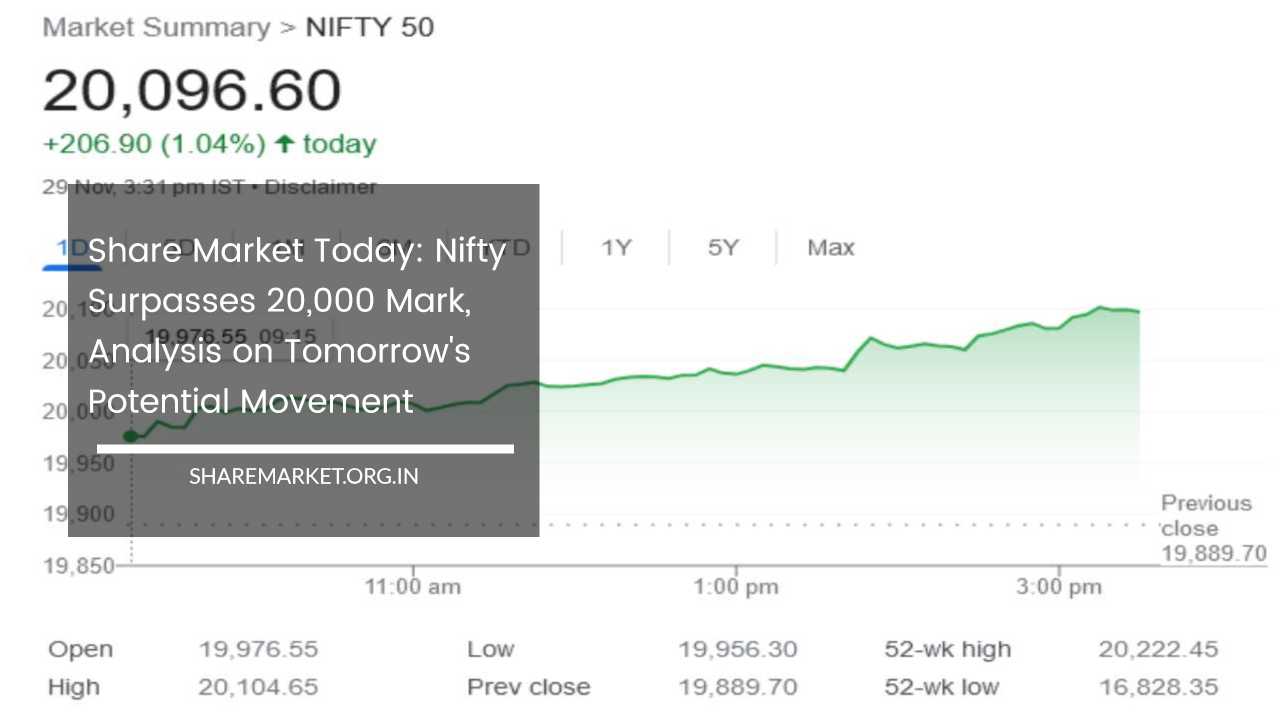

Share Market Today: Nifty Surpasses 20,000 Mark, Analysis on Tomorrow’s Potential Movement

Share Market Today

Bullish Momentum Propels Nifty Beyond 20,100: Comprehensive Analysis of Market Dynamics

In a resounding display of bullish fervor, the Indian stock market witnessed a formidable uptrend, with the Nifty index surging past the significant milestone of 20,100 for the first time intraday.

The trading session unfolded with remarkable gains for key players, prominently featuring Hero MotoCorp, M&M, Axis Bank, Wipro, and Tata Motors as the top gainers on the Nifty.

Concurrently, ONGC, Nestle India, Eicher Motors, Adani Enterprises, and Divis Lab found themselves among the top losers, creating a diverse landscape of market movements.

Market Overview:

The bullish momentum reverberated across the market, with the midcap index hitting a new peak for the 10th consecutive day.

Sectors such as Information Technology (IT) and auto played pivotal roles in propelling the market forward, contributing significantly to the overall positive sentiment.

This exuberance was reflected in the broader indices, with both Nifty 200 and Sensex closing more than 700 points higher by the end of the trading day.

At the close of the session, the Sensex stood at an impressive 66,901.91, marking a substantial increase of 727.71 points or 1.10 percent.

