LTIMindtree Dividend Announcement: Ex-Dividend Date Set for October 27

LTIMindtree Dividend

LTIMindtree, a prominent large-cap company in the Information Technology (IT) sector, is set to delight its shareholders with the announcement of a substantial dividend.

The company has declared an interim dividend of 2000% for the fiscal year 2024. Shareholders should mark their calendars for the ex-dividend date, which is scheduled for October 27, 2023.

In an official statement, the company’s board of directors confirmed an interim dividend of Rs 20 for each equity share with a face value of Re 1. On October 26, 2023, LTIMindtree’s stock experienced a minor decline of 0.94%, closing at Rs 5,155.15.

Understanding the Dividend Distribution Process:

Shareholders eagerly await the dividend distribution. According to LTIMindtree’s filing with the stock exchange, the interim dividend will be disbursed within 30 days from the date of declaration.

This distribution will be made to shareholders whose names are recorded in the register of members or in the list of beneficial owners provided by the depository as of the ‘record date,’ which is set for Friday, October 27, 2023. This meticulous approach ensures that the dividend reaches the rightful owners promptly.

The company has demonstrated its commitment to rewarding its investors with a history of consistent dividend payouts. For the fiscal year ending in March 2023, LTIMindtree declared a 1% equity dividend at a face value of Rs 60 per share.

This recent announcement of a substantial interim dividend adds to the company’s track record of creating value for its shareholders. Over the past five years, LTIMindtree has declared dividends on 16 occasions, reinforcing its reputation as a reliable dividend stock.

Quarterly Performance Review:

In addition to the exciting dividend announcement, LTIMindtree’s financial performance is under the spotlight. In the second quarter of the current fiscal year, the company reported a 2.5% year-on-year decline in net profit, amounting to Rs 1,162 crore.

Furthermore, there was a quarterly profit decrease of 0.87%. Despite these figures, the company has shown its confidence in its financial position by announcing an interim dividend of Rs 20 for its shareholders. This demonstrates its commitment to delivering value to investors even in the face of temporary financial challenges.

Investors keen to assess the company’s financial health and performance will find these figures relevant. LTIMindtree has exceeded expectations in this quarter, with total income for Q2FY24 increasing by 7.86% to reach Rs 9,048.6 crore.

This figure is in stark contrast to the total income of Rs 8,388.9 crore recorded in Q2FY23. Although the operating margin, also known as EBIT margin, fell slightly to 16% from 16.7% in Q1FY24, the company’s overall financial performance remains strong.

Analyzing Stock Performance:

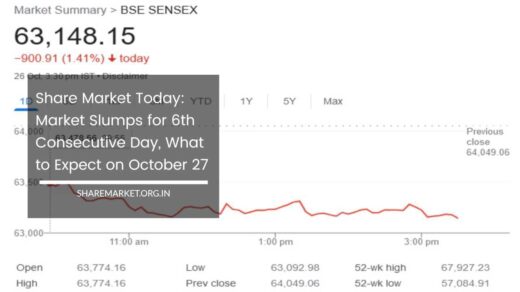

Investors often closely monitor a company’s stock performance. Over the past month, LTIMindtree’s shares have experienced a 5% decrease in value, reflecting short-term market fluctuations.

However, when looking at the bigger picture, the company has delivered substantial returns to investors over the last six months, amounting to approximately 20%. This extended time frame provides a more comprehensive view of the company’s ability to create value for its shareholders.

For the one-year period, investors have realized a profit of 10%, a respectable return considering the market conditions during this period.

Over the last three years, LTIMindtree has provided an impressive gain of 68% to its investors. This long-term perspective is particularly important for those who seek to build wealth over an extended period.

LTIMindtree’s Market Position:

It’s important to consider the broader context in which LTIMindtree operates. The company’s position in the IT sector is significant, as it is categorized as a large-cap company.

This classification implies that the company is well-established and has a substantial market capitalization. Large-cap companies are often considered more stable and less volatile than smaller companies, making them attractive options for investors seeking stability and consistent returns.

The IT sector itself has been a focal point for investors and market analysts in recent years. With the increasing dependence on technology and digital solutions, IT companies have been at the forefront of innovation and growth.

The sector’s performance is closely tied to global technological trends and the demand for IT services and products. LTIMindtree’s presence in this sector positions it to benefit from these trends and contribute to its long-term success.

LTIMindtree’s Dividend Policy:

One of the key factors that make LTIMindtree an attractive investment is its robust dividend policy. A dividend is a payment made by a company to its shareholders from its profits, and it is typically distributed on a per-share basis.

The decision to pay dividends reflects a company’s financial stability and its commitment to providing returns to its shareholders.

LTIMindtree’s dividend history is a testament to its consistent approach to rewarding its investors. Over the past five years, the company has declared dividends 16 times.

This track record of regular dividend payouts showcases the company’s financial strength and its dedication to creating value for its shareholders.

The recent announcement of a substantial interim dividend of 2000% for the fiscal year 2024 is a clear indication of LTIMindtree’s confidence in its financial position.

A high interim dividend percentage like this is exceptional and demonstrates the company’s commitment to sharing its success with its shareholders.

The Importance of the Ex-Dividend Date:

The ex-dividend date, which is October 27, 2023, holds great significance for shareholders of LTIMindtree. It is the date on which the company’s shares will trade without the rights to the impending dividend.

In other words, investors who purchase the company’s shares on or after the ex-dividend date will not be eligible to receive the recently announced interim dividend.

Shareholders who already own LTIMindtree shares should take note of this date and make informed decisions regarding their holdings. They can choose to retain their shares to receive the dividend or decide to sell them if they do not wish to participate in the dividend distribution.

