Market Closed in Red: Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Market Analysis and Outlook: Navigating Volatility in the Stock Market

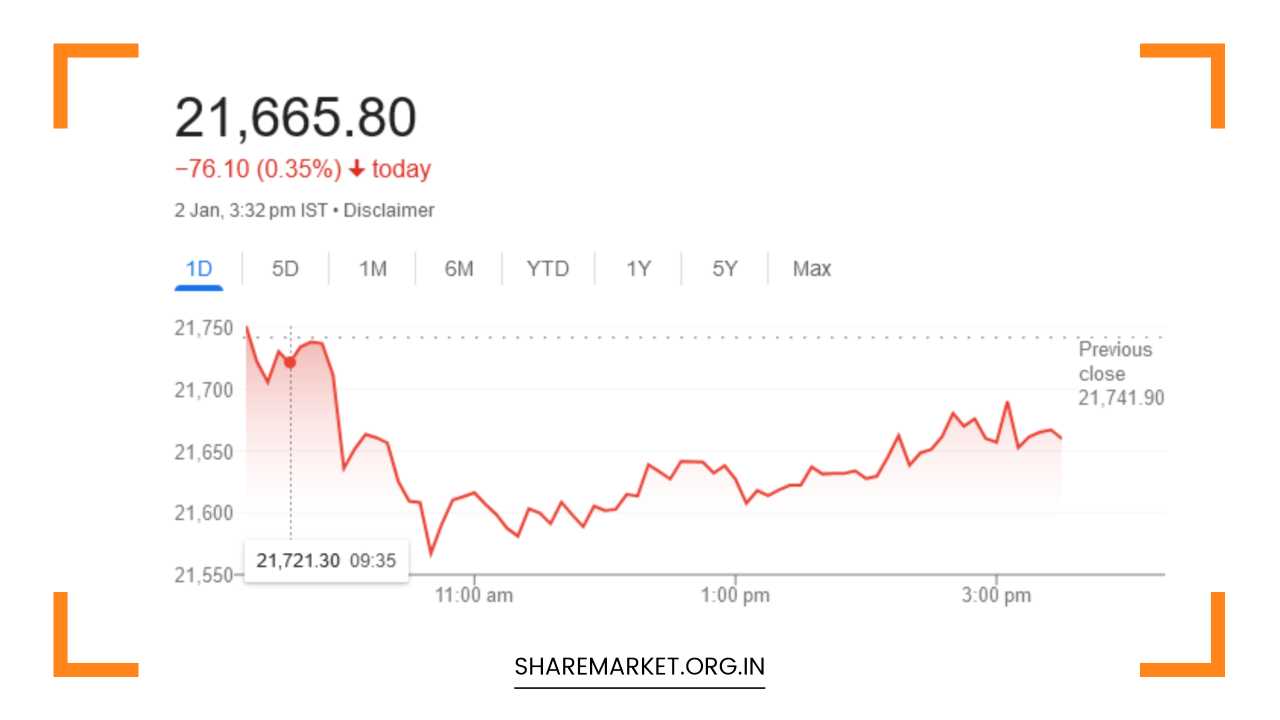

As the curtain closed on the stock market’s trading session on January 2, investors were greeted with a noticeable decline, prompting keen interest and speculation about potential movements on January 3.

This analysis delves into the key market indicators, top-performing and underperforming stocks, sectoral indices, and expert opinions to provide a comprehensive understanding of the prevailing market conditions and the potential trajectory in the coming days.

Market Overview:

On January 2, the Nifty closed at approximately 21,650, registering a decline of 76.10 points or 0.35%. Simultaneously, the Sensex witnessed a more substantial drop of 379.46 points or 0.53%, closing at 71,892.48.

The market activity showcased a mix of bullish and bearish trends, with 1691 shares experiencing gains, 1631 facing declines, and 72 remaining unchanged.

Top Gainers and Losers:

Among the notable losers on the Nifty were Eicher Motors, M&M, UltraTech Cement, L&T, and Kotak Mahindra Bank. Conversely, Coal India, Adani Ports, Sun Pharma, Divis Labs, and Cipla emerged as the top gainers, adding an element of diversity to the market landscape.

This dichotomy in stock performance underscores the dynamic nature of the market and the need for investors to carefully navigate these fluctuations.

