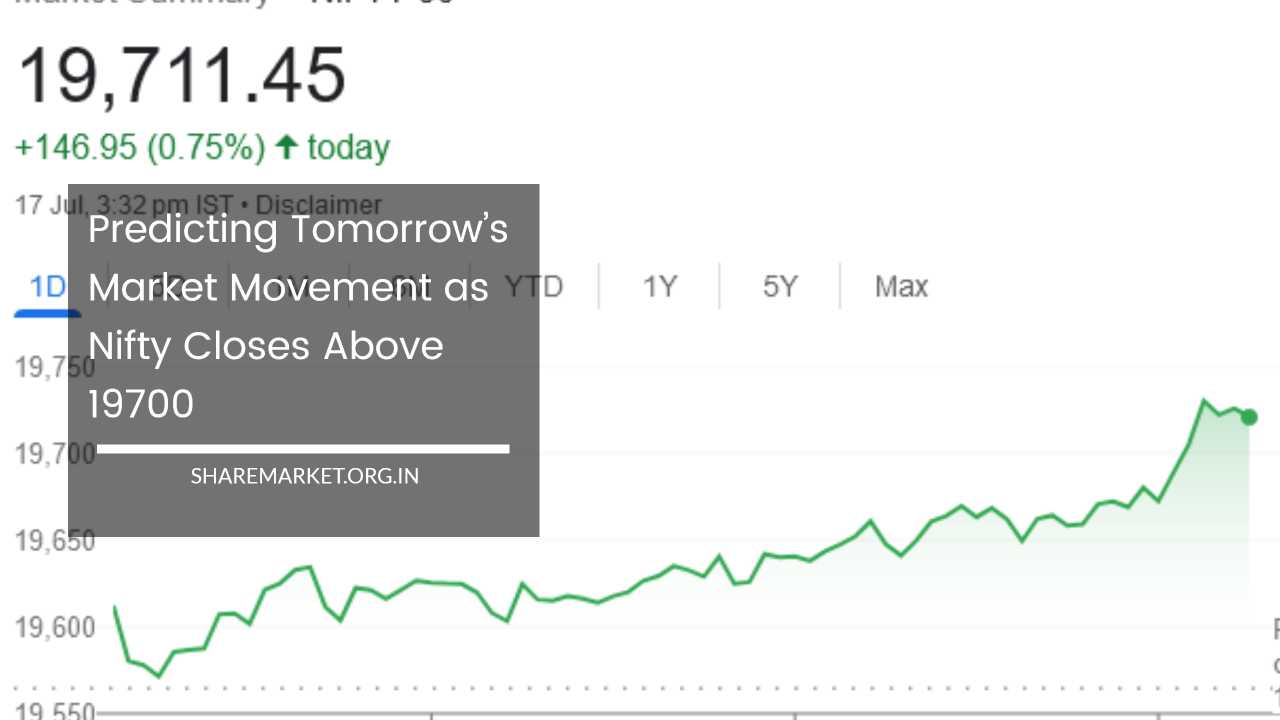

Predicting Tomorrow’s Market Movement as Nifty Closes Above 19700

Nifty Closes Above 19700

Nifty Closes Above 19700 with Gains, Predicting a 19567-19800 Trading Range and Potential Correction

On 17th July, the Indian stock market closed on a positive note, with the Nifty managing to surpass the significant level of 19700.

The Sensex, the benchmark index of the Bombay Stock Exchange (BSE), closed at 66,589.93, registering a gain of 529.03 points or 0.80 per cent. Simultaneously, the Nifty surged by 147.00 points or 0.75 per cent, ending the trading day at 19711.50.

The overall market sentiment was optimistic, with around 2013 shares witnessing gains, while 1559 shares faced declines, leaving 174 stocks unchanged.

Key Gainers and Losers:

Among the prominent gainers on the Nifty were State Bank of India, Dr. Reddy’s Laboratories, Wipro, Grasim Industries, and HDFC Bank. On the flip side, notable losers included Hero MotoCorp, ONGC, Bharti Airtel, Tata Motors, and JSW Steel.

