KPIT Technologies Q1 Results: 53% Surge in Profit, 60% Surge in Revenue

KPIT Technologies Q1 Results

KPIT Technologies, a prominent software and engineering firm with a focus on the automotive industry, recently announced its financial results for the first quarter ended June 30.

The company showcased a remarkable performance with a year-on-year increase of 53.37 per cent in net profit, amounting to Rs 134.43 crore.

This surge in profitability is a testament to KPIT Technologies’ robust business strategies and resilience, especially considering the challenging economic conditions faced by the IT services sector as a whole.

The company’s ability to achieve a 20.48 per cent growth in net profit from the previous quarter further solidifies its position as a leader in the industry.

The substantial increase in profit signifies KPIT Technologies’ successful execution of projects, effective cost management, and continued focus on delivering innovative solutions to its clients.

KPIT Technologies also reported an impressive 60 per cent year-on-year growth in its consolidated revenue from operations for the first quarter of FY24.

The revenue reached a significant milestone of Rs 1,097 crore, showcasing the company’s strong market presence and its ability to seize opportunities in the ever-evolving automotive software and engineering domain.

Moreover, the company’s revenue grew by 7.89 per cent from the previous quarter, indicating a steady upward trajectory in its financial performance.

Despite the headwinds faced by the IT services sector, KPIT Technologies’ focus on the automotive industry has proven to be advantageous.

The company’s specialization in this sector has allowed it to leverage the growing demand for software solutions and engineering services in the automotive domain.

Additionally, KPIT Technologies’ expertise in developing cutting-edge technologies for electric vehicles, autonomous driving, and connected car solutions has positioned it as a preferred partner for leading automotive manufacturers.

In recognition of the company’s remarkable financial performance and as a gesture of rewarding its shareholders, KPIT Technologies announced a final dividend of Rs 2.65 per equity share of Rs 10 each for the fiscal year 2022-23.

This dividend distribution demonstrates the company’s commitment to creating value for its shareholders and reflects its confidence in sustaining growth in the future.

The positive financial results and the declaration of the final dividend have been well-received by investors and analysts alike.

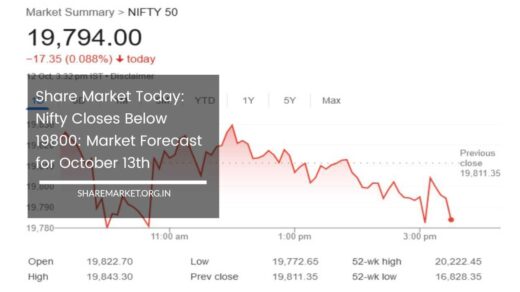

As a result, the KPIT Technologies share price experienced a boost in the market, indicating the market’s confidence in the company’s future prospects.

Looking ahead, KPIT Technologies remains well-positioned to capitalize on the increasing demand for advanced automotive technologies, including software solutions, artificial intelligence, and data analytics.

The company’s focus on innovation, customer-centricity, and its ability to adapt to industry trends will be essential in maintaining its competitive edge in the rapidly evolving automotive landscape.

KPIT Technologies Records Strong Order Book of $19 Billion and Impressive Geographical Growth in Q1 FY24

KPIT Technologies, a leading automotive software and engineering firm, recently revealed its robust performance for the first quarter of fiscal year 2023-24.

The company’s order book for the period stood at an impressive $19 billion, reflecting its strong positioning in the market and continued success in securing strategic accounts.

The order book comprised significant contributions from various segments, including middleware and architecture, electric powertrain, and connected vehicles, reaffirming KPIT Technologies’ prowess in delivering cutting-edge solutions across diverse automotive domains.

1. Expanding Order Book and Diversified Segments

KPIT Technologies’ substantial order book is a testament to its ability to address the evolving needs of the automotive industry.

The company’s focus on technological innovation and its deep domain expertise have positioned it as a preferred partner for major players in the automotive sector.

The inclusion of strategic accounts, middleware and architecture projects, as well as electric powertrain and connected vehicle initiatives in the order book underscore the company’s holistic approach to delivering end-to-end solutions for its clients.

2. Geographical Growth

Geographically, KPIT Technologies experienced significant growth during the first quarter, with the UK and Europe leading the charge. The company witnessed an impressive growth rate of over 105 percent in this region, solidifying its presence in the European automotive market.

Following closely, the US market witnessed a remarkable growth rate of more than 41 percent, indicating KPIT Technologies’ success in catering to the evolving demands of North American clients.

Furthermore, the company achieved a growth rate of 26 percent in the rest of the world, further expanding its global footprint and establishing itself as a truly international player in the automotive software and engineering landscape.

3. Improved EBIT Margin

KPIT Technologies’ financial performance in Q1 FY24 also showcased an improvement in its Earnings Before Interest and Taxes (EBIT) margin.

The EBIT margin increased to 15.9 per cent, up from 14.9 per cent in the previous quarter (Q4 FY23).

This enhancement in EBIT margin highlights the company’s commitment to operational efficiency, effective cost management, and optimized project execution.

