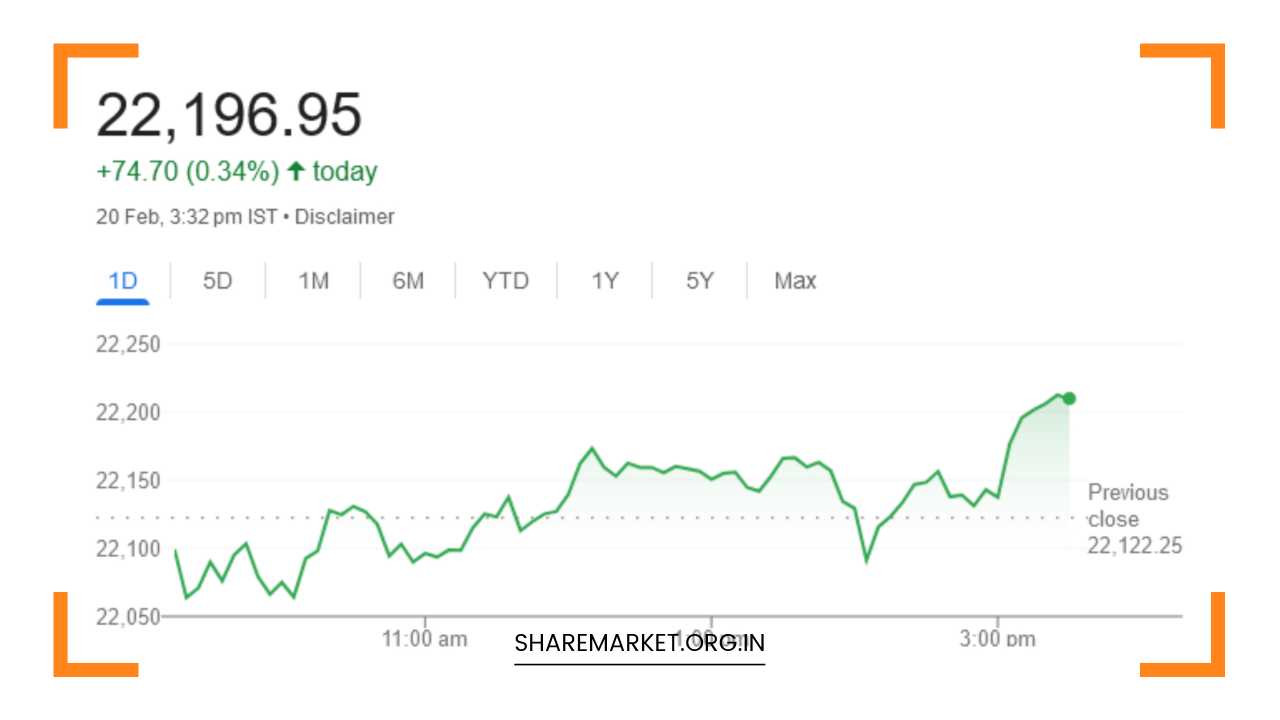

Nifty Closed at 22,197; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Market Highlights: A Day of Gains and Losses

In the ever-dynamic world of financial markets, today’s trading session showcased a mix of gains and losses among prominent stocks.

Power Grid Corporation, HDFC Bank, Axis Bank, NTPC, and Kotak Mahindra Bank emerged as the top gainers, while Hero MotoCorp, Coal India, Bajaj Auto, Eicher Motors, and TCS faced declines, marking them as the leading losers.

These fluctuations underscore the continuous interplay of various factors that shape market dynamics, including economic indicators, corporate performance, and global events.

Broader Market Trends: Sixth Consecutive Day of Uptrend

Zooming out to assess the broader market trends, February 20 witnessed a substantial uptrend, marking the sixth consecutive day of gains.

Nifty, the benchmark index, breached the psychological barrier of 22,200 for the first time, signaling a bullish sentiment. By the close of trading, the Sensex, representing the top 30 stocks on the BSE, settled at 73,057.40, posting a gain of 349.24 points or 0.48 percent.

Simultaneously, Nifty closed at 22,197.00, recording a gain of 74.70 points or 0.34 percent. A deeper dive into the market activity reveals that 1661 stocks experienced positive movements, 1667 stocks witnessed declines, and 65 stocks remained unchanged.

However, the BSE Midcap and Smallcap indices bucked the trend, closing with marginal losses.

Sectoral Dynamics: A Tale of Divergence

Delving into sectoral indices, there was a discernible uptick of 0.8-2 percent in the Bank, Media, Power, and Realty sectors.

In contrast, the Auto, IT, and Metal sectors faced setbacks, experiencing declines of approximately one percent. This sectoral analysis sheds light on the diverse performance of different industries, adding nuance to the overall market narrative.

Insights for February 21: Expert Perspectives

As investors eagerly anticipate the market’s trajectory on February 21, financial experts offer their insights.

Kunal Shah’s Bullish Outlook on Bank Nifty:

Kunal Shah of LKP Securities underscores the sustained dominance of bulls in the Bank Nifty. He points out that the index closed above the crucial 47000 level, signaling a robust buying sentiment.

The immediate support for Bank Nifty is identified at 46700, corroborated by recent put writing. Shah suggests that any market dips should be viewed as buying opportunities.

Looking ahead, he projects a short-term target of 48000 for Bank Nifty, reinforcing the bullish outlook.

Rupak De’s Comprehensive Analysis of Nifty’s Momentum:

Rupak De, also from LKP Securities, provides a comprehensive analysis of Nifty’s upward momentum. After a consolidation breakout on the daily chart, Nifty has continued its ascent, maintaining itself above both the psychological level of 22000 and the 21EMA on the daily timeframe.

De anticipates that upon decisively crossing the 22200 mark, Nifty may aim for higher levels around 22400/22600.

To provide a risk management perspective, De identifies support at the lower end, situated at 22000. This analysis provides investors with a clear roadmap for potential entry and exit points.

Aditya Gaggar’s Perspective on Nifty’s Record Highs:

Aditya Gaggar, the Director of Progressive Shares, sheds light on Nifty’s recent performance, emphasizing a late surge in heavyweights that propelled Nifty to close at another record high of 22,196.95, accompanied by a gain of 74.70 points.

Gaggar notes the breakout from the Ascending Triangle formation with a bullish candle, a technical pattern signaling a potential upward trend. According to this pattern, Gaggar sets a target of 23,120 for Nifty, projecting further optimism in the market.

Bank Nifty’s Noteworthy Movements:

Bank Nifty’s movements are particularly noteworthy in today’s trade. Not only did it breach its 50DMA barrier, but it also surpassed the 46,580 level, marking a significant milestone.

Looking ahead, the next resistance for Bank Nifty is identified at 47,730. On the downside, support is identified at 46,340.

This nuanced analysis by Gaggar provides investors with a detailed understanding of potential levels to watch for in the coming sessions.

Final Remarks: Cautious Optimism Prevails

In summary, these expert opinions collectively paint a cautiously optimistic picture of the market. The bullish sentiments observed in Bank Nifty, coupled with Nifty’s record highs and sectoral dynamics, hint at positive trends.

However, the analysts also emphasize the importance of vigilance, suggesting that investors carefully monitor support and resistance levels for informed decision-making.

The potential buying opportunities highlighted by experts underscore the importance of strategic and well-informed investment decisions in navigating the intricacies of today’s dynamic market landscape.

As investors brace for further market movements, these insights provide valuable guidance in navigating the complex and ever-evolving world of financial markets.