The BSE Midcap index concluded with a moderate gain of 0.3 per cent, while the Smallcap index recorded a more substantial gain of 1 per cent.

Sectoral Performance:

With the exception of the Auto sector, all other sectoral indices ended the day with gains. The PSU Bank Index showed a notable surge of 2 per cent, and the Nifty Bank Index also performed well, rising by 1 per cent.

These indices’ positive performance indicates that the banking sector is likely to remain in the limelight in the near term.

Currency Market:

In the currency market, the Indian rupee displayed strength, gaining 13 paise to close at Rs 82.04 against the US dollar.

This compared favorably to the previous close of 82.17 on Friday. The rupee’s gain can be attributed to positive market sentiment and foreign capital inflows into the Indian markets.

Market Predictions for Tomorrow:

Given the Nifty’s closing above 19700 and the broader market’s positive outlook, market analysts predict a potential trading range between 19567 and 19800 for the Nifty index.

This range suggests that the market may see fluctuations within these levels, and traders should be cautious about their positions.

It is essential to highlight that after a sustained upward movement, a correction in the market might be on the horizon.

A correction is a normal part of market cycles and often follows extended periods of bullish trends. Investors and traders should keep a close eye on the market movements and be prepared for potential corrections, as they can offer buying opportunities for those looking to enter the market at more favorable prices.

Banking Sector in Focus:

The banking sector has been in focus recently, with the PSU Bank Index and the Nifty Bank Index showing significant gains.

This trend is likely to continue in the near term, as the banking sector plays a crucial role in the Indian economy.

Factors such as government policies, interest rates, and economic conditions can impact the banking sector’s performance, so investors should closely monitor these factors while making investment decisions in banking stocks.

Conclusion:

In conclusion, the Indian stock market closed on a positive note, with the Nifty crossing the 19700 mark and the Sensex registering gains.

Market analysts anticipate a trading range of 19567-19800 for the Nifty in the coming sessions. However, caution should be exercised as a correction may be on the horizon after a prolonged bullish trend.

Investors should closely monitor market movements and stay updated on economic and policy developments to make informed decisions.

Additionally, the banking sector is expected to remain in the limelight, presenting potential investment opportunities for traders and investors alike.

As with any investment, a careful and prudent approach is recommended to navigate the dynamic market environment successfully.

Market Outlook for July 18: Positive Momentum Continues with Bullish Indicators

As the Indian stock market approaches July 18, Jatin Gedia of Sharekhan analyzes the recent market trends and provides insights into the potential movements of Nifty and Bank Nifty indices.

Nifty’s Trend and Technical Analysis:

The trading day preceding July 18 showed a notable trend of follow-through buying in the Nifty index. It closed with a gain of 147 points, indicating strong buying interest in the market. On the daily chart, a significant breakthrough occurred as Nifty broke out of its sideways consolidation range.

This breakout suggests that the index has now entered into a trending phase. Furthermore, a positive crossover in the daily momentum indicator indicates a bullish buying sentiment among investors.

Additionally, the daily Bollinger Bands, a technical indicator that measures volatility and price range, have started to expand.

This expansion suggests that Nifty’s trading range is widening, and the potential for larger price movements has increased. Taken together, these technical indicators point towards a continuation of the market’s upward trajectory.

Key Levels for Nifty:

Based on the technical analysis, there is an immediate resistance zone for Nifty, which lies around 19830-19900. If the index manages to surpass this resistance level, it could open up further upside potential. On the other hand, there is a support zone near 19570-19550, which could act as a buffer in case of any downward corrective moves.

Bank Nifty’s Breakout and Potential Upside:

Bank Nifty, on the other hand, witnessed a significant development on the preceding trading day. It broke out of its descending channel pattern, indicating the end of its consolidation phase.

This breakout suggests that the banking sector is likely to experience a sharp upward movement in the coming trading sessions.