4. Rising Basic Earnings Per Share (EPS)

Another positive indicator of KPIT Technologies’ growth trajectory was the increase in its Basic Earnings Per Share (EPS).

In the June quarter, the company’s EPS rose to Rs 4.95, demonstrating substantial growth from Rs 4.13 recorded in the preceding quarter (March quarter).

This significant improvement in EPS signals the company’s ability to create value for its shareholders and reflects its financial strength and promising prospects.

CEO and MD Kishor Patil Commends KPIT Technologies’ All-Round Performance and Confirms Positive Outlook

Kishor Patil, the Co-founder, CEO, and MD of KPIT Technologies, expressed his satisfaction with the company’s strong all-round performance in the first quarter of fiscal year 2023-24.

He remarked that the company had started the year on a positive note, delivering results in line with their expectations for a robust first half.

As a key player in the automotive software and engineering domain, KPIT Technologies has capitalized on opportunities arising from the continued investments by mobility players in cutting-edge technologies such as electrification, vehicle autonomy, connectivity, and personalization.

Addressing the Financial Performance

Kishor Patil emphasized that KPIT Technologies’ first-quarter results showcased a commendable performance across various fronts, reflecting the company’s dedication to excellence and innovative solutions.

The strong financial results, including a significant increase of 53.37 per cent in net profit and a remarkable 60 per cent growth in consolidated revenue from operations, reinforced the company’s capabilities in delivering value to its stakeholders.

Optimism for the Medium Term

Looking forward, Kishor Patil expressed his confidence in the company’s growth prospects for the medium term. He highlighted the presence of a robust pipeline of projects and noted that KPIT Technologies was well ahead of the mega strategic commitments announced in the previous year.

This positive development bodes well for the company’s future performance and provides a reasonable outlook for the medium-term trajectory.

Future Growth Drivers

As the automotive industry undergoes transformative changes, with a strong emphasis on sustainable and technologically advanced solutions, KPIT Technologies is well-positioned to capitalize on emerging opportunities.

The company’s expertise in areas such as electrification, vehicle autonomy, connectivity, and personalization aligns perfectly with the evolving needs of mobility players.

With the automotive landscape continually evolving, KPIT Technologies’ comprehensive suite of solutions and services places it at the forefront of technological innovation.

Reaching the Announced Outlook

Kishor Patil reaffirmed the company’s commitment to achieving its announced outlook for revenue growth and operating margin for the fiscal year 2023-24 (FY2024).

This outlook indicates KPIT Technologies’ determination to pursue steady growth while ensuring operational efficiency and financial stability.

KPIT Technologies Announces 26.5 Percent Dividend for FY 2022-23 and Stock Market Response

In addition to its strong financial performance in the first quarter of fiscal year 2023-24, KPIT Technologies delighted its shareholders by declaring a final dividend of Rs 2.65 per equity share of Rs 10 each for the financial year 2022-23.

This dividend amounts to an impressive 26.5 percent, reflecting the company’s commitment to rewarding its stakeholders for their continued support and confidence in its growth trajectory.

Rewarding Shareholders with a Generous Dividend

KPIT Technologies’ declaration of a 26.5 percent dividend for FY 2022-23 demonstrates its dedication to creating long-term value for its shareholders.

The dividend distribution is a reflection of the company’s strong financial position, successful execution of strategies, and its optimism for future growth prospects.

The decision to distribute such a substantial dividend further reinforces the trust and assurance that KPIT Technologies provides to its investors, attracting both new and existing shareholders.

Market Response to the Q1 Results

The announcement of KPIT Technologies’ impressive financial results and the declaration of the dividend resonated positively in the stock market.

On the day the results were announced, the company’s shares were trading at Rs 1,091.80 on the National Stock Exchange (NSE), experiencing a significant uptick of 3.31 percent.

This increase in share price reflects the market’s acknowledgment of KPIT Technologies’ strong performance and its recognition of the company’s ability to deliver sustainable growth and value to its shareholders.

The stock’s performance remained favorable even at the time of closing the market that day. Though the share price witnessed a marginal decline of 0.02 percent or Rs 0.20, closing at Rs 1,056.60, it still maintained a positive sentiment in the market.

The stock’s resilience in the face of minor fluctuations is an indicator of investors’ confidence in the company’s future prospects and its ability to navigate market dynamics.

Conclusion

KPIT Technologies’ announcement of a 26.5 percent dividend for FY 2022-23 is a testament to its strong financial performance and its commitment to sharing its success with shareholders.

The company’s ability to deliver robust results and reward its stakeholders with attractive dividends showcases its leadership in the automotive software and engineering domain.

As KPIT Technologies continues to focus on innovation, customer-centricity, and expanding its global presence, it remains poised for sustained growth and success in the highly competitive automotive industry.

With its positive market response and optimistic outlook for the medium term, KPIT Technologies is well-positioned to capitalize on emerging opportunities and continue delivering value to its clients and investors alike.

The company’s dedication to excellence, backed by visionary leadership, makes it a force to be reckoned with in the rapidly evolving automotive landscape.