LTIMindtree’s Financial Resilience:

Although LTIMindtree reported a decline in net profit in the second quarter of the fiscal year, its financial resilience is worth noting.

The company’s ability to continue paying dividends in the face of a temporary decline in profits reflects a strong financial foundation.

The fact that LTIMindtree has maintained its dividend distribution despite the challenging market conditions speaks to its long-term perspective.

Companies that prioritize dividends understand the importance of creating value for their shareholders over time. As a result, investors who trust LTIMindtree with their investments can feel assured that the company is committed to their financial well-being.

LTIMindtree’s Growth and Income Potential:

Investors often seek a balance between growth and income potential when evaluating a company. LTIMindtree offers an appealing combination of both.

Its commitment to paying dividends demonstrates a dedication to income potential for shareholders, while its track record of stock performance over the last six months, one year, and three years highlights its growth potential.

In the last six months, LTIMindtree has provided investors with an impressive return of around 20%. This growth is particularly noteworthy in a market where rapid changes in stock values are common.

The one-year return of 10% further exemplifies the company’s ability to deliver consistent results. Over the last three years, LTIMindtree has rewarded investors with a remarkable gain of 68%, showcasing its long-term growth potential.

The combination of income and growth potential positions LTIMindtree as an attractive investment option for a wide range of investors, from those seeking income stability to those looking to capitalize on capital appreciation.

Navigating Market Volatility:

Market volatility is a fact of investing, and it can lead to fluctuations in stock prices. LTIMindtree’s recent 5% decrease in share value over the last month is an example of short-term market volatility.

While such fluctuations may concern some investors, it’s essential to recognize that market volatility is a natural part of investing.

Investors often adopt various strategies to navigate market volatility. Diversifying one’s investment portfolio by including different asset classes and industry sectors can help spread risk and reduce the impact of market swings.

This approach can provide a buffer against short-term market fluctuations and help investors achieve their long-term financial goals.

Furthermore, investors who are concerned about market volatility may consider adopting a long-term perspective. By focusing on a company’s performance over several years, they can gain a more comprehensive understanding of its ability to weather market ups and downs.

LTIMindtree’s Long-Term Vision:

LTIMindtree’s long-term vision is reflected in its consistent dividend policy and its ability to deliver growth over an extended period.

The company’s commitment to shareholders is evident in its history of regular dividend payouts and its announcement of a substantial interim dividend for the fiscal year 2024.

This long-term perspective aligns with the goals of many investors who seek to build wealth and achieve financial security over time. LTIMindtree’s performance over the last three years, with a 68% gain for investors, is a testament to the company’s ability to create long-term value.

LTIMindtree’s Position in the IT Sector:

The IT sector is a dynamic and rapidly evolving industry with a pivotal role in the global economy.

The sector encompasses a wide range of businesses involved in technology development, software services, hardware manufacturing, and more. LTIMindtree, as a significant player in this sector, has the opportunity to capitalize on the sector’s growth potential.

Technology continues to advance, and digitalization is a prominent trend across various industries. This presents IT companies like LTIMindtree with opportunities for innovation and expansion. As companies worldwide invest in digital solutions and IT services, the demand for specialized IT firms is expected to remain robust.

LTIMindtree’s strategic positioning within the IT sector positions it to leverage these opportunities and contribute to the sector’s growth.

The company’s ability to adapt to evolving technology trends and provide relevant solutions is a key driver of its long-term success.

Investor Considerations:

Investors evaluating LTIMindtree should consider various factors, including their investment goals, risk tolerance, and time horizon. Here are some key considerations for potential investors:

- Investment Goals: Clarify your investment goals, whether they are focused on income, growth, or a combination of both. LTIMindtree offers both income potential through its dividends and growth potential through its stock performance.

- Risk Tolerance: Assess your risk tolerance to determine the level of market volatility you can comfortably withstand. Consider diversifying your portfolio to manage risk effectively.

- Time Horizon: Define your investment time horizon, whether it’s short-term, medium-term, or long-term. LTIMindtree’s long-term vision aligns well with investors seeking extended growth and income potential.

- Market Research: Stay informed about market conditions, company news, and industry trends. This knowledge can help you make informed investment decisions.

- Financial Planning: Develop a financial plan that includes clear investment objectives and strategies. Consider working with a financial advisor to create a comprehensive investment strategy tailored to your specific needs.

- Review Your Portfolio: Periodically review your investment portfolio to ensure it aligns with your goals and risk tolerance. Make adjustments as needed to stay on track with your financial objectives.

Final Remarks:

LTIMindtree’s recent announcement of a substantial interim dividend for the fiscal year 2024 has captured the attention of investors.

This large-cap company in the IT sector has a track record of consistent dividend payouts and strong stock performance over the long term.

The ex-dividend date, October 27, 2023, is approaching, and shareholders need to be aware of the significance of this date. It is the point at which shares will trade without the rights to the upcoming dividend, making it a crucial consideration for investors.

While market volatility can lead to short-term fluctuations in stock prices, a long-term perspective is essential for assessing a company’s ability to create value over time.

LTIMindtree’s financial resilience, combined with its dividend policy and growth potential, makes it an attractive option for a wide range of investors.

Investors looking to capitalize on both income and growth potential in the IT sector should consider LTIMindtree as part of their investment strategy.

However, it’s crucial to conduct thorough research, assess your financial goals, and tailor your investments to your risk tolerance and time horizon. By doing so, you can make informed decisions and potentially benefit from the opportunities presented by LTIMindtree.