With the consolidation phase over, Bank Nifty could be poised for a potential rally towards the 46500 levels in the short term. Investors and traders in the banking sector can expect improved sentiment and increased buying interest, which may drive prices higher.

Support Level for Bank Nifty:

While the potential upside looks promising, it is essential to consider possible downside scenarios. For Bank Nifty, a support level is observed at 44700, indicating a potential floor for the index in case of any corrective moves.

Market Sentiment and Conclusion:

The technical indicators and trend analysis suggest a positive market sentiment for both Nifty and Bank Nifty. The breakout in Nifty’s daily chart and the expansion of Bollinger Bands signal further upward momentum, while the positive breakout in Bank Nifty indicates the potential for significant gains in the banking sector.

However, as with any financial market, there are inherent risks and uncertainties. Traders and investors should exercise caution and implement risk management strategies while navigating the markets.

News events, global economic developments, and geopolitical factors can impact market sentiment, leading to unexpected price movements.

Market Outlook Based on Analyst Opinions: Nifty Hits Record High, Positive Indicators Suggest Further Growth

As the Indian stock market experienced a surge on July 17, Rupak Dey of LKP Securities and Deepak Jasani of HDFC Securities provide insights into the factors driving the market’s performance and predictions for the near future.

Strong Performance of Key Sectors:

Nifty’s impressive rally was driven by the robust performance of key sectors such as Information Technology (IT), big banks, and Reliance Industries. These sectors’ contributions helped Nifty achieve a new record high, showcasing the underlying strength of the market.

Nifty’s Technical Analysis:

On the daily chart, Nifty demonstrated a significant breakout from a period of consolidation. This breakout signals a positive change in the market’s momentum, suggesting that the bullish sentiment is likely to persist.

Furthermore, the Relative Strength Index (RSI) also exhibited a bullish crossover, further reinforcing the notion of potential growth in the market.

Immediate Resistance and Support Levels:

Nifty faces immediate resistance around 19725-19750 levels. If the index manages to breach this resistance zone, it could open up opportunities for further upside movement. Conversely, support for Nifty is visible at the lower level around 19600, which may provide a cushion in case of any corrective pullbacks.

Volume and Smallcap Index Gains:

On July 17, Nifty reached a new all-time high, closing at 19711.45, with a gain of 0.75 per cent or 146.9 points. This surge was accompanied by high trading volumes on the National Stock Exchange (NSE), indicating strong participation from investors.

The Smallcap index outperformed the Nifty, showing higher gains, which suggests broad-based market strength.

Global Market Influences:

While Indian markets soared, some European and Asian stocks experienced declines on the same day. This was attributed to concerns over the Chinese economy’s growth rate, which was reported to be slower than expected.

Investors’ patience was tested as there were no announcements regarding a stimulus package from the Chinese government at that time.

Global market dynamics can impact Indian markets, and investors should remain vigilant about international economic developments.

Expected Trading Range for Nifty:

Given the recent market trends and technical indicators, analysts predict a trading range of 19567-19800 for Nifty. This range implies that Nifty may experience fluctuations within these levels, and investors should be prepared for potential corrections amid the ongoing bullish sentiment.

Banking Sector in Focus:

The banking sector and related stocks are likely to remain in the headlines in the near term. As evidenced by the breakout in Bank Nifty on the preceding day, investors can expect significant developments in this sector, which may further contribute to the market’s overall performance.

Conclusion:

The Indian stock market’s recent record high, driven by strong performances in the IT sector, big banks, and Reliance Industries, suggests positive momentum and potential for further growth.

Technical indicators, such as the breakout from consolidation and bullish RSI crossover, reinforce the optimistic outlook.

However, market participants should closely monitor resistance and support levels and stay informed about global market dynamics to make well-informed investment decisions.

While the potential for a trading range of 19567-19800 exists, some corrections may be observed.

The banking sector’s performance and developments in the Chinese economy are among the key factors to watch closely in the near future.