Net Avenue Technologies IPO Listing: After Bumper Listing, Shares Locked in Lower Circuit

Net Avenue Technologies IPO Listing

Net Avenue Technologies IPO: Unveiling a Remarkable Debut and Unpacking the Company’s Business Landscape

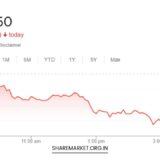

In a dazzling debut on the NSE SME platform on December 8, Net Avenue Technologies captured the market’s attention with a bumper listing.

The opening price of Rs 42 per share marked a staggering premium of more than 133 percent over the upper price band of its Initial Public Offering (IPO).

However, the stock’s jubilant entry into the market encountered a swift descent, with a 5 percent decline prompting the imposition of the lower circuit at Rs 39.90.

Despite this early dip, the overall listing was in accordance with market expectations, a sentiment mirrored in the pre-listing premium of Rs 130 observed in the gray market.

IPO Subscription Frenzy:

The IPO subscription window for Net Avenue Technologies spanned from November 30 to December 4, and it witnessed an unprecedented response from investors.

The subscription rate skyrocketed to an astonishing 511.21 times, with an overwhelming demand for 1,93,85,20,000 shares against the 3,792,000 shares available in the issue.

This exceptional level of subscription is indicative of the strong investor confidence and interest in the company’s growth prospects.

Breaking down the subscription statistics, the reserved portion for qualified institutional buyers experienced a subscription rate of 61.99 times, underlining the institutional interest.

Non-institutional investors demonstrated remarkable enthusiasm with a subscription rate of 616.25 times, while retail investors, known for their discerning approach, subscribed at an astonishing rate of 721.89 times.

These figures not only speak to the attractiveness of Net Avenue Technologies but also signify the diverse appeal it holds across different investor segments.

Financial Details and IPO Utilization:

The IPO size for Net Avenue Technologies was Rs 10.25 crore, with a price band set at Rs 16-18 per share. The company successfully issued 56.96 lakh new shares, capitalizing on the fervent demand in the market.

The proceeds from the fresh shares issued in the public offering are earmarked for specific strategic initiatives. Net Avenue Technologies plans to allocate these funds towards working capital needs, customer acquisition, and general corporate purposes.

However, the stock market’s reaction post-listing reflects the inherent volatility and dynamic nature of market sentiment.

The immediate dip and lower circuit triggered by the stock’s descent to Rs 39.90 underscore the unpredictable nature of market reactions, even for companies with strong fundamentals and robust subscription rates.

Net Avenue Technologies: A Glimpse into Operations:

Net Avenue Technologies has carved its niche in the competitive realm of online digital direct-to-consumer businesses, with a primary focus on Indian ethnic wear and accessories.

The company traces its origins back to 1998 when it was known as Net Avenue Inc. Initiating its journey with the gifting portal chennaibazaar.com, Net Avenue Technologies rapidly diversified its offerings.

Subsequent introductions of portals such as cbazaar.com and ethnicov.com broadened its scope to provide an extensive array of ethnic clothing and jewelry.

Despite the stock market turbulence following its IPO, Net Avenue Technologies boasts a diversified portfolio of portals, reflecting its adaptability and responsiveness to evolving consumer preferences in the digital marketplace.

The company’s journey from a gifting portal to a comprehensive provider of ethnic wear and accessories underscores its ability to stay attuned to market demands and consumer trends.

Financial Performance Analysis:

Examining Net Avenue Technologies’ financial performance for the fiscal year 2022-23 reveals a mixed picture.

While the company achieved a commendable 5.34 percent growth in revenue, signaling positive momentum, the net profit registered a notable decline of 32.55 percent. Such a contrast prompts a deeper dive into the specific factors influencing the bottom line.

The online retail sector is known for its dynamism and constant evolution, with consumer preferences, competitive landscapes, and economic conditions playing pivotal roles.

The substantial dip in net profit invites scrutiny into the areas where Net Avenue Technologies faces challenges and potential strategies for future improvement.

Navigating the intricacies of the online retail space demands not only a robust business model but also agility in adapting to changing market dynamics.

As Net Avenue Technologies seeks to solidify its position in the sector, it must strategically address challenges and capitalize on opportunities to ensure sustained growth.

Strategic Initiatives and Future Prospects:

With the capital infusion from the IPO, Net Avenue Technologies is poised to embark on strategic initiatives aimed at fortifying its market presence.

Working capital enhancements, customer acquisition strategies, and general corporate purposes are on the agenda for utilization of the IPO proceeds.

The online retail sector is undergoing transformative changes, with technology and consumer preferences shaping the landscape.

Companies that can adapt to these changes and innovate in their approach are likely to thrive in this competitive space. Net Avenue Technologies’ strategic vision and ability to leverage emerging trends will be critical in navigating the dynamic digital retail landscape.

Final Remarks

Net Avenue Technologies’ IPO listing has been a rollercoaster ride, marked by a spectacular premium, a swift descent triggering lower circuits, and an overall listing that aligns with market expectations.

The company’s ability to navigate the aftermath of its IPO and channel the raised capital for strategic initiatives will be closely monitored by investors and industry observers.

The coming quarters will provide insights into how Net Avenue Technologies leverages the momentum gained through the IPO, addresses challenges in the online retail sector, and positions itself for sustained growth.

The company’s journey from its inception in 1998 to its recent IPO underscores the resilience and adaptability required to succeed in the competitive world of e-commerce.

As the chapters unfold, Net Avenue Technologies has the opportunity to showcase its true potential in the digital marketplace. Investors, industry analysts, and stakeholders will be keenly watching as the company navigates this critical phase of its journey.