Nifty gain 97 Points and Closed at 21840; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Market Analysis and Outlook: A Rollercoaster Day in the Stock Market

The trading day of February 13 unfolded with a mix of uncertainty and resilience in the stock market, witnessing a rollercoaster ride that eventually culminated in a robust recovery.

Despite an initial dip in the market, the closing hours saw a remarkable turnaround, highlighting the dynamic nature of financial markets.

In this comprehensive analysis, we delve into the key indices’ performances, sectoral dynamics, and expert opinions to gain a nuanced understanding of the market trends and potential movements on February 14.

Market Performance Overview:

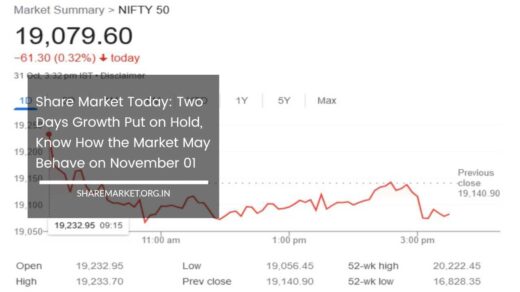

The stock market on February 13 exhibited a seesaw pattern, characterized by an early decline followed by a significant recovery in the later hours.

The Sensex, the benchmark index, experienced an impressive surge of 278 points, reaching a closing figure of 71,833. Similarly, the Nifty index recorded a positive upswing, gaining 97 points to conclude at 21,840.

The banking sector, represented by Bank Nifty, displayed strength with a substantial rise of 406 points, closing at 45,908.

Sectoral Dynamics:

The day’s standout performers included the Public Sector Enterprises (PSE), PSU Bank, and Energy shares, contributing to the overall positive momentum in the market.

Metal, auto, and infra indices also posted gains, indicating a broad-based recovery across various sectors. However, the IT and pharma sectors faced selling pressure, underscoring the market’s selective nature.

Midcap and smallcap shares garnered buying interest, reflecting a willingness among investors to explore opportunities beyond large-cap stocks.

Banking stocks, in particular, showcased resilience as buying activity emerged from lower levels, resulting in a substantial rise of 496 points in the midcap index, which closed at 48,332.

Individual Stock Performance:

Among the 30 stocks listed on the Sensex, 17 witnessed buying activity, reflecting a mixed sentiment among investors.

A similar trend was observed in the Nifty index, where 35 out of the 50 stocks experienced positive traction. Bank Nifty, with 9 out of its 12 shares witnessing buying, further contributed to the positive sentiment.

However, the currency market painted a contrasting picture as the rupee weakened against the dollar, depreciating by 3 paise and closing at 83.03.

Expert Opinions and Market Outlook:

As market participants eagerly anticipate the movements on February 14, industry experts offer valuable insights and forecasts to guide investors in navigating the current market landscape.

Ajit Mishra from Religare Broking acknowledges the market’s resilience amidst weak global signals. He views the day’s pullout as a sign of consolidation amid mixed signals, suggesting that this trend might persist in the near future.

Mishra advises traders to approach the market cautiously, emphasizing the importance of selectively investing in quality stocks and avoiding overly aggressive strategies.

Jatin Gedia of Sharekhan analyzes Nifty’s performance, noting its opening in the red but swift recovery throughout the day.

Gedia observes that bulls came forward swiftly to support the index, resulting in a gain of 97 points. On the daily chart, Nifty maintained support levels, and shopping activity was observed throughout the day.

Gedia suggests that Nifty has reached the upper end of the falling channel on the hourly chart, indicating potential consolidation with a positive trend.

He identifies immediate resistance levels for Nifty at 22,000 – 22,020, with support in the zone of 21,650 – 21,670.

Rupak Dey of LKP Securities provides a perspective on Nifty’s volatility, highlighting its bullish trend throughout the day following a weak start.

Dey identifies the critical level of 21,850, stating that as long as Nifty remains below this point, the negative trend will persist.

However, if Nifty surpasses 21,850, a strong rally may ensue, potentially moving towards 22,200. Dey underscores that the short-term support for Nifty is at 21,700.

Final Remarks:

In conclusion, the stock market’s fluctuations on February 13 underscore the delicate balance between optimism and caution among investors.

The robust recovery in key indices and notable performances in specific sectors reflect the market’s resilience.

However, the selective nature of buying, pressure on certain sectors, and the currency market’s dynamics highlight the need for a nuanced approach.

As traders gear up for the trading session on February 14, expert opinions suggest a cautious yet strategic stance.

The emphasis on selective investments in quality stocks, attention to crucial support and resistance levels, and an awareness of potential consolidation underscore the importance of a well-informed and measured approach in navigating the current market scenario.

As financial markets continue to respond to a myriad of factors, staying attuned to expert analyses and market dynamics will be essential for investors seeking to make informed decisions.