Simultaneously, Nifty closed at 20,096.60, registering a noteworthy gain of 206.90 points or 1.04 percent.

The day’s trading witnessed a pronounced bullish trend, with 1828 shares experiencing gains, 1706 shares in decline, and no change observed in 123 shares.

Gainers and Losers:

A detailed examination of the market movement revealed Hero MotoCorp, M&M, Axis Bank, Wipro, and Tata Motors as the top gainers, underscoring the strength of their market positions and their ability to capitalize on the prevailing bullish sentiment.

Conversely, ONGC, Nestle India, Eicher Motors, Adani Enterprises, and Divis Lab faced headwinds, closing the day as the top losers, navigating the challenges posed by the market dynamics.

Sectoral Performance:

With the exception of the realty sector, all other sectoral indices closed in the green, offering a comprehensive view of the widespread positivity in the market.

Noteworthy gains of 1 percent were observed in sectors such as Auto, Bank, IT, and Oil-Gas, signaling the broad-based nature of the bullish momentum.

The BSE Midcap index closed up by a substantial 0.8 percent, while the Smallcap index closed up by 0.4 percent, further highlighting the overall optimism in the market.

Index Movement:

The positive sentiment was not confined to specific stocks or sectors but manifested in the movement of indices.

Buying activity was robust, with 26 out of 30 Sensex stocks and 41 out of 50 Nifty stocks witnessing heightened investor interest.

The Bank Nifty, a significant indicator of the financial sector’s performance, saw buying interest in 11 out of its 12 constituent stocks, emphasizing the broad-based nature of the market rally.

Expert Perspectives:

Aditya Gaggar, Director, Progressive Shares:

Aditya Gaggar, Director at Progressive Shares, offered insightful observations on the day’s trading dynamics. He noted that bulls dominated the session, breaking through resistance levels with apparent ease.

The result was a substantial gain for Nifty, which closed at 20,096.60, reflecting an increase of 206.90 points. Gaggar highlighted the impressive 1.53 percent gain in technology shares, a sector that played a pivotal role in driving the overall market momentum.

He identified the formation of a large positive candle on the daily chart, signaling the potential continuation of the current uptrend.

With optimism in the air, Gaggar suggested that Nifty is likely to achieve new highs in the coming days. He pinpointed immediate resistance at 20,200, with downward support visible at 19,915.

Prashant Tapse, Mehta Equities:

Prashant Tapse, representing Mehta Equities, provided additional insights into the market dynamics. He emphasized that investors strategically placed strong bullish bets in anticipation of the monthly Futures and Options (F&O) expiry.

Following the recent rush of initial public offerings (IPOs), funds flowed back into the secondary market, showcasing investor confidence.

Tapse expressed optimism regarding the medium-term prospects of the market, citing expectations that U.S. interest rates would remain stable.

He also highlighted the positive backdrop of India’s strong economic data, contributing to the upbeat sentiment.

However, Tapse cautioned that volatility might prevail on Friday, driven by the release of exit poll results from five states, reminding investors of the ever-present influence of geopolitical and macroeconomic factors.

Looking Ahead:

The buoyant market sentiment, driven by bullish trends and positive economic indicators, sets the stage for a favorable medium-term outlook.

Investors respond to encouraging economic data and the return of funds to the secondary market post the IPO rush, contributing to the overall optimism.

The stability in U.S. interest rates further adds to the positive narrative surrounding the Indian market.

However, the potential for volatility cannot be overlooked, particularly with the impending release of exit poll results from five states on Friday.

This development has the potential to introduce short-term fluctuations as market participants react to political developments.

Investors are urged to exercise caution and remain vigilant in navigating the dynamic landscape of the stock market.

Final Remarks:

In conclusion, the day’s trading session showcased the resilience and strength of the Indian stock market, marked by the Nifty crossing the significant threshold of 20,100.

The widespread bullish sentiment, coupled with notable gains in key sectors, paints a picture of optimism and resilience.

As experts point to potential new highs and a continuation of the uptrend, investors are cautiously optimistic about the medium-term outlook.

The intricate interplay of various factors, both domestic and global, underscores the complexity of the market dynamics.

Investors, armed with a thorough understanding of these dynamics, are better positioned to navigate the evolving landscape and make informed decisions in the ever-changing world of finance.