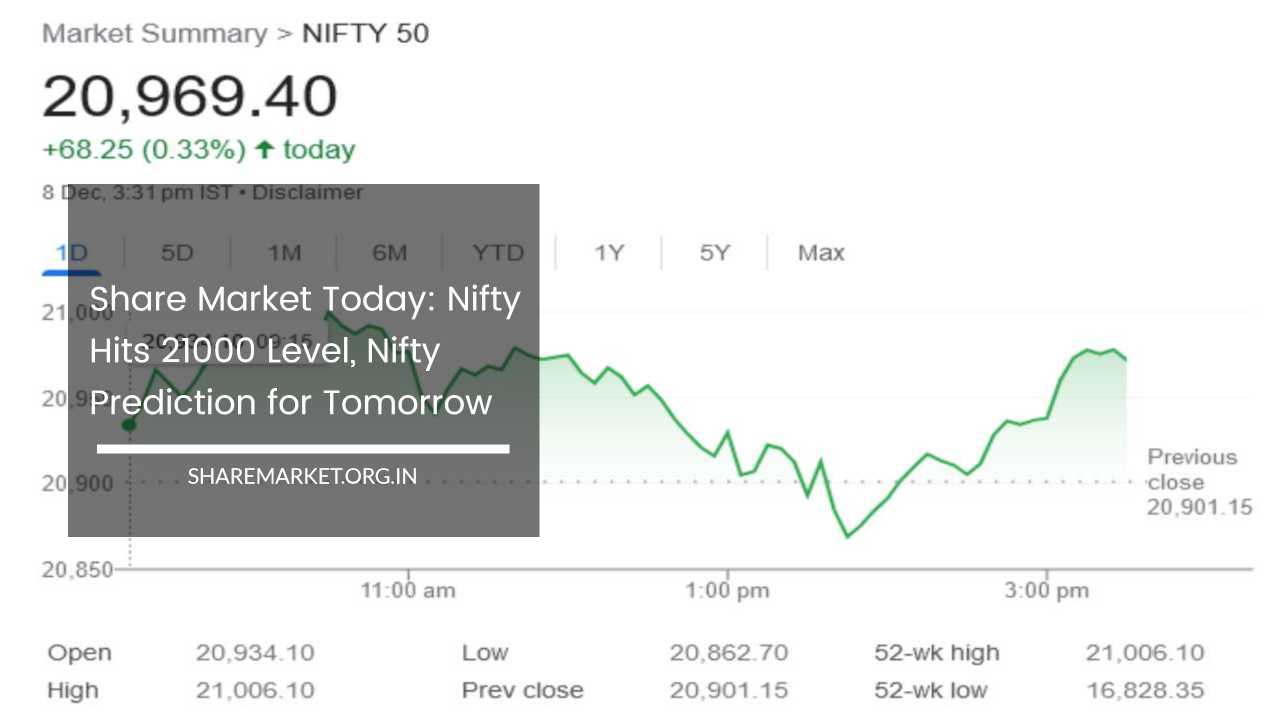

Share Market Today: Nifty Hits 21000 Level, Nifty Prediction for Tomorrow

Share Market Today

Indian Stock Market: Unraveling the Dynamics of a Pivotal Week

The Indian stock market has wrapped up the week ending today on a high note, boasting its most substantial weekly gain since July 2022.

This period witnessed a remarkable surge in both the Sensex and Nifty, with gains surpassing 3 percent, while the Nifty Bank emerged as the standout performer with an impressive growth of over 5 percent.

The trading session on December 8, in particular, unfolded against a backdrop of volatility, culminating in a day marked by noteworthy market dynamics.

Closing Figures: Navigating Volatility with Gains

On December 8, amid fluctuations and shifts in investor sentiment, the Indian markets managed to close with gains.

The Nifty, a key indicator for the National Stock Exchange (NSE), concluded the day around 20,950, showcasing resilience in the face of market dynamics.

Simultaneously, the Bombay Stock Exchange (BSE) recorded a positive gain, closing at 69,825.60, reflecting an increase of 303.91 points or 0.44 percent.

The Nifty closed at 20,969.40, further affirming the positive sentiment with a gain of 68.25 points or 0.33 percent.

Breaking down the trading activity on the NSE, of the 2,611 traded shares, 1,060 experienced an uptrend, 1,435 faced a decline, and 116 remained unchanged.

This pattern highlights the nuanced movements in individual stocks and the varied reactions among market participants.

Top Gainers and Losers: Sectoral Contributions

The landscape of top gainers and losers provided insight into the diversity of sectors contributing to the market’s positive momentum. HCL Technologies, JSW Steel, LTI Mindtree, Apollo Hospitals, and Infosys emerged as the top gainers on the Nifty.

Their performance underscores the varied sectors experiencing growth and contributing to the overall market uptrend.

On the flip side, Adani Enterprises, ITC, Adani Ports, Hero MotoCorp, and Britannia Industries faced declines and were identified as the top losers, reflecting the challenges encountered by these specific companies.

Sectoral Performance: Nuances in the Market Tapestry

A closer examination of different sectors revealed a nuanced picture. There was a 1 percent decline in FMCG, Oil and Gas, and Power indices, indicating the challenges and headwinds faced by these sectors.

The health care and auto sectors also experienced a 0.5 percent decrease. However, the Bank, IT, and Realty sectors closed 0.5-1 percent higher, signaling relative strength and investor confidence in these segments.

Weekly Overview: A Milestone in Market Resilience

The standout feature of this week’s market activity was the substantial weekly increase, a feat not witnessed since July 2022. Both the Sensex and Nifty recorded a surge of more than 3 percent, signaling a resurgence in investor optimism.

