Tata Motors to Demerge Businesses Into two Separate Listed Companies

Tata Motors

Revolutionizing Corporate Structure: Tata Motors’ Strategic Demerger Plan for Long-Term Success

In a groundbreaking move, Tata Motors, a stalwart in the automotive industry, recently announced a transformative decision to divide its business into two distinct entities.

The approval for this strategic shift was granted by the company’s board on Monday, March 4th, marking a significant reconfiguration of Tata Motors’ corporate structure.

This bold initiative involves segregating its business into two standalone entities – commercial vehicles and passenger vehicles, both of which are slated to be listed as independent companies on domestic markets.

Navigating the Demerger Landscape: A Comprehensive Overview

Tata Motors, in an official filing post the equity market close on the same day, provided intricate details about its demerger plan, elucidating the complexities involved in this strategic maneuver.

The demerger process will be facilitated through the National Company Law Tribunal (NCLT) Scheme of Demerger Arrangement, a meticulous procedure that encompasses several crucial stages.

- Presentation to the Board of Directors:

- The initial step involves presenting the NCLT scheme of arrangement for demerger before the Board of Directors of Tata Motors in the forthcoming months. This stage is pivotal in setting the foundation for subsequent approvals and implementations.

- Shareholder and Creditor Approval:

- Following the presentation to the Board, the demerger plan necessitates approval from both shareholders and creditors. This critical phase is integral to ensuring widespread acceptance and support for the strategic bifurcation.

- Regulatory Nod:

- Regulatory approval is another essential milestone in the demerger process. Complying with legal and regulatory frameworks ensures a seamless transition and adherence to industry standards.

While Tata Motors anticipates that this intricate process could span 12 to 15 months, the company has assured stakeholders that the demerger will not disrupt the stability of its workforce, relationships with customers, or partnerships with business associates.

Unlocking Shareholder Value: A Catalyst for Change

At the core of this strategic decision is the aim to unlock and enhance shareholder value by providing them with a direct stake in the performance of each specific business segment.

This innovative bifurcation aims to empower shareholders to participate more directly in the growth and profitability of either the commercial or passenger vehicle business.

Analyzing Tata Motors’ Share Performance: A Tale of Resilience and Growth

A deeper analysis of Tata Motors’ recent share performance offers valuable insights into investor sentiment and confidence in the company’s strategic direction.

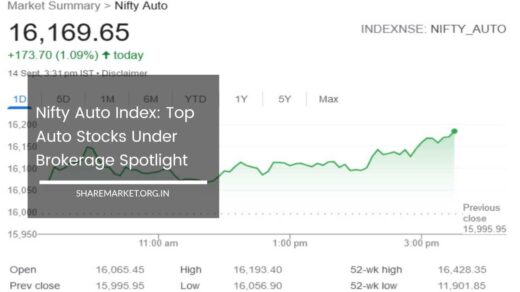

As of the latest market data, Tata Motors’ shares closed at Rs 987.20 on the Bombay Stock Exchange (BSE) with a marginal decline of 0.12 percent. However, a more extensive analysis over the past year unveils a compelling trajectory.

- One-Year Low to High:

- On March 28, 2023, Tata Motors’ shares hit a one-year low of Rs 400.40. Since then, the company has experienced a remarkable turnaround, with its shares surging by approximately 149 percent within a year.

- Current One-Year High:

- As of March 4, 2024, Tata Motors achieved a one-year high, closing at Rs 995.75. This notable increase in share value signifies the positive market response to Tata Motors’ strategic initiatives and the anticipated benefits from the impending demerger.

Strategic Impact on Tata Motors: A Vision for Sustainable Growth

The decision to separate commercial and passenger vehicle businesses aligns with Tata Motors’ commitment to creating sustainable and profitable growth.

By providing shareholders with direct exposure to distinct business segments, Tata Motors aims to optimize performance, enhance operational efficiency, and create additional value for its investors.

Diving Deeper into the Commercial and Passenger Vehicle Segments:

- Commercial Vehicles:

- The commercial vehicle segment is a cornerstone of Tata Motors’ operations, serving a diverse range of industries. By having a dedicated entity for commercial vehicles, Tata Motors aims to focus on innovations, collaborations, and market strategies tailored specifically for the commercial sector.

- Passenger Vehicles:

- The passenger vehicle segment, with its own entity, presents an opportunity for Tata Motors to cater to the evolving demands of individual consumers. A more targeted approach allows the company to invest in cutting-edge technologies, design aesthetics, and customer-centric services.

Employee and Stakeholder Assurance:

While major structural changes can often raise concerns among employees, stakeholders, and business partners, Tata Motors has been proactive in reassuring them.

The company has emphasized that the demerger will not have any adverse impact on its workforce, customers, or business partners.

This strategic move is about optimizing operations and creating a more focused business approach without disrupting existing relationships.

Looking Beyond the Numbers: A Holistic Perspective on Corporate Transformation

Beyond the financial numbers and market dynamics, Tata Motors’ decision to demerge reflects a broader shift in the corporate mindset.

It signifies a commitment to adaptability, responsiveness, and a proactive approach to industry trends.

In an era where the automotive landscape is undergoing rapid transformations, companies that can swiftly align their structures with emerging needs are better poised for sustained success.

Final Remarks: Navigating Towards a Transformed Future

In conclusion, Tata Motors’ announcement to divide its business into two listed companies represents a monumental paradigm shift in its corporate strategy.

While the demerger process involves intricate legal and regulatory steps, the anticipated benefits for shareholders, combined with the recent positive performance of Tata Motors’ shares, underscore the potential success of this strategic move in the ever-evolving automotive industry landscape.

As the company embarks on this transformative journey, stakeholders will keenly watch the developments and milestones leading to the successful implementation of the demerger plan.

Tata Motors’ strategic vision for a more streamlined and focused approach to addressing the unique needs of commercial and passenger vehicle segments sets the stage for a future marked by resilience, growth, and enhanced shareholder value.

The forthcoming months will undoubtedly be critical as Tata Motors navigates through the complexities of the demerger process and paves the way for a transformed and dynamic future.

The automotive industry is witnessing a profound evolution, and Tata Motors is positioning itself as a pioneer in adapting to these changes, setting a benchmark for strategic corporate transformation.

This bold move by Tata Motors reflects their commitment to strategic evolution. The demerger into two listed entities is a smart play, allowing enhanced focus on distinct segments and ultimately delivering greater shareholder value.