Nifty Closed Near 21000, Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

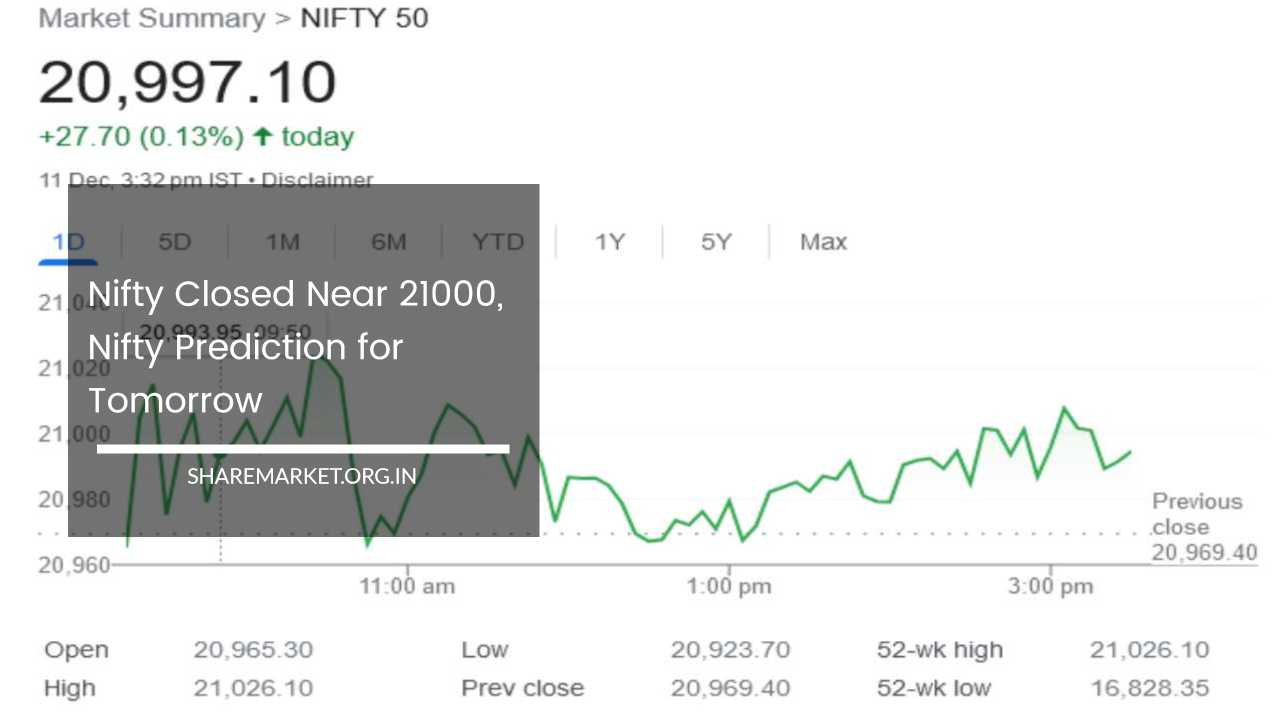

Market Update: December 11, 2023

Closing Numbers:

In a day marked by cautious movements, the market concluded with the Nifty index settling at 20,997.10, registering a gain of 27.70 points.

As of December 11, amidst notable fluctuations, Nifty managed to close around the 21,000 mark. The Sensex, reflecting the broader market sentiment, closed at 69,928.53, marking a gain of 102.93 points or 0.15%.

Simultaneously, Nifty exhibited an increase of 27.70 points or 0.13%, closing at 20,997.10.

The day witnessed a mixed bag of market dynamics, with approximately 2,211 shares recording gains, 1,358 experiencing losses, and no change observed in 174 shares.

Top Gainers and Losers:

Among the notable gainers on Nifty were UPL, UltraTech Cement, Bajaj Auto, Adani Enterprises, and LTIMindtree. On the flip side, the top losers included Dr Reddy’s Laboratories, Cipla, Axis Bank, BPCL, and M&M. The day’s market movements reflect a blend of sector-specific performances and individual stock dynamics.

Sectoral Performance:

A closer look at the sectoral indices unveils a diverse landscape. The PSU Bank, FMCG, Capital Goods, Power, Metal, and Realty indices closed with gains ranging from 0.5% to 1%.

