HDFC Bank Q2 Results: Rs 15,976 Crore Profit in First Quarter Post-Merger – Detailed Overview

HDFC Bank Q2 Results

HDFC Bank, India’s largest private sector bank, has recently announced its financial results for the second quarter of the current financial year.

This announcement is particularly significant as it marks the first quarterly report after HDFC Bank’s merger with Housing Development Finance Corp (HDFC).

The bank reported a substantial net profit of Rs 15,976.11 crore, surpassing CNBC-TV18’s estimate of Rs 14,616.5 crore.

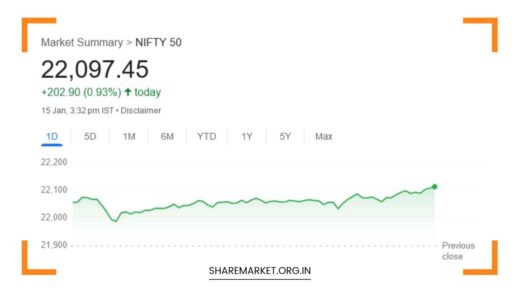

The results were released after the market closed, with the bank’s stock closing at Rs 1532, showing a slight decline of 0.24 percent.

Analyzing the Quarterly Results

HDFC Bank’s quarterly results were nothing short of impressive. The bank reported a 50 percent increase in profit on an annual basis and a substantial 33.7 percent increase on a quarterly basis.

However, it’s crucial to note that these figures cannot be directly compared on a quarterly or annual basis due to the recent merger with HDFC, which was completed on July 1, 2023.

One key metric that investors and analysts closely monitor is the bank’s non-performing assets (NPA). In this regard, HDFC Bank demonstrated its strong asset quality, with gross non-performing assets (NPAs) declining to 1.34 percent in the quarter.

Similarly, the bank’s net NPA for the July-September quarter stood at an impressive 0.35 percent. These figures indicate a well-managed loan portfolio with relatively low levels of bad loans.

The net interest income (NII) for the quarter was reported at Rs 27,385 crore, which, while substantial, was slightly lower than CNBC-TV18’s estimated NII of Rs 28,187.4 crore.

Nonetheless, HDFC Bank’s NII is a critical source of revenue for the bank, and it remains a strong contributor to its profitability.

HDFC Bank provided additional insights into its asset quality metrics, revealing that gross non-performing assets (NPAs) amounted to Rs 31,578 crore, equivalent to 1.34 percent of gross advances.

Net NPAs stood at Rs 8,073 crore, constituting 0.35 percent of net advances. These figures reiterate the bank’s commitment to maintaining a healthy and robust loan book.

The bank also allocated a total provision of Rs 2,904 crore, indicating a prudent approach to risk management and provisioning for potential losses.

Such provisioning is a standard practice in the banking industry, ensuring that banks are adequately prepared for any unforeseen challenges that may arise.

Key Financial Metrics

HDFC Bank’s return on assets (RoA) is a vital indicator of its profitability and efficiency.

In this quarter, RoA stood at 1%, representing an improvement from the 2% annualized rate for H1FY24. This suggests that the bank is utilizing its assets efficiently to generate returns for its shareholders.

Another critical financial metric is the net interest margin (NIM), which is a measure of a bank’s profitability from its core lending and borrowing operations.

HDFC Bank’s NIM stood at 3.4 percent, indicating that it is earning a healthy spread between the interest it pays on deposits and the interest it earns on loans.

The core net interest margin was even more impressive, at 3.65 percent, demonstrating the bank’s strength in its core banking activities.

The pre-provision operating profit of the bank reached Rs 22,694 crore. This figure reflects the bank’s ability to generate profits before accounting for provisions and non-performing assets. It underscores the bank’s sound financial health and robust operational performance.

Gross advances, a measure of the bank’s total loan portfolio, stood at an impressive Rs 23.54 lakh crore. This figure showcases the bank’s strong lending activities and its role in facilitating economic growth by providing credit to individuals and businesses.

Implications of the HDFC Merger

The merger of HDFC Bank with Housing Development Finance Corp (HDFC) was a significant event in the Indian banking and financial sector.

The two entities coming together has created a financial powerhouse with substantial assets, a broad customer base, and a comprehensive suite of financial products and services.

This merger has undoubtedly contributed to the bank’s improved financial performance. However, it also brings about certain challenges in terms of integration, streamlining operations, and aligning the two organizations’ cultures and systems.

Mergers of this scale require meticulous planning and execution to realize their full potential and deliver value to shareholders.

Outlook and Conclusion

HDFC Bank’s robust financial results in the second quarter of the financial year reflect its resilience and ability to adapt to changing market conditions.

The bank’s merger with HDFC has expanded its capabilities and reach, positioning it as a formidable player in the Indian banking and financial landscape.

The bank’s commitment to maintaining a healthy loan portfolio and its ability to efficiently manage its assets and generate profits are evident in its strong financial metrics.

With improving asset quality, prudent provisioning, and an impressive NIM, HDFC Bank is well-prepared to navigate the challenges and opportunities in the banking industry.

As with any financial institution, HDFC Bank will continue to face various economic and regulatory challenges.

However, its strong fundamentals, market leadership, and diversified product offerings make it a promising player in the Indian banking sector.

Investors and stakeholders will continue to closely monitor its performance, especially in the post-merger era, to gauge its ability to deliver sustainable and profitable growth.