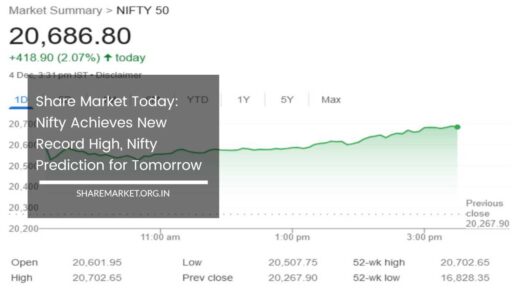

Sensex-Nifty Closed With Gains; Nifty Prediction for Tomorrow

Nifty Prediction for Tomorrow

Market Analysis: Volatility Anticipated as Financial Year Nears End

The financial markets are currently abuzz with anticipation as market experts foresee heightened volatility towards the end of the financial year.

Investors are contemplating strategic shifts in their portfolio positions, setting the stage for potential market fluctuations.

This analysis, based on the events of February 15, delves into the recent performance of the stock market, key indices, and expert predictions for the near future.

Stock Market Performance on February 15:

On February 15, the stock market demonstrated resilience by marking the third consecutive trading day of growth. Despite this positive trend, the day was characterized by significant volatility.

Nifty, a key benchmark, managed to close above 21,900, reflecting an overall positive sentiment. The market’s trajectory for the day exhibited a fascinating journey, starting with an initial surge in response to favorable global signals.

However, this early momentum was short-lived, as the market lost ground in the initial hours, leading to a range-bound movement during the first half of the trading session.

Nonetheless, a noteworthy rebound occurred in the second half, propelling the market to close near the day’s high.

Closing Statistics:

At the end of the trading session, the Sensex closed at 72,050.38, registering a gain of 227.55 points or 0.32 percent.

Simultaneously, Nifty closed at 21,910.75, with a gain of 70.70 points or 0.32 percent. The Nifty Bank index, after experiencing a dip to 45,590.20 during the day, managed to recover and closed 0.7 percent higher at 46,218.90.

The broader market indices, BSE Midcap and Smallcap, displayed positive momentum by closing up 1-1 percent.

Top Gainers and Losers:

M&M, BPCL, ONGC, NTPC, and Power Grid Corporation emerged as the top gainers on Nifty, while Axis Bank, Apollo Hospitals, ITC, HUL, and Nestle India found themselves among the top losers.

Sectoral indices revealed a 0.9 percent decline in the FMCG index, juxtaposed against gains in Auto, PSU Bank, Metal, Realty, Power, and Oil & Gas sectors, ranging between 1-2 percent.

Expert Insights on Market Volatility:

Anticipating an increase in volatility as the financial year draws to a close, market experts point to several contributing factors.

The impending 2024 general elections and the prospect of interest rate cuts are expected to be pivotal in shaping market dynamics. Trivesh D of Tradejini suggests that the upcoming election season could lead to heightened market volatility, potentially resulting in higher option premiums.

Additionally, the impact of election outcomes on market liquidity is a notable concern, as political parties tend to withdraw funds from the market to allocate resources towards electoral campaigns, causing a potential shortage of cash.

Current Market Scenario and Outlook:

According to Trivesh, the market is currently moving within a range, and unless this range is decisively broken on either side, new highs or lows are unlikely.

This range-bound movement indicates an environment of ongoing volatility, characterized by fluctuations and unpredictability.

“Unless a new trend emerges, there will be ups and downs,” Trivesh notes, highlighting the need for caution amid the current market conditions.

Technical Analysis and Immediate Support Levels:

Mandar Bhojne of Choice Broking provides insights into the technical aspects of the market, emphasizing the importance of analyzing the daily chart of Nifty. Notably, a neutral candlestick pattern with a long wick and heavy volume suggests increased volatility.

Bhojne identifies the immediate support level for Nifty at 21,800, while resistance is observed at 22,000 and 22,100.

He asserts that crossing the 22,000 level could pave the way for Nifty to reach an all-time high of 22,200-22,300 in the next few trading sessions.

Positive Market Breadth and Short-Term Projections:

Rupak Dey of LKP Securities paints an optimistic picture, noting that Nifty closed above the resistance level of 21,850.

A consolidation breakout on the daily chart indicates a positive shift in sentiment. Furthermore, the index has closed above the 20-day moving average (20DMA) for the third consecutive session, with the Relative Strength Index (RSI) showing a bullish crossover.

Dey predicts a short-term movement towards 22,200 for Nifty, with a downward support level at 21,750.

Price and Momentum Indicators:

Jatin Gedia from Sharekhan reinforces the positive market sentiment by highlighting Nifty’s ability to maintain gains after a strong rise in the previous trading session.

The Daily Momentum Indicator has initiated a positive crossover, indicative of a bullish market. Gedia suggests that both price and momentum indicators signal a continued upward trajectory.

Immediate resistance on the upside is identified in the zone of 22,100 – 22,130, while support is visible in the zone of 21,770 – 21,750.

Bank Nifty Strength and Short-Term Rally:

Examining Bank Nifty, Gedia notes that it managed to close above the 20 and 40-day moving averages (45597 and 46084), signaling strength in the market. A short-term rally in Bank Nifty is predicted, with a potential upswing to 46,600 – 47,000.

Final Remarks:

In conclusion, the current market landscape is marked by a delicate balance of positive indicators and potential challenges.

The anticipation of increased volatility as the financial year concludes, coupled with the influence of the 2024 general elections, adds an element of uncertainty to market projections.

However, technical analyses and expert insights provide a cautiously optimistic outlook, suggesting potential short-term gains and emphasizing the need for vigilance amid the dynamic market conditions.

As investors navigate through this period of uncertainty, staying informed and adaptable remains crucial in making informed decisions.