Sectoral Analysis:

A closer examination of sectoral indices revealed a mixed picture. The Pharma index emerged as a standout performer, closing up by 2.5%, indicating relative strength in the pharmaceutical sector.

On the flip side, sectors such as Auto, Realty, Capital Goods, Bank, and IT experienced a decline of 1%, contributing to the overall market downturn.

BSE Midcap and Smallcap indices, however, concluded the day on a flat note, further highlighting the nuanced nature of market movements.

Expert Opinions and Projections:

Rupak Dey’s Perspective (LKP Securities): Rupak Dey noted the formation of a bearish candle on the daily Nifty chart, signaling continued weakness in the near term.

He emphasized the significance of the 21,750 level, stating that as long as Nifty remains below this threshold, a weak trend is anticipated. Any attempt to breach 21,750 might encounter selling pressure.

On the flip side, a decisive breakout above 21,750 could inject enthusiasm into the Nifty. Dey identified support at 21,500 on the downside, providing a potential buffer against further declines.

Kunal Shah’s Analysis (LKP Securities): Kunal Shah focused on the persistent bearish pressure observed in Bank Nifty throughout the trading day.

This led to a close below the critical support of 48,000. Shah suggested that to regain fresh momentum, a breakout above the 48,300 resistance in Bank Nifty is essential.

A successful breakout could pave the way for achieving the target levels of 49,000/50,000. Immediate support for Bank Nifty is identified at 47,600, aligned with its 20-day moving average (20DMA). A breach of this support level could intensify the downward momentum.

Ajit Mishra’s Analysis (Religare Broking): Ajit Mishra highlighted the market’s vulnerability to the underperformance of major banking stocks, exerting considerable pressure.

Mishra asserted that for a substantial upward movement, Nifty must successfully close above 21,800. In the current scenario, he recommended focusing on defensive stocks and sectors such as FMCG and Pharma.

These defensive sectors may provide a shield against market volatility until Nifty exhibits a decisive breakthrough above the 21,800 mark, signaling a potential market rise.

Market Implications and Strategic Considerations:

The recent performance of the stock market underscores the importance of a strategic and diversified approach for investors in navigating volatile market conditions.

While the overall sentiment appears cautious, opportunities may arise for those who can discern trends and respond accordingly.

Given the mixed performance across sectors, investors may consider rebalancing their portfolios to mitigate risks and capitalize on potential opportunities.

The standout performance of the Pharma sector suggests a defensive play, and investors may find refuge in allocating resources to pharmaceutical stocks.

The contrasting fortunes of Eicher Motors, M&M, UltraTech Cement, L&T, and Kotak Mahindra Bank as losers on the Nifty caution investors to scrutinize their holdings and adjust portfolios accordingly.

Expert recommendations provide valuable guideposts for investors to consider. Rupak Dey’s emphasis on the 21,750 level as a critical threshold for Nifty highlights the importance of monitoring key support and resistance levels.

A clear breakout above 21,750 could signal a shift in momentum, while failure to breach this level may prolong the prevailing weak trend.

Kunal Shah’s insights into Bank Nifty underscore the significance of the 48,300 resistance level. Investors keen on banking stocks should closely monitor developments around this level, as a breakout could usher in a new wave of positive momentum.

Conversely, a breach of the 47,600 support level could intensify selling pressure, necessitating a cautious approach.

Ajit Mishra’s cautious optimism centers around Nifty’s ability to close above 21,800 for a significant upward movement.

Until this milestone is achieved, defensive stocks in sectors like FMCG and Pharma could serve as safe havens. This strategic shift aligns with a risk-averse approach amid uncertainties in the broader market.

Concluding Thoughts:

In conclusion, the stock market’s recent performance reflects a delicate balance of gains and losses, with sectoral variations adding complexity to the overall landscape.

Expert opinions from analysts at LKP Securities and Religare Broking provide valuable insights into key levels, potential breakout points, and areas of support and resistance.

Investors navigating these volatile times may find wisdom in diversifying their portfolios, closely monitoring key levels identified by experts, and considering defensive stocks in anticipation of market uncertainties.

As the market unfolds on January 3, careful analysis and strategic decision-making will be crucial for investors seeking to navigate and capitalize on potential opportunities.

While uncertainties persist, a well-informed and agile approach can position investors to weather the storm and identify pockets of resilience in the ever-evolving stock market.