Multibagger Stock: Mayur Uniquoters Ltd

Mayur Uniquoters Ltd

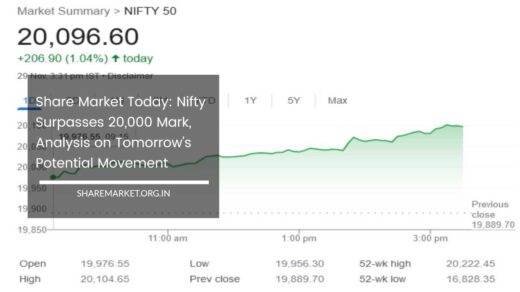

Shares of Mayur Uniquoters: A Remarkable 15-Year Journey from Rs 3.93 to Rs 552.25

Investing in the stock market has the potential to yield substantial returns over time, and the story of Mayur Uniquoters is a testament to this fact.

In just 15 years, shares of this synthetic leather manufacturer skyrocketed from a humble Rs 3.93 to an impressive Rs 552.25, making early investors millionaires with a mere investment of Rs 72 thousand.

This incredible journey not only highlights the power of long-term investing but also provides valuable insights into the stock’s past performance and future prospects.

The Meteoric Rise:

Mayur Uniquoters is a synthetic leather producer that has captured the attention of investors with its remarkable growth.

The story begins on October 3, 2008, when the company’s shares were available at a modest Rs 3.93. Fast forward to the present, and the stock stands at an astounding Rs 552.25, representing an astonishing increase of 13,952 percent.

Such exponential growth is a rare phenomenon in the stock market, and it showcases the wealth-building potential that lies within equities.

Investor’s Journey to Millionaire Status:

What makes Mayur Uniquoters’ journey even more remarkable is the fact that investors who believed in the company’s potential and invested a relatively small amount of Rs 72 thousand became millionaires over the 15-year period.

This transformation highlights the power of compounding and the importance of having a long-term investment perspective.

Navigating Short-Term Volatility:

While the stock has delivered exceptional returns over the years, it’s essential to acknowledge the short-term volatility that comes with investing in the stock market.

On the day of this report, Mayur Uniquoters’ shares experienced a decline of more than two and a half percent due to weak market sentiment.

However, seasoned investors understand that short-term fluctuations are a natural part of the market’s dynamics.

Future Growth Potential:

Despite the temporary setback in share price, experts remain optimistic about Mayur Uniquoters’ future prospects.

They view the current decline as a potential buying opportunity. ICICI Securities, a reputable brokerage firm, predicts a promising future for the company and anticipates a potential 27 percent increase in its stock price from the current level.

Recent Performance:

To gain a better perspective on the stock’s recent performance, let’s delve into its movements over the past year. On December 26, 2022, the stock hit a one-year low of Rs 382.40, reflecting a temporary downturn.

However, the company’s shares quickly rebounded, surging by more than 52 percent in just eight months and reaching a one-year high of Rs 583.60 on August 22, 2023.

This remarkable recovery showcased the stock’s resilience and its ability to bounce back from short-term setbacks. Nevertheless, it’s worth noting that the stock has experienced a modest decline of over 5 percent from its recent high.

Mayur Uniquoters: An Overview:

Mayur Uniquoters specializes in manufacturing synthetic leather used in various industries, including automotive, footwear, and apparel.

Approximately 50-60 percent of its sales are derived from the automotive sector, while 20-30 percent are attributed to the footwear segment.

Notably, the company has secured partnerships with prestigious global luxury car manufacturers such as Mercedes and BMW, solidifying its position in the market.

Analyst Insights:

ICICI Securities, a leading domestic brokerage firm, is bullish on Mayur Uniquoters’ growth potential. They highlight several key factors that contribute to the company’s positive outlook:

- Strong Growth Prospects: The automotive sector, where Mayur Uniquoters has a significant presence, is expected to experience robust growth. This bodes well for the company’s future sales and profitability.

- Healthy Margin Profile: Mayur Uniquoters boasts a healthy margin profile, which is an attractive feature for investors. It indicates the company’s ability to generate profits from its operations.

- Efficient Capital Utilization: The company’s business model involves minimal capital utilization, allowing it to maintain a positive cash balance sheet. This financial stability is reassuring for investors and supports the company’s growth potential.

Investment Opportunity:

In light of the positive outlook for Mayur Uniquoters, ICICI Securities has assigned a buy rating to the stock.

Additionally, they have set a target price of Rs 700 for potential investors, underscoring their confidence in the company’s growth prospects.

This target price represents a significant upside potential from the current stock price, further fueling optimism among investors.

Final Thoughts

Mayur Uniquoters’ incredible journey from Rs 3.93 to Rs 552.25 over 15 years is a testament to the wealth-building potential of the stock market.

While short-term volatility is a part of investing, the company’s positive outlook, strong growth prospects, healthy margin profile, and efficient capital utilization make it an attractive investment opportunity.

As with any investment, it’s essential for investors to conduct thorough research, consider their risk tolerance, and adopt a long-term perspective.

Mayur Uniquoters serves as a compelling example of the transformative power of patient and strategic investing in the stock market.