The Nifty Bank, with an impressive growth of over 5 percent, played a pivotal role in driving the overall market sentiment.

Additionally, the midcap index demonstrated resilience, closing with gains for the 6th consecutive week, underscoring the breadth of the market rally.

Market Analysts’ Perspectives: Decoding Market Dynamics

Market analysts offered valuable perspectives on the factors influencing market dynamics during this pivotal week.

Vinod Nair’s Insights:

Vinod Nair of Geojit Financial Services provided insights into the impact of the Reserve Bank of India’s (RBI) recent decisions.

The RBI’s balanced approach, which included raising economic growth forecasts while expressing concerns about food inflation, is seen as a positive factor influencing the market in the short term.

This balancing act indicates a thoughtful response to the economic landscape, injecting confidence into the investor community.

However, concerns about rising food grain prices, indicated by declining Rabi sowing and reservoir levels, had a discernible impact on FMCG shares, contributing to their weaker performance.

Ajit Mishra’s Tactical Analysis:

Ajit Mishra from Religare Broking provided a detailed analysis of the day’s trading session. He noted that the markets traded within a range, experiencing slight gains at the close.

Notably, Nifty briefly touched the “21000” mark in early trade, indicating the potential for an upward trajectory.

However, profit-booking in leading stocks tempered the gains. A resurgence in IT majors and fresh buying in select private banking counters re-energized the market, leading to Nifty’s closing at 20,969.40. Despite strong performance in recent days, mid and small caps faced downward pressure.

Rotational buying in large-cap stocks has been evident, and this trend is expected to continue. Mishra suggested that support for Nifty is identified in the 20,700-20,800 zone, while profit booking could occur around the 21,200 level.

Traders are advised to exercise caution in stock selection, with banking and IT sectors being preferable for long trades.

Jatin Gedia’s Technical Perspective:

Jatin Gedia of Sharekhan provided additional insights, highlighting that Nifty opened with a flat trend on the discussed day.

After initial fluctuations, it witnessed a pullback to close at its all-time high, marking a positive development. On the chart, Nifty has started rising again after two days of consolidation. However, momentum indicators are overbought, signaling caution at upper levels.

The recommended strategy is to maintain a long position with a trailing stop-loss mechanism. Support for Nifty is visible at 20,860 – 20,800, and any decline should be viewed as a buying opportunity, considering the overall positive market trend. On the upside, immediate resistance is seen at 21,060-21,100.

Macro Factors and Economic Indicators: A Holistic View

While the week’s market dynamics were influenced by immediate factors and trading patterns, it’s crucial to consider broader economic indicators and macro factors shaping the market landscape.

Central Bank’s Role:

The RBI’s decisions, as reflected in its balanced approach, play a pivotal role in shaping market sentiment.

The combination of raising economic growth forecasts and expressing concerns about food inflation is indicative of a nuanced understanding of the economic landscape.

This delicate balance is aimed at fostering short-term market confidence while addressing potential challenges.

Food Inflation Concerns:

The concerns about rising food grain prices, echoed by declining Rabi sowing and depleting reservoir levels, are critical factors influencing specific sectors, particularly FMCG.

The impact on FMCG shares, as noted by Vinod Nair, highlights the intricate interplay between economic indicators and sector-specific dynamics.

Technical Analysis: Charting the Path Forward

Jatin Gedia’s technical analysis adds another layer to the understanding of market dynamics. The overbought nature of momentum indicators signals caution at upper levels, emphasizing the importance of strategic trading.

The recommended strategy of maintaining a long position with a trailing stop-loss mechanism aligns with a cautious yet optimistic outlook.

Strategic Trading Outlook: A Call for Caution and Selectivity

The insights from market analysts converge on a common theme – a call for caution and selectivity in trading strategies.

The rotational buying observed in large-cap stocks suggests a nuanced market where strategic stock selection becomes paramount.

Traders are advised to tread carefully, considering potential support and resistance levels, and placing emphasis on sectors like banking and IT for long trades.

Looking Ahead: Market Resilience and Challenges

As the market continues to navigate through dynamic conditions, investors are advised to stay attuned to sectoral movements and evolving trends, exercising prudence in their trading strategies.

The recent week’s impressive gains reflect a renewed sense of optimism and resilience in the market.

While challenges and uncertainties persist, the positive momentum and analyst sentiments suggest that the Indian stock market remains an area of keen interest for investors and observers alike.

Final Remarks: Deciphering Signals in a Complex Landscape

In conclusion, the Indian stock market’s performance in the week ending today serves as a microcosm of the broader economic landscape.

The intricate interplay of macroeconomic factors, central bank decisions, sectoral dynamics, and technical indicators creates a complex tapestry.

Investors and traders alike must navigate through these dynamics with a keen understanding of the nuanced factors at play.

The substantial weekly gain, a notable feat after several months, signifies a resurgence in market optimism. However, the cautionary notes from analysts remind us that this optimism is tempered with an awareness of potential challenges.

Rising food inflation, sector-specific headwinds, and overbought technical indicators serve as reminders of the multifaceted nature of the market.

As the chapters of market dynamics continue to unfold, stakeholders in the Indian stock market will closely monitor how these narratives evolve.

The coming weeks may offer further insights into the sustainability of the current momentum and the emergence of new trends.

In the ever-changing landscape of financial markets, adaptability and strategic acumen remain the keys to success. Investors, analysts, and market participants will continue deciphering signals, making informed decisions, and navigating the intriguing terrain of the Indian stock market.