However, the Pharma index experienced a marginal decline of 0.4%. The BSE Midcap index exhibited notable strength, marking a 1% increase, while the Smallcap index showed resilience with a 0.7% gain.

This sectoral diversity underscores the nuanced nature of market movements, with different industries responding to distinct drivers.

Market Analyst Insights:

Aditya Gaggar, Director of Progressive Shares, sheds light on the market’s behavior, characterizing it as moving within a limited range.

Despite this, Nifty managed to close at 20,997.10 with a gain of 27.70 points. Gaggar notes that, except for the Pharma sector, all other sectoral indices closed in the green.

Notably, PSU banks and media stocks emerged as the day’s biggest gainers. Volume-based buying in railway shares added an interesting dimension to the day’s trading.

Despite the range-bound trading, the positive market breadth suggests a heightened interest in small-cap stocks, leading to outperformance in mid and smallcap indices.

Taking a technical perspective, Gaggar points out that Nifty has exhibited fluctuations within a tight range over the past few days.

However, the positive aspect is that the support level has shifted upwards. According to his analysis, the immediate resistance for Nifty stands at 21,090, while on the downside, support is observed at 20,900.

Vinod Nair, from Geojit Financial Services, provides additional insights into the market’s dynamics. Nair notes that the Sensex surpassed the significant psychological level of 70,000 on the mentioned day.

While the broader market outperformed the benchmark indices, profit-booking was witnessed at higher levels.

Traders were cautious, anticipating cues from the Index of Industrial Production (IIP) along with crucial inflation data set to be released in the coming days, both in the US and India.

Nair highlights the anticipation of stable inflation in the United States, but there is market apprehension regarding a potential increase in domestic inflation.

He notes that despite these concerns, the market received a boost from better-than-expected US jobs data and a modest rise in US bond yields from recent lows. These factors encouraged investors to book profits at higher levels.

Investors are closely monitoring the Federal Open Market Committee (FOMC) meeting for insights into future interest rate policies. However, Nair mentions that the prevailing expectation is for rates to remain status quo during this particular meeting.

Jatin Gedia of Sharekhan offers a daily chart perspective, noting that Nifty opened on a flat note and continued consolidating within a range, ultimately closing with a slight gain of 20 points.

From a short-term perspective, Nifty is observed trading around the 21,000 level, which serves as a psychological barrier.

Gedia highlights the overall positive trend in the market and suggests that any decline towards 20,870-20,850 should be considered a buying opportunity.

Gedia’s analysis also points out that after the strong rise witnessed in the previous week, the market is expected to remain stable or exhibit slow-paced growth.

He anticipates that due to sector rotation and the rise of specific stocks, the market may see an upward trend in the short term.

The rise in Bank Nifty also continued on the mentioned day, closing with a slight gain. However, selling pressure was encountered around the 47,500 levels.

Looking ahead, Gedia expects some consolidation in Bank Nifty, projecting a consolidation range of 46,800 – 47,500.

Despite this, the overall trend in Bank Nifty remains positive, with any decline presenting an opportunity for investors.

Future Outlook:

As the market navigates through a series of fluctuations and consolidations, investors are advised to maintain a vigilant stance.

The positive trend in Nifty, coupled with the stable performance of Bank Nifty, reflects an overall optimistic outlook.

However, external factors such as global economic indicators, particularly inflation data, remain pivotal in shaping market sentiment.

The anticipated consolidation in Bank Nifty aligns with broader expectations for a stabilizing trend. Investors are encouraged to closely monitor cues from the upcoming FOMC meeting, which may provide crucial insights into future interest rate policies.

The prevailing expectation is for rates to remain unchanged during this meeting, but market participants will be attuned to any nuanced shifts in the central bank’s stance.

Jatin Gedia’s observation that the market may witness a rise in the short term, driven by sector rotation and the ascent of specific stocks, underscores the importance of strategic stock selection.

Investors should remain agile, capitalizing on buying opportunities during declines and carefully considering sectoral dynamics.

In conclusion, while the market demonstrates resilience and positive undertones, it remains subject to external factors and global economic developments.

Market participants are encouraged to stay informed, exercise caution, and consider a diversified and well-informed approach to navigate the dynamic landscape of the stock market.