investment opportunities.

This selective approach within the IT sector allows investors to capitalize on specific growth opportunities while mitigating risks associated with broader market volatility.

Final Remarks:

As the Indian stock market grapples with heightened volatility, investor sentiment is undergoing a significant test. The impact of HDFC Bank’s performance, coupled with the ongoing corporate results season, has created an environment of uncertainty.

Investors are urged to adopt a cautious approach, conduct thorough analyses, and consider sector-specific strategies to navigate through these challenging times.

While market experts offer varying perspectives, the consensus is clear – patience and vigilance are key virtues in the current market landscape.

The coming weeks will likely reveal the resilience of the market and provide insights into potential long-term investment opportunities amidst the prevailing uncertainties.